The national economic landscape today focuses on Bank Indonesia's strategic steps in maintaining a balance between monetary stability and the drive for economic growth. Amidst exchange rate fluctuations and pressure from international institution opinions, the monetary authority continues to prioritize policy consistency to provide certainty for financial markets. Furthermore, the emergence of optimistic projections for the coming years serves as positive sentiment coloring domestic fiscal and monetary dynamics. This report reviews the benchmark interest rate decision, liquidity expansion strategies, and responses to external tax policy recommendations.

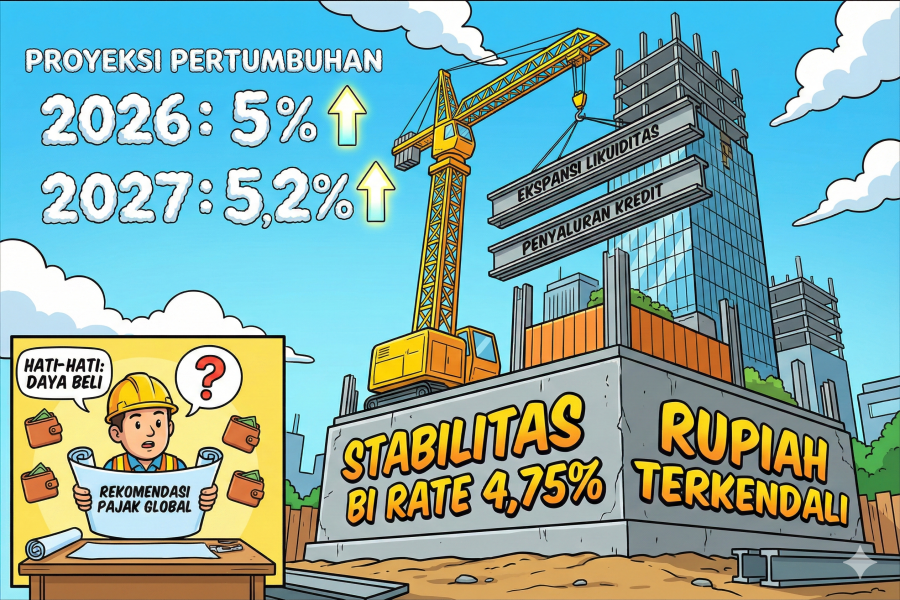

Bank Indonesia (BI) has decided to maintain the BI Rate at the 4.75% level to ensure inflation remains under control and macroeconomic stability is preserved. In line with this policy, Bank Indonesia asserts that the Rupiah exchange rate remains in a controlled condition, even though the currency experienced weakening pressure against the US Dollar. The monetary authority continues to perform necessary interventions in the foreign exchange market so that exchange rate volatility stays within reasonable limits for market certainty.

To support growth acceleration, Bank Indonesia is driving the national economy through an aggressive liquidity expansion strategy in the banking sector. BI targets double-digit growth in base money to ensure the availability of sufficient funds for banks to channel credit to the real sector more broadly. This step is expected to strengthen domestic economic resilience, especially after the World Bank released projections that Indonesia's economic growth will reach 5% in 2026 and increase to 5.2% in 2027.

Although international institutions show confidence in Indonesia's fundamentals, several economic observers remind the government to be cautious in adopting World Bank recommendations regarding tax policy. Experts assess that any tax rate adjustment must consider domestic purchasing power so that such policies do not backfire against the ongoing economic recovery momentum. The synergy between stable monetary policy and fiscal policy that is empathetic toward the people is the key to the sustainability of these long-term growth targets.

These various monetary decisions and international projections carry significant implications for capital flows and national fiscal strategy. Maintaining the BI Rate at 4.75% implies the preservation of domestic financial asset attractiveness for foreign investors, thereby minimizing pressure on foreign exchange reserves. Meanwhile, the target of double-digit base money growth implies an increase in bank lending capacity, which, if well-absorbed, will accelerate business expansion across various sectors. On the other hand, long-term growth projections from the World Bank imply increased interest in Foreign Direct Investment (FDI) to Indonesia, but observer warnings regarding taxes imply a risk of social resistance if the government rushes to increase tax burdens without proper mitigation.

Overall, the harmonization between stable monetary policy and cautious fiscal planning is the primary key to facing current economic challenges. Bank Indonesia's firmness in managing the Rupiah and liquidity provides a sense of security for market participants, while positive projections from the World Bank offer an optimistic roadmap for the coming years. Although global recommendations remain an important reference, sovereignty in determining the direction of pro-people tax policies will dictate the sustainability of national economic stability during this transition period.