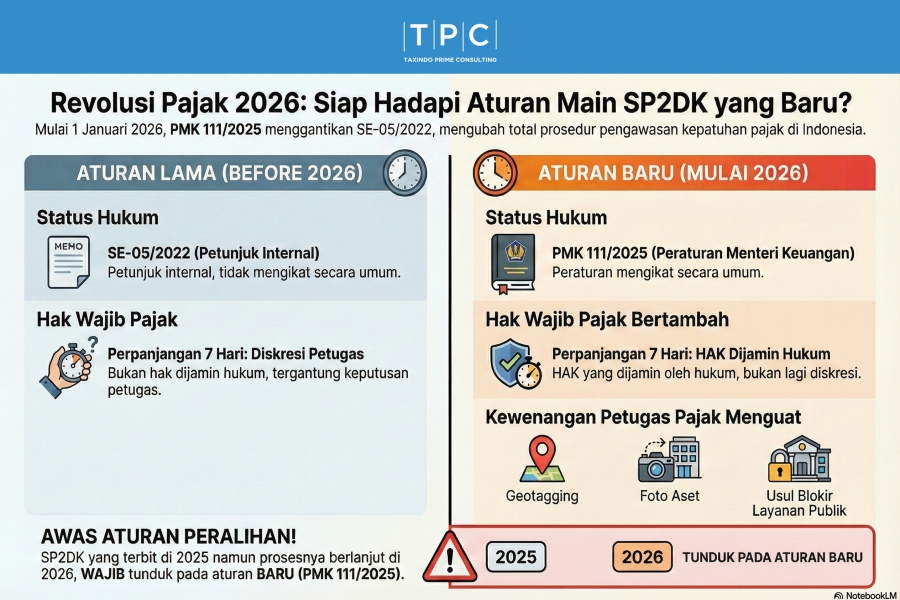

In the dynamics of Indonesian taxation, compliance supervision is the heart of the self-assessment system. For the past few years, Taxpayers and tax practitioners have been very familiar with the Circular Letter of the Director General of Taxes Number SE-05/PJ/2022 as the "bible" for audit and supervision procedures. However, this landscape will change drastically starting January 1, 2026, with the enactment of Minister of Finance Regulation (PMK) Number 111 of 2025 concerning Supervision of Taxpayer Compliance.

This change is not merely cosmetic. PMK 111 of 2025 brings an elevation in legal status and technical details that are much sharper than its predecessor. This article will comprehensively dissect the differences in the resolution mechanisms and follow-up actions for the Request for Explanation on Data and/or Information (SP2DK) between these two regulations through detailed comparisons.

The most fundamental difference lies in the legal hierarchy. PMK 111 of 2025 was issued to provide greater justice and legal certainty for the general public, changing the status of the procedure from internal guidelines to generally binding regulations.

Below is the comparison table of general SP2DK regulations:

| Regulatory Aspect | SE-05/PJ/2022 (DGT Circular Letter) | PMK 111 of 2025 (Minister of Finance Regulation) |

|---|---|---|

| Legal Status | Internal technical guidelines for DGT employees in carrying out supervision. | Legislation that is generally binding, providing legal certainty and justice for Taxpayers and Tax Authorities. |

| Response Deadline | Taxpayers are given the opportunity to provide an explanation within a maximum of 14 calendar days from the date of sending/delivery. | Same, Taxpayers provide a response within a maximum of 14 days from the date of sending/delivery. |

| Deadline Extension | Allows submission of explanations past the deadline based on the Head of KPP's consideration (administrative discretion). | Explicitly regulated as a right: Taxpayers can extend the period for a maximum of 7 days after the initial period ends by written notification. |

| Response Submission Channels | Face-to-face, face-to-face via audio-visual media, and written (including via DJP Online if available). | Reaffirmed formally in regulation: Face-to-face, audio-visual media (video conference), and written (Taxpayer Account, post/expedition). |

| Audio Visual Media (Online) | Regulated as a method of face-to-face meeting that must be recorded with Taxpayer consent. | Legally confirmed as a valid method "via online media with video conference" for submitting explanations. |

| Use of Taxpayer Account | Delivery of SP2DK and responses can be done via DJP Online if the system accommodates it. | Affirms the use of the Taxpayer Account (Coretax) as the main channel for letter delivery and receipt of responses electronically. |

PMK 111 of 2025 expands and clarifies the authority of Account Representatives (AR) and other tax officers, especially in digital and territorial aspects.

