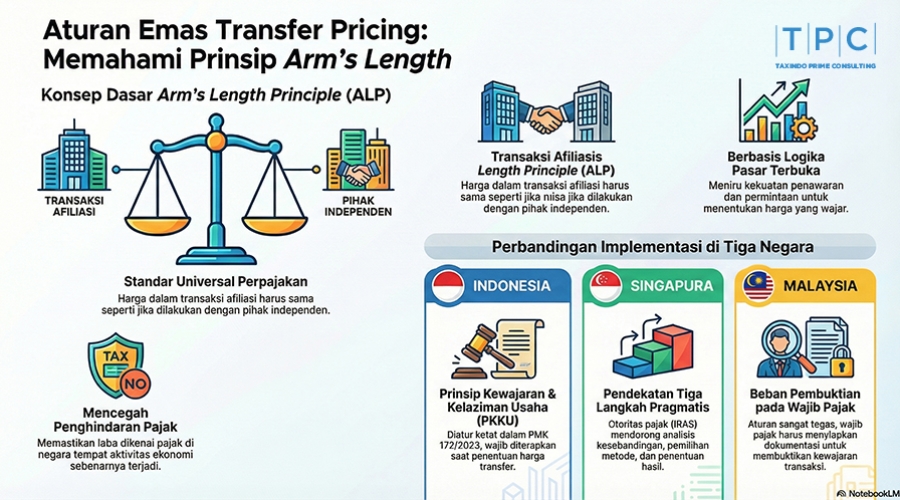

In the international taxation ecosystem, one concept stands as the main supporting pillar governing how multinational enterprises (MNEs) set prices in their internal transactions: Arm's Length Principle (ALP).

Whether you are in Europe, America, or Southeast Asia, this principle is the universal standard adopted to prevent tax avoidance while avoiding double taxation. This article will dissect the ALP concept based on global guidelines (OECD and UN) as well as its specific application in Indonesia, Singapore, and Malaysia.

Fundamentally, the Arm's Length Principle is based on the idea that entities within one multinational enterprise group must be treated as separate and independent entities (separate entity approach).

Both OECD and UN base the ALP definition on Article 9 paragraph (1) of the Model Tax Convention. The core of this article states: "Where conditions are made or imposed between the two enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly."

The logic behind this principle is market forces. When independent parties transact, prices are determined by market forces (supply and demand). However, when related parties transact, they may not be directly affected by those market forces. Therefore, ALP attempts to place affiliated transactions (controlled transactions) on an equal footing with independent transactions (uncontrolled transactions).

The UN (UN TP Manual) emphasizes that ALP application is not just about matching prices, but ensuring that the tax base (profit) is reported in the jurisdiction where economic activity and value creation occur.

Indonesia fully adopts ALP into its domestic law under the term Principle of Fairness and Business Prevalence (PKKU). The latest regulation, MoF Regulation (PMK) 172 of 2023, provides very detailed technical guidance.

According to Article 1 number 10 of PMK 172/2023, PKKU is the principle applicable in healthy business practices carried out as independent transactions. Taxpayers in Indonesia are required to apply PKKU in every transaction influenced by a special relationship.

Key Point: The obligation to apply this principle is carried out at the time of transfer price determination (ex-ante) and/or at the time the transaction occurs.

PKKU application in Indonesia is done by comparing the conditions and price indicators of the affiliated transaction with comparable independent transactions. If they do not match, the Director General of Taxes has the authority to re-determine the amount of income or deduction.

Singapore, through guidelines published by the Inland Revenue Authority of Singapore (IRAS), also fully supports ALP. IRAS encourages a pragmatic approach through the "Three-step approach":

Malaysia, through the Inland Revenue Board of Malaysia (IRBM), has very strict transfer pricing rules. In Malaysia, the burden of proof lies entirely with the taxpayer.

Taxpayers must prepare Contemporary Transfer Pricing Documentation. IRBM has the authority to make price or interest adjustments, and even disregard the transaction structure if its economic substance is considered different from its formal form or not commercially rational.

There is a common thread in ALP application worldwide (OECD, UN, Indonesia, Singapore, Malaysia):

The heart of ALP is comparison. Comparability factors include: product/service characteristics, functional analysis (assets & risks), contractual terms, economic circumstances, and business strategies.

Transactions must be defined based on actual substance. If the contract differs from the actual behavior of the parties, then the actual behavior is used to delineate the transaction.

Tax authorities have the right to disregard a transaction if it lacks commercial rationality—meaning, independent parties would never agree to such a transaction.

The Arm's Length Principle concept is not merely a technical rule, but a basic philosophy of international taxation demanding fairness: intra-group transactions must reflect open market realities.

For Taxpayers in Indonesia, Singapore, or Malaysia, maintaining robust Transfer Pricing Documentation (TP Doc) is the primary risk mitigation step to avoid tax corrections and administrative sanctions.

Is My Company Required to Create a Transfer Pricing Document?