The current government policy focus is directed towards Fiscal reform and strengthening stimulus amidst positive signals from the consumption side. Finance Minister Purbaya Yudhi Sadewa highlights the decline in tax collection, particularly from large Taxpayers (WPs), underpinning the need for stricter enforcement. Simultaneously, the potential of the Digital Economy is increasingly prominent with significant tax achievements up to September 2025. The government also relies on the Rp31.5 trillion BLT Stimulus (Direct Cash Assistance) to support Fourth Quarter 2025 Economic Growth, supported by increased Consumer Confidence, according to a Bank Indonesia survey. On the Monetary side, BI confirms that Rupiah Redenomination will not affect public purchasing power.

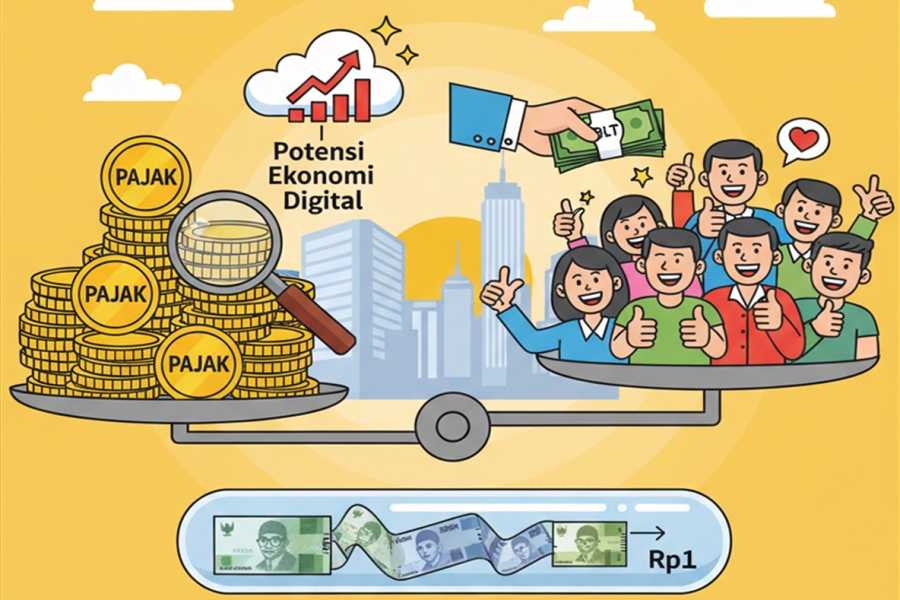

The government is focusing efforts on enforcement and expanding the Taxation base amidst the need for support for Economic Growth. Finance Minister Purbaya exposes the culprit behind the sharp decline in tax collection after visiting wealthy Taxpayers (WPs). This statement indicates non-compliance among large WPs, which is the main focus of tax enforcement. Furthermore, the Government highlights the potential of the Digital Economy and its tax realization as of September 2025. This highlight affirms that the digital sector is a new source of revenue that the state continues to explore.

To boost Economic Growth, the government relies on Fiscal stimulus and positive consumer sentiment. The Rp31.5 trillion BLT Stimulus (Direct Cash Assistance) becomes a support for Fourth Quarter 2025 Economic Growth. This policy aims to maintain the purchasing power of lower-income communities and boost consumption at year-end. This stimulus effort is supported by positive sentiment, where a Bank Indonesia (BI) Survey shows Indonesian Consumer Confidence increased sharply in October 2025. This increase indicates public optimism about future economic conditions.

On the Monetary side, Bank Indonesia (BI) provides certainty regarding a strategic policy. Bank Indonesia (BI) ensures Rupiah Redenomination will be carried out without reducing purchasing power and the Rupiah's value. This affirmation aims to eliminate public concerns about this major Monetary policy.

Finance Minister Purbaya's focus on wealthy Taxpayers (WPs) and the potential of Digital Tax shows that the government prioritizes increasing revenue through enforcement and tax base extensification. Macroeconomically, the BLT Stimulus is expected to offset global economic uncertainty, especially since Consumer Confidence has increased sharply. On the Monetary side, BI's affirmation regarding Redenomination provides assurance that nominal changes will not affect the real value of people's money.

The latest developments reflect the government's "carrot and stick" strategy—strictly enforcing tax discipline on one hand, while distributing the BLT Stimulus to maintain the pace of Economic Growth supported by Consumer Optimism. Simultaneously, Bank Indonesia continues to ensure Monetary stability through the affirmation of the Rupiah Redenomination plan.