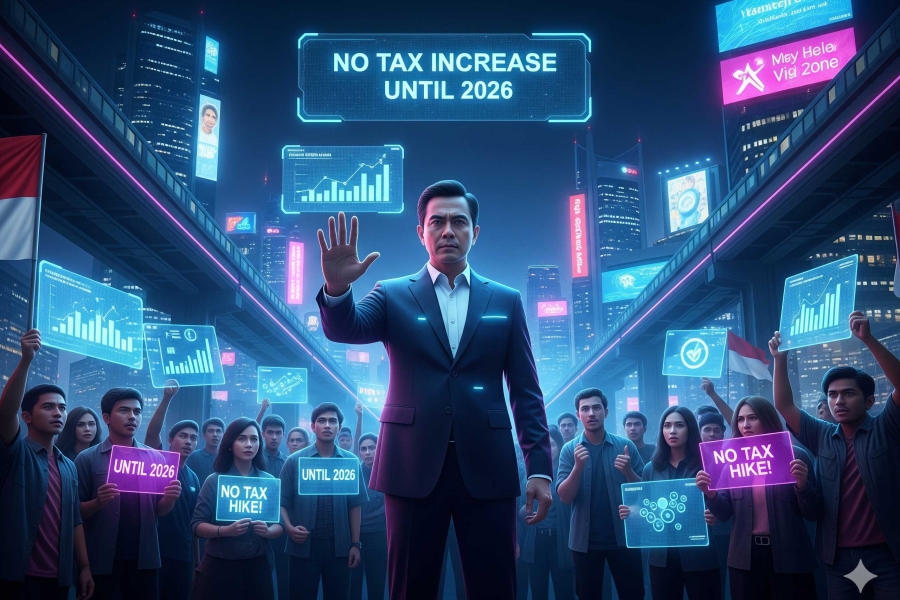

Public dissatisfaction with fiscal policy has become a central issue, triggering a wave of protests that highlight the problem of tax injustice (or tax inequity). In this context, the government has shown various responses, ranging from guaranteeing no tax rate increases, claiming fairness for the poor, to appealing for mutual cooperation (gotong royong) in paying taxes. On the other hand, these reports also hint at the government's failure to effectively address inequality, which is the root cause of public unrest.

The government's guarantee that there will be no tax rate hikes until 2026 is certainly a step to maintain economic stability and avoid burdening the public. Finance Minister Sri Mulyani Indrawati also claimed that tax collection on the lower-income group remains fair, despite the increase in the state revenue target for 2026. However, this claim clashes with reality, where some economists believe the government's costly programs have not been effective in tackling economic inequality, which is the core of public dissatisfaction.

The wave of protests triggered by the issue of fiscal injustice has emerged. Economists observe that the tax burden feels heavier for lower-income groups, while the tax system is deemed not progressive enough to reach the upper economic group. This situation has prompted the Directorate General of Taxes (DJP) to request public support and assert that tax is a shared responsibility to finance national development.

These events reveal a mismatch between government policy and public perception. Although the government has promised not to raise tax rates, the public remains resistant because the main issue is not the size of the rate, but the fairness of the system overall. Therefore, a more just and transparent tax reform, along with an evaluation of the effectiveness of social programs, is considered urgent to restore public trust and quell the protests.

The government currently faces challenges from various sides. On one hand, the government is attempting to strengthen tax revenue from new sectors like crypto assets through international cooperation. On the other hand, the government must address the concerns of Micro, Small, and Medium Enterprises (UMKM) regarding tax incentives and respond to public protests concerning the legitimacy of tax collection. Delays in providing legal certainty for UMKM and the issue of transparency in tax utilization can erode public trust, which may ultimately affect overall tax compliance.

This dynamic reflects the significant challenge the government faces in managing fiscal affairs amidst public demands. To maintain stability, the government not only needs to ensure optimal state revenue but must also demonstrate that tax funds are used effectively and equitably to address inequality. Open dialogue and tangible reform are essential steps to restore public confidence and create a more stable and inclusive economic foundation.