The Tax Court decision in the case of PT OIU affirms an important limitation in the application of Government Regulation Number 46 of 2013, particularly with respect to attempts to change the income tax regime through amendments to Tax Returns (SPT) made while a tax audit is in progress. In this Income Tax dispute, the Panel of Judges rejected the Taxpayer’s appeal in its entirety and upheld the correction made by the Directorate General of Taxes (DGT), with the primary consideration that amendments to tax returns made during an audit cannot be used as a basis to change the tax treatment for subsequent tax years.

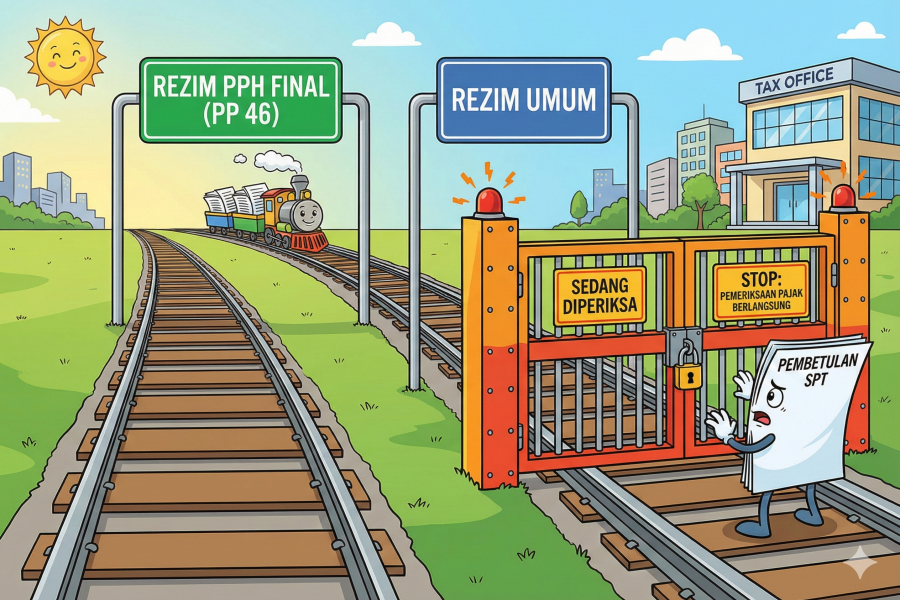

The core issue in this case concerns whether the amendment to the 2016 Annual Tax Return submitted by PT OIU could be used as a basis to conclude that the company no longer met the criteria as a taxpayer subject to Final Income Tax under PP 46 of 2013 for the 2017 Tax Year. PT OIU argued that its actual business conditions indicated that the company should have exited the final income tax regime, and therefore its 2017 income should not have been subject to final tax at a rate of 1 percent. However, the DGT continued to treat such income as subject to Final Income Tax based on the tax reporting data submitted by the Taxpayer itself.

The DGT based its correction on administrative facts showing that in the 2016 Tax Year, PT OIU reported its income tax obligations by applying PP 46 of 2013. Amendments I, II, and III to the tax return submitted by PT OIU were all made while the tax audit for the 2017 Tax Year was ongoing. In addition, in its 2017 Annual Tax Return, PT OIU again reported gross turnover of Rp226,650,000 and calculated and paid Final Income Tax at a rate of 1 percent. These facts demonstrate that the Taxpayer knowingly and voluntarily continued to apply the PP 46 of 2013 regime under the self-assessment mechanism for the 2017 Tax Year.

In its defense, PT OIU asserted that the amendment to the 2016 Annual Tax Return reflected the company’s actual business conditions and should have been used by the tax authority as a basis to assess its tax obligations for the 2017 Tax Year. According to the Taxpayer, the amendment showed that the company had exceeded certain thresholds required for the application of PP 46 of 2013, and therefore the imposition of Final Income Tax for the 2017 Tax Year was no longer appropriate. However, this argument relied entirely on amendments made after the audit had commenced and was not supported by consistent tax compliance reporting from the outset.

In its considerations, the Panel of Judges stated that although Article 8 of the Law on General Provisions and Tax Procedures grants taxpayers the right to amend their tax returns, amendments made while a tax audit is in progress do not automatically bind the tax authority if they do not reflect conditions that were reported consistently beforehand. The Panel further emphasized that under the self-assessment system, consistency and timeliness of reporting carry significant evidentiary weight. Based on these considerations, the Panel concluded that the DGT’s correction had been properly made and was in accordance with the prevailing tax laws and regulations, and therefore the appeal filed by PT OIU was entirely rejected.

This decision provides an important lesson that although, normatively, PP 46 of 2013 does not apply permanently, changes to the income tax regime must be reflected in tax reporting that is timely and consistent. Claims that a taxpayer has exited the Final Income Tax regime cannot be established solely through amendments to tax returns made while a tax audit is in progress, without being supported by a consistent track record of administrative compliance. Accordingly, this decision underscores that timing and consistency of reporting are key factors in determining the applicable tax regime in income tax disputes.

Comprehensive and Complete Analysis of This Dispute is Available Here