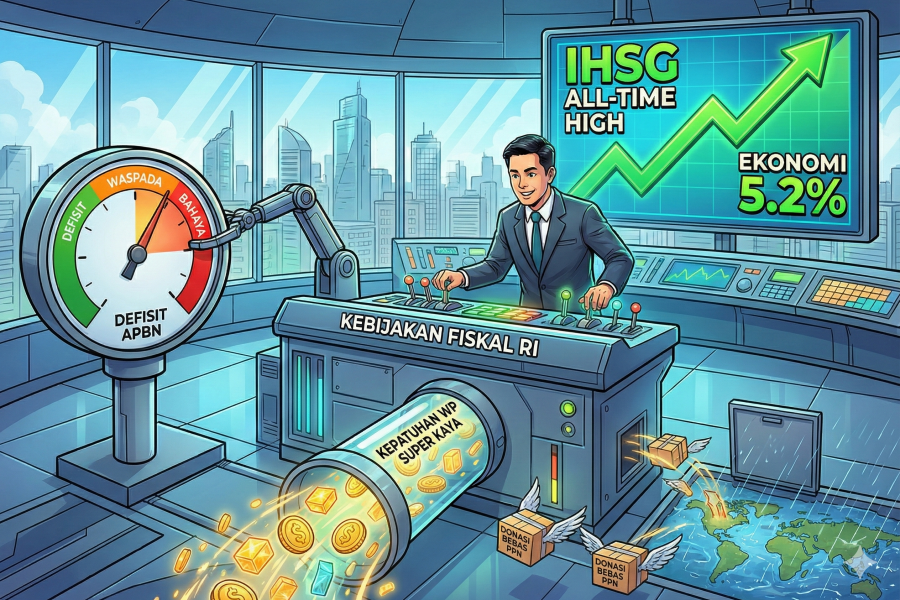

Today’s developments highlight the significant challenges in securing state revenue and the government's commitment to maintaining budget discipline. Fiscal authorities are currently struggling with a potential widening of the tax collection shortfall while simultaneously attempting to provide incentives for social activities. Furthermore, extra efforts to increase the compliance of the upper economic class have become a priority to improve the state revenue structure, which still lags behind neighboring countries. This report discusses the state budget deficit condition, the national tax ratio challenge, and the tax authority's strategic steps toward major taxpayers.

The Finance Minister acknowledges that the tax revenue shortfall will widen by the end of this year; however, the government remains committed to ensuring the state budget deficit stays below the 3% of GDP threshold to maintain fiscal credibility. This condition poses a serious challenge, as the OECD report states that Indonesia's tax-to-GDP ratio is the lowest in the ASEAN region, even falling below Laos. This data underscores the urgent need for deeper tax reforms to expand national fiscal space in the future.

As a strategic measure, the Directorate General of Taxes (DJP) is summoning a number of super-wealthy taxpayers (High-Net-Worth Individuals) as part of compliance monitoring and efforts to pursue state revenue targets. This step was taken to ensure that tax contributions from the highest economic group remain in accordance with applicable regulations amidst a tightening budget. Conversely, the government decided to waive Value Added Tax (VAT) on clothing donations for flood and landslide victims in Sumatra as a form of fiscal support to accelerate humanitarian aid.

While fiscal authorities work hard to stabilize revenue, Coordinating Minister Airlangga Hartarto reported to President Prabowo that the 5.2% economic growth target can be achieved this year. This optimism is driven by capital market performance, where the Jakarta Composite Index (IHSG) successfully reached an all-time high. The synergy between positive macroeconomic performance and efforts to strengthen the tax base is expected to mitigate the impact of the widening tax shortfall at the end of the fiscal year.

This dynamic fiscal situation has significant implications for state spending policies and investor confidence. The Finance Minister's admission regarding the widening shortfall implies a tightening of ministry/agency spending to keep the deficit under the 3% legal limit. Meanwhile, Indonesia's status as the lowest tax ratio in ASEAN according to the OECD implies increasing pressure on the DJP to conduct tax intensification more aggressively, including through the summons of HNWIs. On the other hand, the IHSG reaching an all-time high implies positive sentiment in the capital market, which, if managed well, can contribute to tax collections from the financial sector.

In general, Indonesian fiscal authorities are operating within a narrow maneuvering space between pursuing revenue targets and maintaining economic growth momentum. The government's intensive efforts to curb the deficit and improve the compliance of large taxpayers are crucial steps in addressing the OECD's criticism regarding the low state revenue ratio. Despite facing shortfall challenges, policy flexibility—such as the VAT waiver for donations—demonstrates that the function of tax as a social instrument continues to run alongside its function in securing the state treasury.