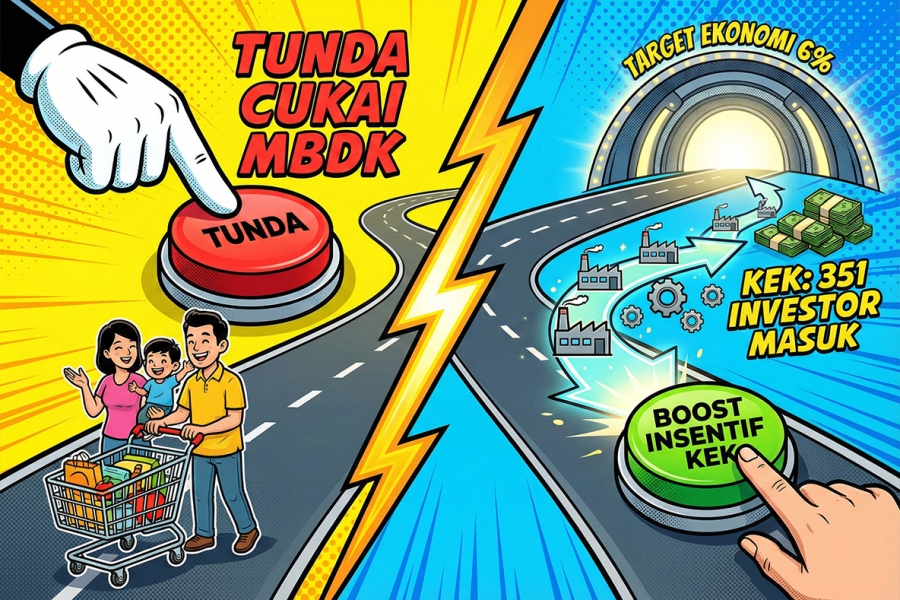

Today's fiscal policy focus highlights the government's strategy in maintaining public purchasing power and boosting investment through incentives. The government officially postponed the excise duty on packaged sweetened beverages (MBDK), making its implementation conditional on achieving the 6% economic growth target. This decision was taken to maintain economic stability. In line with stimulus efforts, tax incentives in Special Economic Zones (SEZs) proved highly attractive, drawing 351 companies to operate. Furthermore, as support for the green energy policy, the government will immediately exempt ethanol from excise duty. This summary will cover the postponement of the MBDK excise and the success of the SEZ tax incentive program.

The Government decided to postpone the excise duty on sweetened beverages. The duty will only be implemented once economic growth reaches 6%. This postponement aims to protect public purchasing power from price increases. In addition to delaying the duty, the Government will immediately exempt ethanol from excise duty. This step is being taken to support Minister Bahlil's policy on green energy development and increase investment in that sector.

Meanwhile, the investment stimulus policy through Special Economic Zones (SEZs) proved successful in attracting interest. The massive tax incentives in SEZs successfully met the Incremental Capital Output Ratio (ICOR) target set by President Prabowo. This achievement demonstrates the effectiveness of the incentives in attracting quality investment.

Evidence of this success is seen in the fact that tax discount facilities in SEZs proved successful in attracting interest; a total of 351 companies have commenced operations in the SEZs. This figure reflects the success of the incentive policy in boosting investment and creating jobs regionally.

The latest information has direct implications for public consumption and investment strategy. The postponement of the MBDK excise until the economy reaches 6% growth implies stronger purchasing power recovery, but delays the potential for additional state revenue. Meanwhile, the success of the SEZ tax incentives, which attracted 351 companies and met the ICOR target, implies an increase in quality investment and regional economic growth in the future. The ethanol excise exemption policy implies concrete support for the energy transition and real sector policy.

In general, the government is taking a conservative step regarding domestic revenue by postponing the MBDK excise for the sake of price stability and purchasing power. On the other hand, the pro-investment strategy through SEZ tax discounts proved effective in attracting domestic and foreign investment, evidenced by the operation of 351 companies. This dual focus aims to create a balance between protecting consumption and creating quality investment as a foundation for achieving 6% economic growth in the future.