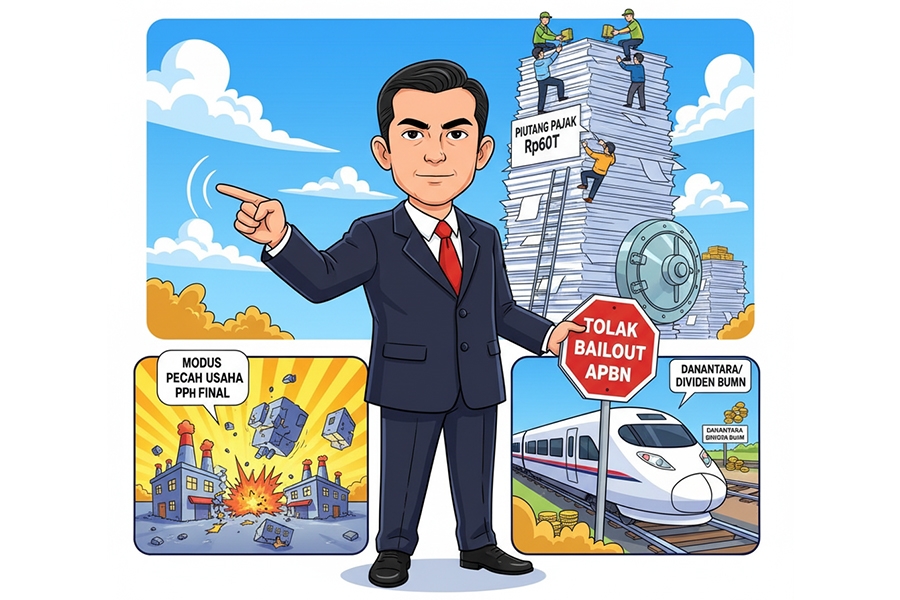

The Ministry of Finance will investigate alleged tax avoidance practices through a business-splitting scheme by Taxpayers aiming to maintain the preferential final Income Tax (PPh Final) rate of 0.5%. This practice is indicated to be carried out by business actors with an annual turnover above IDR 4.8 billion who divide their business entity into several smaller units so that they formally still meet the criteria as MSME (Micro, Small, and Medium Enterprises) tax subjects.

Minister of Finance Purbaya Yudhi Sadewa stated that the investigation will involve the Directorate General of Taxes (DJP) by utilizing the internal database through the Coretax system and coordinating with the legal entity administration data at the Ministry of Law and Human Rights (Kemenkumham). "We will further investigate whether we can detect it with the database available in Coretax, or later through cooperation with the Kumham database," said Purbaya. This step aims to identify Taxpayers who should have transitioned to the general Income Tax regime.

Although this issue was previously highlighted by the Coordinating Minister for Economic Affairs Airlangga Hartarto, Purbaya emphasized that this in-depth effort is a new initiative and does not target significant results in the short term. On the other hand, the government ensures that the MSME final Income Tax facility will remain extended until 2029 for individual Taxpayers, in line with the current policy commitment.

Finance Minister Asserts KCIC Debt is Danantara's Responsibility, Not the State Budget (APBN)

Minister of Finance Purbaya Yudhi Sadewa has set the government's position regarding the debt obligations of PT Kereta Cepat Indonesia China (KCIC), emphasizing that the responsibility for its settlement lies with Danantara as the managing entity of State-Owned Enterprises (BUMN) assets. This stance firmly rejects the use of the State Revenue and Expenditure Budget (APBN) funds to cover the debt burden of the strategic project, aligning with the principle of separation between government function and state corporation management.

Purbaya outlined the financing mechanism that Danantara must pursue, which is by utilizing the BUMN dividend allocation that it now manages. According to him, with the potential annual dividend earnings reaching IDR 80 trillion, Danantara has the financial capacity to manage the obligation independently. "They should manage (the KCJB debt) from there. It shouldn't be us again," he asserted, referring to the policy that BUMN dividends are no longer deposited directly as Non-Tax State Revenue (PNBP) into the state treasury.

This assertion emerges amidst significant financial pressure experienced by KCIC. Based on the financial report of PT KAI as the consortium leader, the entity PT Pilar Sinergi BUMN Indonesia (PSBI) recorded a loss of IDR 4.195 trillion throughout 2024, with continued losses of IDR 1.625 trillion in the first semester of 2025. This operational loss underscores the urgency of resolving KCIC's debt structure at the corporate level.

Tax Authority Reveals Thousands of Taxpayers Behind IDR60 Trillion in Arrears

The Ministry of Finance clarified that the number of Taxpayers (WP) with significant arrears behind the IDR60 trillion tax receivables is not limited to the 200 prominent individuals previously highlighted, but reaches thousands. This confirmation was delivered by the Minister of Finance’s Expert Staff for Tax Compliance, Yon Arsal, who mentioned that the collection of tax receivables is a routine process carried out by the Directorate General of Taxes (DJP) but often faces complex cases.

Yon Arsal explained that the slow collection process is due to complex juridical challenges. In accordance with the mandate of the Law on General Provisions and Tax Procedures (UU KUP), an arrear can only be forcibly collected after going through a series of legal processes if the Taxpayer files an objection. This process can continue up to the dispute level in the Tax Court and even cassation at the Supreme Court (MA). "This does not mean it is being neglected, but there is a process, perhaps the taxpayer has already gone bankrupt," he explained.

Nevertheless, the government affirms its commitment to resolving these receivables. Minister of Finance Purbaya Yudhi Sadewa stated that from the total target, payments of around IDR 7 trillion have been received. Intensive collection will continue to be monitored and it is hoped that the majority of the arrears can be settled towards the end of 2025, with technical execution carried out by the relevant Tax Service Offices (KPP) under the supervision of the DJP central office.