The application of Article 18 paragraph (3) of the Income Tax Law (UU PPh), which grants the Director General of Taxes (DJP) the authority to redetermine the amount of income and deductions in transactions involving a special relationship, has once again been tested in the Tax Court. The case of PT SMS highlights the complexity of equalizing Transfer Pricing corrections from Corporate Income Tax (CIT) to Withholding Tax, specifically Final Income Tax Article 4 paragraph (2) on the lease of land and/or buildings. This matter arose after DJP carried out a negative correction on Lease Expense in the 2021 CIT audit, deeming the paid rent value to be below the arm’s length price, and consequently made a positive correction to the Final PPh Article 4 paragraph (2) Tax Base (DPP) for the November 2021 Tax Period.

The core conflict in this dispute lies in the validity and limits of Transfer Pricing correction within the context of Final PPh. The DJP argued that after establishing a special relationship and finding the paid rental value was lower than the arm's length market price (based on the Tax Assessor Functional Team's Report), the correction to the Lease Expense in CIT must be equalized to the Final PPh Article 4 paragraph (2) DPP correction. This assumption is based on the premise that the difference in the arm's length rental value constitutes income for the lessor, and thus the lessee should have withheld Final PPh on that amount.

PT SMS, on the other hand, countered with the fundamental argument that the corrected difference by the DJP is a fictitious calculated value (imputed value) which was never paid or recognized as a liability in the books. According to PT SMS, as per Article 4 paragraph (1) and (2) Government Regulation Number 34 of 2007, the object of Final PPh Article 4 paragraph (2) is the gross amount of the lease value that was genuinely paid or due. PT SMS bolstered their defense by proving the arm's length nature of the lease transaction (revenue sharing) through a Transfer Pricing analysis (TNMM) which showed PT SMS's Operating Margin (OM) was still within the comparable range and accounted for the specific conditions of the COVID-19 Pandemic.

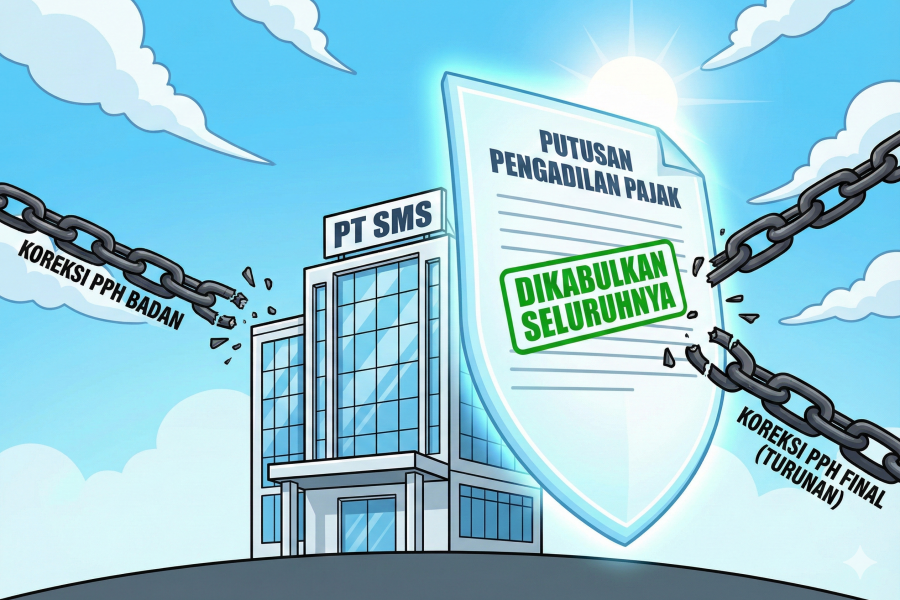

The Panel of Judges, in its legal consideration, did not focus on re-testing the Transfer Pricing arm's length nature. Instead, the Panel adopted a related dispute approach by referring to the previous Tax Court Decision on the parent dispute, the negative correction of the 2021 CIT Lease Expense. Since that parent CIT dispute Decision had Granted the Appeal in Full (effectively nullifying the negative Lease Expense correction of IDR 42,781,612,448.00), the legal basis for carrying out the derivative correction on the Final PPh Article 4 paragraph (2) DPP disappeared.

The implication of this Decision is highly significant for tax practice, particularly in handling Transfer Pricing disputes that have a dual effect on other types of tax. The Decision confirms that the validity of a derivative correction (Final PPh) is highly dependent on the final outcome of the underlying parent dispute (CIT). For Taxpayers, this serves as a crucial lesson that strong evidence in a CIT dispute (via a solid TP Doc and non-financial supporting data such as the impact of a pandemic) can directly nullify related Withholding Tax corrections. This Decision reinforces the Taxpayer's position that a calculated Transfer Pricing correction cannot automatically be considered an object of Final PPh, as long as there is no actual payment or recognition of a liability.

The action taken by the Panel of Judges demonstrates that consistency in handling linked cases is a priority. With the appeal of PT SMS being granted in full, the Final PPh Article 4 paragraph (2) Underpayment Tax Assessment Letter (SKPKB) for the November 2021 Tax Period becomes zero, securing the Taxpayer's position in the Transfer Pricing equalization dispute.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here