The Tax Court has issued an important ruling that highlights how differing interpretations of revenue recognition and the treatment of in-kind employee benefits can lead to substantial tax adjustments. The case involving PT Tunggal Mitra Plantations (PT TMP) centered on three key issues: the timing of a quality claim on CPO sales, the deductibility of rice rations provided to plantation workers, and discrepancies identified through PPh 21 equalization.

The Directorate General of Taxes (DGT) argued that the quality claim settled by PT TMP during the year should have been recorded in the preceding fiscal period, thereby reducing prior-year revenue. The DGT also asserted that the provision of rice rations constituted non-deductible in-kind benefits, and that discrepancies in the PPh 21 equalization indicated improperly recognized employee-related expenses. PT TMP rejected these adjustments, maintaining that the quality claim was only finalized economically in the disputed year, and that the rice rations were mandatory under the Collective Labor Agreement and inherently linked to operations in remote plantation locations.

The Tax Court ultimately granted the appeal in part, concluding that several of the DGT’s adjustments could not be sustained. After examining the evidence and explanations from both sides, the Court found that the DGT had not conclusively demonstrated that the PPh 21 equalization differences represented in-kind benefits that must be added back. The Court also emphasized that the timing of revenue recognition must reflect when the claim is settled economically—not merely when it is raised. As a result, part of the DGT’s adjustments was overturned.

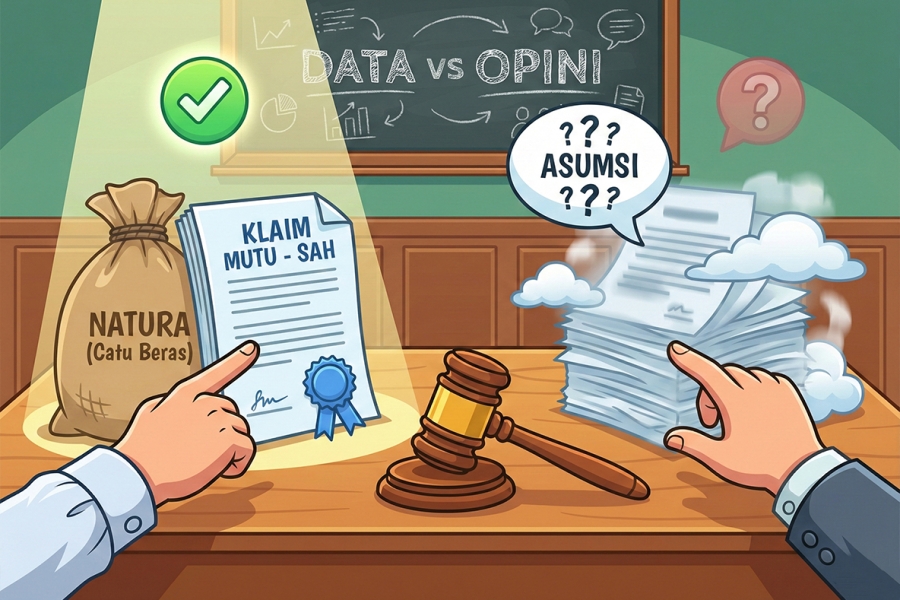

This decision underscores that tax adjustments—especially those involving in-kind benefits or the timing of revenue recognition—require concrete evidence and clear methodology. PT TMP successfully demonstrated that the disputed expenses were directly tied to its operational activities, while the DGT had not provided sufficient analytical basis to support its corrections. The case serves as a reminder that tax adjustments cannot be based on assumptions, but must rest on verifiable data, coherent reasoning, and traceable reconciliation.

The PT TMP decision also serves as a reminder that the tax treatment of in-kind benefits must always be assessed in light of the applicable fiscal year. For Fiscal Year 2017, in-kind benefits were generally non-deductible, subject to limited exceptions. However, the regulatory landscape has since evolved: under PMK 66/2023, in-kind benefits can now be treated as deductible expenses, provided that the employer has properly withheld and remitted PPh Article 21 in accordance with regulations. This shift reinforces that adjustments involving in-kind benefits cannot be applied mechanically, and must reflect both the historical rules and the contemporary tax framework.

Comprehensive and Complete Analysis of This Dispute is Available Here