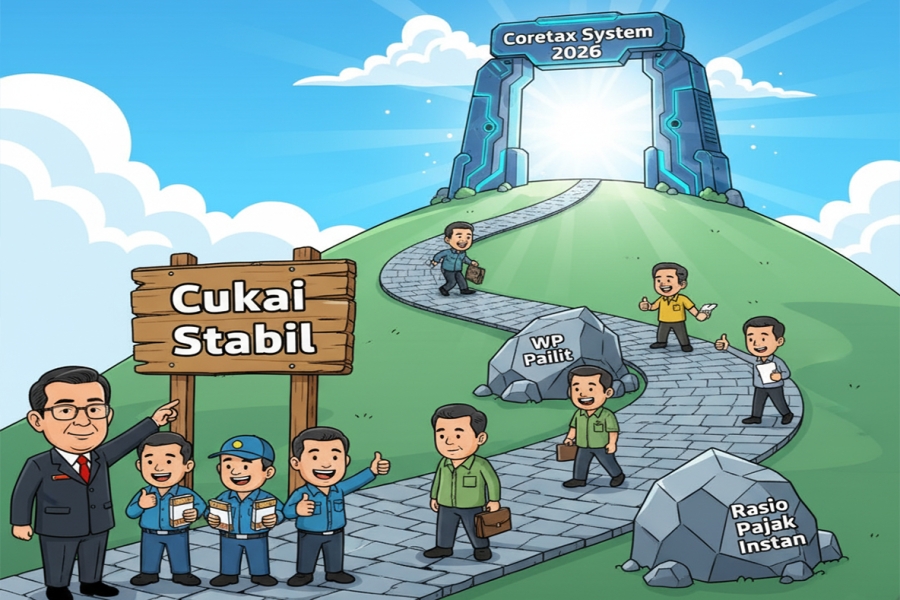

The issue of tax reform and the government's efforts to balance state revenue with business certainty are the main highlights. The statement by the Minister of Finance regarding the policy of stabilizing tobacco excise tariffs is seen as sending a positive signal to the industry, in line with the plan to modernize the tax administration system through the implementation of the Coretax System in 2026. Nevertheless, several structural challenges still loom, such as the risk of hastily pushing for an increase in the tax ratio and the problem of bankrupt taxpayers who still owe tax obligations.

The Indonesian government is taking conservative steps on sectoral policy amid pressure to boost revenue. Finance Minister Purbaya Yudhi Sadewa confirms that excise and the Retail Selling Price (HJE) of cigarettes will not increase next year. This decision aims to provide business certainty for the tobacco industry, while also curbing the circulation of illegal cigarettes. In the trade sector, the government will intensify Import Duty collection on imports of mobile phones and electronic goods, carried out to optimize revenue from the international trade sector and protect the domestic electronic industry.

However, efforts to increase revenue through taxation instruments are confronted with structural challenges and policy risks. Observers expose the risks behind the opportunity to instantly raise the tax ratio to 12%, known to be that such rushed efforts could create distortion, depress purchasing power, and potentially disrupt the business climate. Furthermore, the Directorate General of Taxes (DGT) faces complex collection challenges, as data shows that the number of Tax Delinquents (WP) reaches thousands, with the surprising fact that some of them have already been declared bankrupt.

To address administrative weaknesses and ensure sustainable revenue increase, the government is preparing a fundamental modernization. Starting in 2026, Annual Tax Return (SPT) submissions must use the Coretax System and is claimed not to have errors. This modernization is a fundamental part of fiscal reform, aiming to simplify things for Taxpayers (WP) and improve the accuracy of state revenue data, serving as a foundation for achieving a higher tax ratio gradually.

Minister Purbaya's decision to stabilize the excise provides positive certainty for the tobacco industry. However, structural challenges in taxation remain significant, where the DGT must deal with thousands of tax delinquents who are even bankrupt, indicating that collection is not merely an issue of compliance, but also of solvency. The effort to intensify Import Duty on mobile phone/electronic imports is a short-term strategy to boost trade revenue. Fundamentally, the plan for Coretax 2026 implementation is a key step to mitigate the risk of instantly increasing the tax ratio in a more structured and accurate data-driven manner.

The current dynamics reflect the government's commitment to fiscal reform and cautious sectoral policy (stable excise), balanced by efforts to tighten non-tax revenue (Import Duty on imports). Business players must note the DGT's promise regarding the error-free implementation of Coretax 2026 as a momentum to improve tax compliance. Meanwhile, the risks revealed by observers concerning the tax ratio and the problem of bankrupt tax delinquents call for deeper, rather than merely instant, solutions from the fiscal authorities.