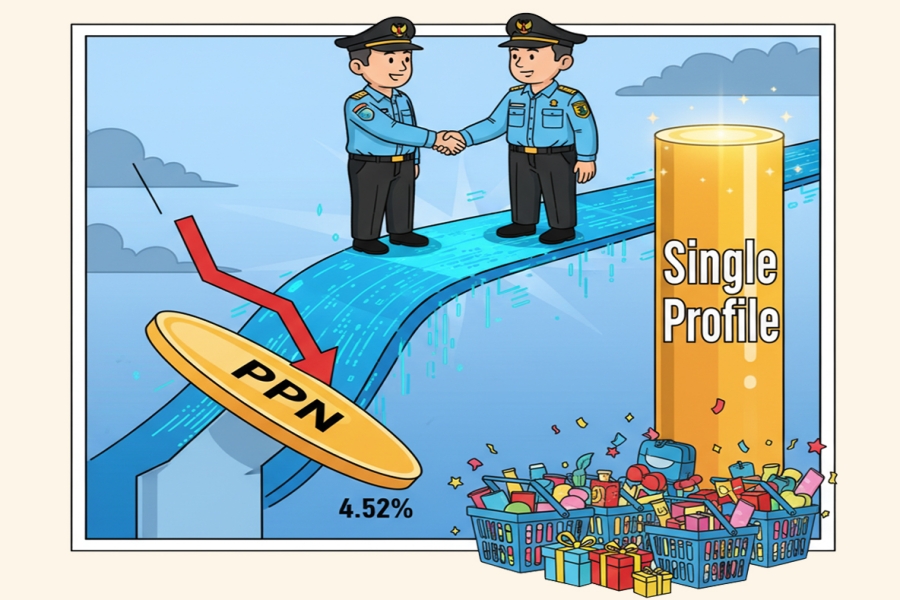

This period highlights the fiscal challenges in the Value Added Tax (VAT) sector and the government's efforts to strengthen tax administration efficiency. The VAT collection ratio, which fell to 4.52% in Quarter III 2025, reflects the weak performance of the Consumption Tax. In response, the Directorate General of Taxes (DJP) affirms its readiness to support the implementation of the Single Profile project with Customs. This fiscal pressure emerges amidst positive projections that Retail Sales are expected to increase in December 2025 and March 2026. On the Monetary side, Bank Indonesia (BI) also provides further clarification regarding the planned implementation of Rupiah Redenomination.

The government is responding to fiscal challenges caused by the sluggish Economy with administrative reform. The Indonesian Value Added Tax (VAT) collection ratio fell to 4.52% in Quarter III 2025. This figure affirms the serious challenge in securing Consumption Tax revenue, aligning with the fact that the Consumption Tax collection power is further declining amidst Indonesia's sluggish Economy. This decrease indicates a negative correlation between VAT performance and Consumption activities amidst the economic slowdown.

In response, the Directorate General of Taxes (DJP) is taking an integrative step. The DJP states its readiness to support the Single Profile project with Customs and other related agencies. This support aims to integrate taxpayer data, enhance administrative efficiency, and strengthen fiscal supervision amid declining revenue.

Nevertheless, the consumption sector is predicted to experience a recovery during specific periods. Retail Sales are predicted to increase in December 2025 (driven by National Religious Holidays/HBKN) and March 2026 (driven by the fasting month and Eid al-Fitr). This prediction indicates the potential for Consumption recovery during these periods. Aside from fiscal issues, Bank Indonesia (BI) provides an answer regarding when Rupiah Redenomination will be implemented. This statement aims to provide clarity to the public about this strategic Monetary policy.

The decline in the VAT ratio and the power to collect Consumption Tax signal a weakening of Domestic Demand that needs attention. The DJP's response through supporting the Single Profile project shows a focus on administrative reform to enhance efficiency and supervision amidst revenue decline. Nonetheless, the prediction of rising Retail Sales towards year-end offers hope for a consumption rebound. On the Monetary side, BI's clarification regarding Rupiah Redenomination provides important public education ahead of the policy's implementation.

The latest developments show the government's effort to curb the decline in VAT revenue through administrative improvements, including the acceleration of the Single Profile project. The Consumption sector is projected to strengthen in the coming periods, while BI continues to maintain communication regarding the Rupiah Redenomination plan to ensure Monetary stability.