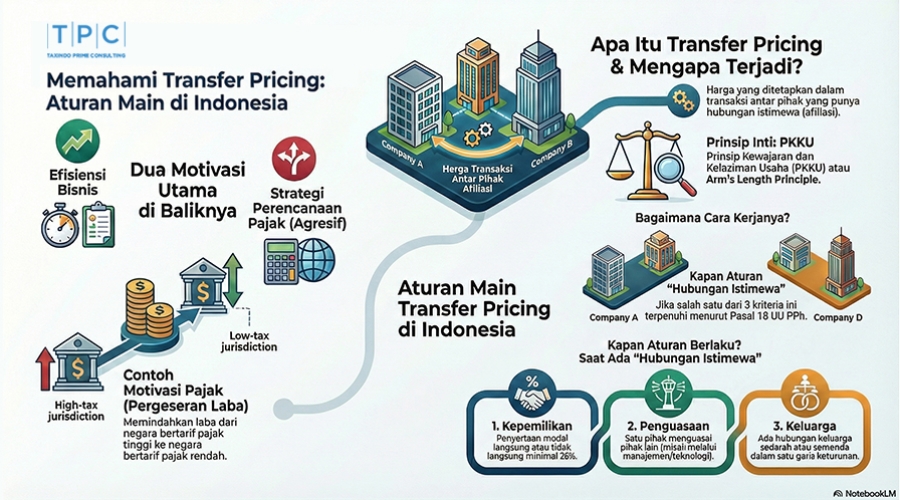

In the increasingly integrated global business ecosystem, cross-border transactions conducted by multinational enterprises (MNEs) dominate world trade. One of the most critical issues in international taxation arising from this phenomenon is Transfer Pricing. Simply put, transfer pricing is the price charged in transactions between parties who have a special relationship (affiliates), whether for the sale of goods, services, intangible assets, or loans. For tax authorities, this issue is not merely a matter of business pricing, but a potential for profit shifting that can erode a country's tax base.

Fundamentally, transfer pricing occurs due to the operational need of companies to determine the exchange value of goods or services between divisions or entities within a business group. However, in its development, this practice is often influenced by certain motivations that go beyond mere operational efficiency.

Multinational companies utilize advancements in technology, transportation, and communication to run their business groups in various countries to gain economies of scale. They conduct integrated supply chain management for the overall efficiency of the group. In this context, transfer pricing is a management accounting tool to allocate costs and revenues between units.

Problems arise when transfer pricing is used as an aggressive tax planning strategy. Multinational companies operate in various countries with different tax rates. This creates an incentive for business groups to manipulate transfer prices to shift profits from high-tax jurisdictions to low-tax jurisdictions (tax havens).

Some of the main motives for transfer price manipulation include:

Indonesia, as part of the global economy and a member of the G20, pays serious attention to transfer pricing practices. The government realizes that affiliated transactions can be used as a tool for tax avoidance detrimental to state revenue. Therefore, Indonesia adopts generally accepted international principles (such as OECD guidelines) into domestic law.

The main legal basis for transfer pricing in Indonesia is contained in Article 18 paragraph (3) of the Income Tax Law (UU PPh). This article grants authority to the Director General of Taxes (DGT) to re-determine the amount of income and deductions and to determine debt as equity to calculate the amount of Taxable Income for Taxpayers who have a special relationship in accordance with fairness and business prevalence.

The latest technical regulation governing this is Minister of Finance Regulation Number 172 of 2023 (PMK 172/2023). This regulation unifies various previous rules to provide legal certainty, justice, and ease in the implementation of tax rights and obligations regarding affiliated transactions. In Indonesia, the main focus of tax authorities is ensuring that every affiliated transaction meets the principle of fairness, is well-documented in Transfer Pricing Documentation (TP Doc), and does not cause erosion of the national tax base.

In Indonesia, the gold standard for testing transfer pricing is referred to as the Principle of Fairness and Business Prevalence (PKKU) or internationally known as the Arm’s Length Principle (ALP).

PKKU is the principle applicable in healthy business practices carried out as independent transactions. The core of this principle is treating affiliated companies as if they were independent entities transacting in an open market. If the conditions in the affiliated transaction are the same as the conditions in an independent transaction, then the price or profit obtained must be the same.

Taxpayers conducting transactions influenced by a special relationship are required to apply PKKU. These transactions include affiliated transactions as well as transactions with independent parties where the counterparty or the price is determined by an affiliated party.

The application of PKKU is carried out through the following stages:

Comparability Analysis: Comparing the conditions of the affiliated transaction with independent transactions. Transactions are considered comparable if differences in conditions do not materially affect the price, or if accurate adjustments can be made.

Method Selection: Selecting the most appropriate transfer pricing method. The five methods recognized in Indonesia are:

Fair Price Determination: Determining the fair price or profit based on comparable data (internal or external). If the affiliated transaction price does not match the fair price (falls outside the arm's length range), the DGT has the right to make a fiscal correction.

The concept of "Special Relationship" is the gateway to the application of transfer pricing rules. If there is no special relationship, then transfer pricing rules and the obligation to apply PKKU do not apply.

Based on Article 18 paragraph (4) of the Income Tax Law, Article 2 paragraph (2) of the VAT Law, and reaffirmed in PMK 172/2023, a special relationship is considered to exist if it meets one of the following three criteria:

A special relationship occurs if the Taxpayer has direct or indirect capital participation of at least 25% (twenty-five percent) in another Taxpayer. This relationship also applies if there is a tiered ownership or cross-ownership of 25% or more in two or more Taxpayers.

A special relationship is considered to exist if the Taxpayer controls another Taxpayer, or two or more Taxpayers are under the same control, whether directly or indirectly. This control is not limited to share ownership, but also includes control through management (ability to determine strategic decisions) or the use of technology.

A special relationship can also occur due to blood family relationships (such as parent and child) or affinity/marriage relationships (such as parent-in-law and stepchild) in a straight line and/or sideways one degree.

Understanding Transfer Pricing in Indonesia requires a complete understanding of the business and tax reasons behind the transactions, the applicable legal framework (Income Tax Law and PMK 172/2023), and the technical application of the Principle of Fairness and Business Prevalence (PKKU). For Taxpayers, accurate identification of special relationships is a crucial initial step to ensure compliance and mitigate the risk of tax corrections in the future.

Is My Company Required to Create a Transfer Pricing Document?