Executive Summary

Introduction to Transfer Pricing and TNMM

Transfer Pricing is the determination of prices in Transactions Influenced by a Special Relationship. In accordance with the Ministry of Finance Regulation (PMK) Number 172 of 2023, this pricing must be determined based on the Arm’s Length Principle (ALP) (known locally as Prinsip Kewajaran dan Kelaziman Usaha or PKKU). The ALP is applied by comparing the conditions of an Affiliated Transaction with the conditions and price indicators of the same or comparable Independent Transactions.

One of the mandatory stages in applying the ALP is determining the most appropriate Transfer Pricing method. The Transactional Net Margin Method (TNMM) is one of the commonly used methods, particularly when comparable data at the price level (Comparable Uncontrolled Price/CUP method) and gross profit level (Resale Price Method and Cost Plus Method) are unavailable. TNMM compares the net operating profit level of the tested party with the net operating profit level of the comparable.

In the application of TNMM, finding reliable comparables is paramount. The ideal comparable is often an Internal Comparable, which is the primary focus of this article.

Internal Comparables are defined as transactions conducted between an independent party and: a. The Taxpayer (the tested party); or b. The Affiliate Party that is the counterparty to the transaction.

A specific example of an Internal Comparable is a segment of the Taxpayer's own independent transactions, which appears in financial statements that have been segmented (separated).

The Priority Principle under PMK 172

PMK 172 emphasizes a priority principle in the selection of comparables. Internal comparables must be selected and used in cases where both internal and external comparables are available with the same level of comparability and reliability.

This means that if the Taxpayer possesses their own internal transaction data with independent parties that have characteristics comparable to the affiliated transaction being tested, that internal data takes precedence over seeking data from external comparable companies. Generally, this internal data is considered more reliable than external comparables because it possesses a higher degree of similarity in conditions. This internal independent transaction segment functions to provide a benchmark for the reasonable net operating profit level in the Internal TNMM method.

Internal TNMM and Comparability Analysis

TNMM is applied by comparing the net operating profit level of the tested party with the net operating profit level of the comparable. This method is typically chosen when price-based and gross profit-based methods are unavailable.

To ensure that Internal Comparables are reliable, TNMM must be applied to the transaction or business segment that is most appropriate and possesses the simplest functions, assets, and risks. This brings us to the importance of Comparability Analysis.

Comparability Analysis is the heart of ALP application. This analysis aims to prove that the Transfer Price applied by the Taxpayer is arm's length—that is, if its indicator value equals the indicator value of a comparable Independent Transaction price.

In the context of Internal TNMM, the independent transaction segment used must have a level of comparability that is the same as or similar to the affiliated transaction being tested. This comparability analysis covers comparisons of relevant economic characteristics, including:

The Taxpayer is obligated to explain in detail in the Local File regarding the characteristics of the Affiliated Transaction being tested based on the FAR Analysis, as well as explain any differences in conditions between the tested affiliated transaction and the potential comparable. If there are material differences, accurate and appropriate adjustments must be made.

The Critical Role of Segmented Financial Statements in Internal TNMM

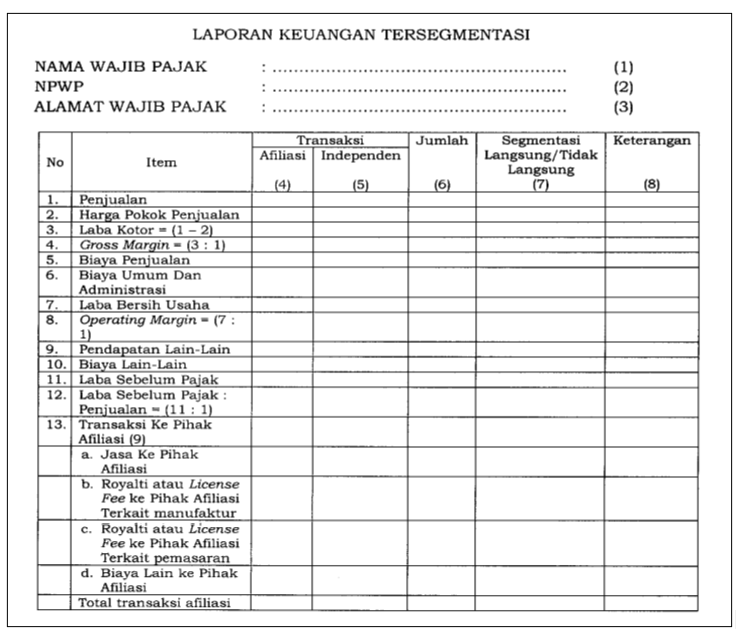

The application of Internal TNMM is impossible without the existence of Segmented Financial Statements. This financial statement segmentation must be created systematically and in detail, with the primary objective of isolating and separating financial data related to Affiliated Transactions from transactions conducted with independent parties. This separation must also be done based on different business characterizations.

Segmented financial statements are part of the documentation that presents the Taxpayer's financial information separately based on distinct business characterizations.

Segmented financial statements are crucial in the application of TNMM for the following reasons:

By separating this data, Segmented Financial Statements allow the Taxpayer to identify and use internal independent transaction data as a benchmark to establish a reasonable profit range (or arm's length point) for TNMM.

Segmentation Mechanism: Profit and Loss Statement

To achieve reliability, the segmentation of the profit and loss statement must be detailed. This includes columns indicating whether P&L items are identified or allocated directly or indirectly.

If segmentation is identified indirectly, the Taxpayer must provide an explanation regarding the basis of the allocation. For example, if royalty expenses are charged indirectly, the basis for allocating those royalty expenses to affiliated and independent transactions must be explained. The core of segmentation is ensuring that the financial elements (revenue and expenses) that will be used to calculate the net operating profit in TNMM can be distinguished clearly and reliably.

Documentation Obligations in the Local File

The application of Internal TNMM and all supporting analyses are an integral part of the Local File, which must be maintained and stored by Taxpayers conducting specific Affiliated Transactions. This Local File must be available no later than 4 (four) months after the end of the tax year.

The minimal details that must be included in the Local File related to TNMM and segmentation are as follows:

1. Application of the Arm’s Length Principle (ALP) This section is the core of the transfer pricing analysis. In the Local File, the Taxpayer must present:

2. Taxpayer Financial Information The Local File must also contain specific financial information:

Thus, segmented financial statements are not merely internal operational tools, but are also mandatory and crucial components in tax compliance accountability through the Local File.

Significance of Internal TNMM: Why It Is a Priority

The priority given to Internal Comparables signifies the recognition of their high reliability. In transfer pricing analysis, testing affiliated transactions against independent transactions conducted by the same Taxpayer (in the same segment) substantially eliminates many data imperfection issues generally faced when using external comparables.

Internal TNMM functions like "separating the wheat from the chaff." Financial statement segmentation acts as a vital tool ensuring that the net profit margin calculated for TNMM—both for the tested party and for the internal comparable—is truly isolated and represents the relevant business activity. The existence of reliable internal data facilitates the proof of ALP compliance, reduces the scope of disputes with tax authorities, and increases fairness and legal certainty for the Taxpayer.

In summary, Internal TNMM is the ideal application of TNMM, supported by Segmented Financial Statements that allow Taxpayers to utilize their own independent transaction data, provided it meets the established standards of comparability and reliability, especially regarding functions, assets, risks, and other economic characteristics.