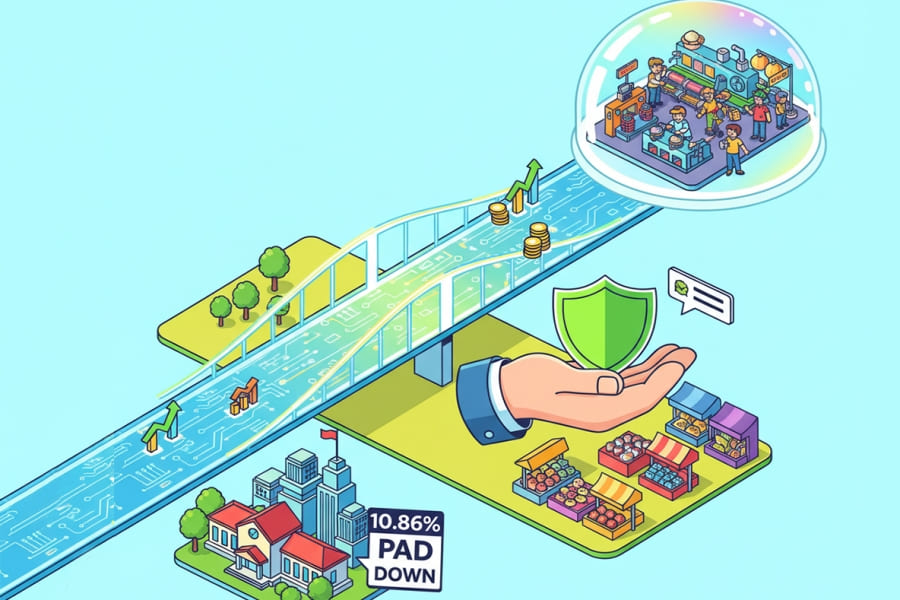

Current issues highlight the government's steps in responding to domestic economic pressures, both in terms of state revenue and the industrial sector. A 10.86% decline in Regional Original Revenue (PAD) prompts the government to accelerate regional Tax Digitalization to increase efficiency. On the other hand, the restriction of Used Clothing Imports is expected to revive the national textile industry. Macroeconomically, monthly Inflation is projected to slow to 0.02%, although the Trade Balance surplus is narrowing due to moderating Export performance. The government also shows support for MSME actors by encouraging Music Royalty exemption.

The government focuses on protecting industry and Micro and Small Enterprises (MSMEs) amid macroeconomic dynamics. The restriction of Used Clothing Imports is expected to revive the national Textile and Garment Industry (TPT). This expectation shows that the government views the restriction as a crucial step to protect domestic producers. In line with this, the Government encourages Music Royalty exemption for Micro and Small Enterprises (MSMEs). This policy aims to reduce operational costs for MSME actors and provide incentives for people's business growth.

However, the government faces serious challenges in the Regional Revenue and international trade sectors. Regional Original Revenue (PAD) declines by 10.86%. In response, the government encourages Tax Digitalization at the regional level. This step aims to enhance efficiency, transparency, and ultimately, increase the eroded Regional Revenue. Externally, the Trade Balance surplus in September 2025 is projected to narrow due to the moderation of Export. This projection highlights the need for market and Export product diversification to maintain international trade performance amidst the global economic slowdown.

Despite these challenges, domestic price stability shows a positive signal. Monthly Inflation is estimated to drop to 0.02% in October 2025. This decrease indicates price stability among the public, which is a positive signal for purchasing power and the business environment.

The 10.86% decline in PAD necessitates swift intervention through regional Tax Digitalization to secure sub-national fiscal health. On the other hand, the MSME issue becomes a focus through the push for Music Royalty exemption. The effort to protect domestic industry is clearly seen in the Used Clothing Import restriction policy, which is expected to restore the TPT Industry. Macroeconomically, although monthly Inflation is expected to decrease, the narrowing Trade Balance surplus requires the government to proactively seek new export markets.

Current developments show the government's focus on long-term solutions, such as accelerating regional Tax Digitalization to offset the PAD decline and import restrictions to protect the national TPT Industry. Challenges persist in maintaining the trade surplus and fostering MSME growth through non-fiscal support like the royalty exemption policy.