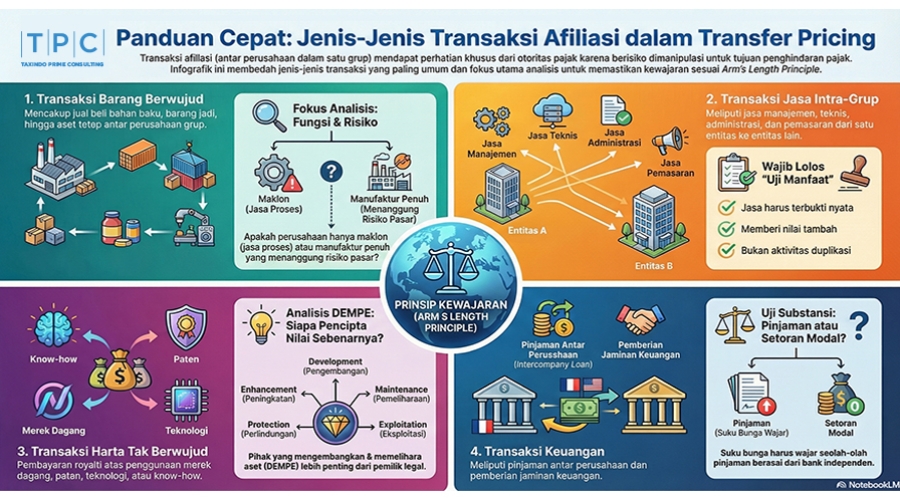

In the modern taxation ecosystem, understanding affiliated transactions (related party transactions) is fundamental for multinational companies as well as local business groups. Affiliated transactions are transactions carried out by Taxpayers with parties who have a special relationship.

Tax authorities pay special attention to these transactions due to the risk of price manipulation (transfer pricing) that does not accord with fair market principles. In Indonesia, the application of the Principle of Fairness and Business Prevalence (PKKU) or the Arm's Length Principle (ALP) is mandatory to be carried out separately for each type of transaction.

This is the most common and fundamental type of affiliated transaction. These transactions cover the purchase and sale of raw materials, semi-finished goods, finished goods, to fixed assets (machinery, equipment, vehicles) between companies within one group.

In tangible goods transactions, the main focus of transfer pricing analysis is on the functions performed by the transacting parties. For example, whether the selling entity acts as a fully fledged manufacturer that bears market and inventory risks, or merely as a toll manufacturer (maklon) that only sells processing services without owning the raw materials.

Transfer pricing determination methods often used include:

Intra-group services refer to activities provided by one member of a business group that provide benefits to other group members. Common examples include management services, technical services, administrative services, IT support, to marketing services.

Unlike goods transactions, service transactions have an extra layer of testing. Before calculating the fair price, the Taxpayer must prove that the service actually occurred and was needed. The Taxpayer must prove:

If this benefit test is not met, the tax authority may consider the value of the transaction to be zero, regardless of how much cost the group incurred.

In the digital economy era, transactions related to intangible assets or intangibles become very crucial and often become tax disputes. These transactions usually take the form of royalty payments for the use of trademarks, technology patents, copyrights, or know-how.

Transfer pricing analysis for intangibles does not only look at who the legal owner of the asset is, but who substantially contributes to the value of the asset. This concept is known as DEMPE analysis:

Entities that only hold legal rights without performing DEMPE functions (only a cash box entity) are entitled to a lower return compared to entities that actively develop and maintain the value of the intangible.

These transactions cover intercompany loans, financial guarantees, cash pooling, and derivative transactions. The tax authority will look at two main things:

Additionally, the analysis must also ensure that the transaction has a clear economic motive (economic rationale) and is not merely a scheme to erode the tax base through excessive interest payments (base erosion).

Business restructuring is defined as cross-border reorganization involving the transfer of functions, assets, and/or risks between affiliated parties. Common examples include:

The main issue in restructuring is whether there is "profit potential" transferred from one country to another. If the transfer has significant economic value, then the party relinquishing the right is entitled to fair compensation (exit charge).

CCA is a contractual framework among affiliated parties to share costs and risks in developing, producing, or obtaining assets or services. Each participant must make a contribution comparable to the share of expected benefits. If not comparable, there must be a balancing payment to meet the principle of fairness.

Identifying types of affiliated transactions is a crucial first step in international tax compliance. Each type of transaction has unique risk characteristics and documentation requirements. Failure to map these transaction types can lead to errors in selecting transfer pricing methods and significant fiscal corrections.

Is My Company Required to Create a Transfer Pricing Document?