Below is the comparison table of tax officer authority:

| Authority Aspect | SE-05/PJ/2022 (Old Rule) | PMK 111 of 2025 (New Rule) |

|---|---|---|

| Basis of Authority | Authority based on internal assignment (Official Note/Assignment Letter). | Authority formally delegated from the Director General of Taxes to the Head of KPP, then to the AR/Officer via a Supervision Order (Surat Perintah Pengawasan). |

| Territorial Authority (Cross-Entity) | Focus on Taxpayers administered at that KPP or specific assignments. | Officers are authorized to collect economic data in their working area, both for Taxpayers they administer and Taxpayers registered at other work units. |

| Digital Data Collection | Observing conditions around the Taxpayer for data validation. | Officers are explicitly authorized to perform Geotagging and Image Capture (photos) of objects/assets indicating economic activity. |

| Authority to Sign Minutes (BA) | If the Taxpayer refuses to sign the Discussion Minutes, the condition is only stated/recorded in the Minutes. | Officers are authorized to sign the Minutes unilaterally if the Taxpayer refuses to sign or does not return the electronic draft within 5 working days. |

| Identity Obligation | Show ID card and assignment letter during Visits. | Mandatory to show ID card and Supervision Order when conducting Visits, Discussions, or Interviews. |

Regarding resolution, PMK 111 of 2025 details the types of follow-up proposals very specifically and limitatively in Article 8, unlike SE-05 which is more of a general recommendation in the LHP2DK.

Below is the comparison table of resolution follow-ups:

| Type of Follow-up | SE-05/PJ/2022 (LHP2DK Recommendation) | PMK 111 of 2025 (Activity Result Proposal) |

|---|---|---|

| Resolution Without Correction | Activity declared complete, SP3 P2DK issued. | Director General of Taxes (via Head of KPP) issues SP3 P2DK as a sign of activity closure. |

| Public Services | Not explicitly mentioned as a main direct output in the LHP2DK recommendation list. | Explicitly mentioned as an SP2DK result proposal: "restriction or blocking of certain public services". |

| Ex-Officio Data Changes | Proposing ex-officio data/status changes. | Detailed further: Data changes, NPWP deletion, PKP confirmation/revocation, to registration/change of Land and Building Tax (PBB) object data ex-officio. |

| Unregistered Taxpayers | Falls under Extensification which is regulated separately. | Integrated into SP2DK. Follow-ups include ex-officio NPWP issuance, Business Activity Place Identity Number (NITKU) issuance, and ex-officio PKP confirmation. |

| Legal Product Correction | Proposing ex-officio correction of legal products if there are errors. | Same, proposing ex-officio correction or cancellation of legal products as regulated in the KUP Law. |

| Criminal Follow-up | Proposing preliminary evidence audit if there is an indication of a crime. | Same, proposing preliminary evidence audit. |

A crucial aspect that Taxpayers must understand concerns legal certainty at the turn of the year 2026. Article 30 Minister of Finance Regulation Number 111 of 2025 explicitly states that it comes into force on January 1, 2026. Given that this PMK does not contain transitional provisions excluding old cases, the general legal principle applies that new procedural rules take immediate effect.

The legal implications for SP2DK issued in late 2025 but processed into 2026 are as follows:

PMK 111 of 2025 is a legislative product (regelling) signed by the Minister of Finance, whereas SE-05/PJ/2022 is merely an internal administrative guideline (beleidsregel) from the Director General of Taxes. As soon as January 1, 2026 arrives, PMK 111 of 2025 becomes the highest legal basis for supervision. Therefore, even if the SP2DK was received by the Taxpayer in 2025 (based on the SE-05 format), its resolution process in 2026 must comply with the standards of PMK 111 of 2025.

If you are responding to a "legacy" 2025 SP2DK in January 2026, you are entitled to use the new mechanisms guaranteed by PMK 111, including:

The most critical point is at the completion stage. If the 2025 SP2DK process is completed in 2026, the Tax Office is bound by the obligation of Article 8 paragraph (2) of PMK 111 to issue a Notification Letter on the Progress of Request for Explanation on Data and/or Information (SP3 P2DK). Under the PMK regime, the issuance of SP3 P2DK is no longer just an internal administrative procedure, but a legal obligation which, if ignored, can constitute maladministration. This provides a much stronger guarantee of legal certainty for Taxpayers that their old cases have been officially legally closed.

The transition from SE-05/PJ/2022 to PMK 111 of 2025 marks the maturity of Indonesia's tax supervision system. For Taxpayers, this PMK offers better legal certainty through procedure formalization, the right to time extensions, and the obligation to issue a completion letter (SP3 P2DK). However, on the other hand, this PMK also brings more serious consequences with the authority to block public services and cross-entity supervision. Do not fall into the assumption that old SP2DKs use old rules. Starting January 1, 2026, the legal umbrella has changed. Ensure you demand procedural rights and completion documents according to PMK 111 of 2025 standards for maximum legal protection.