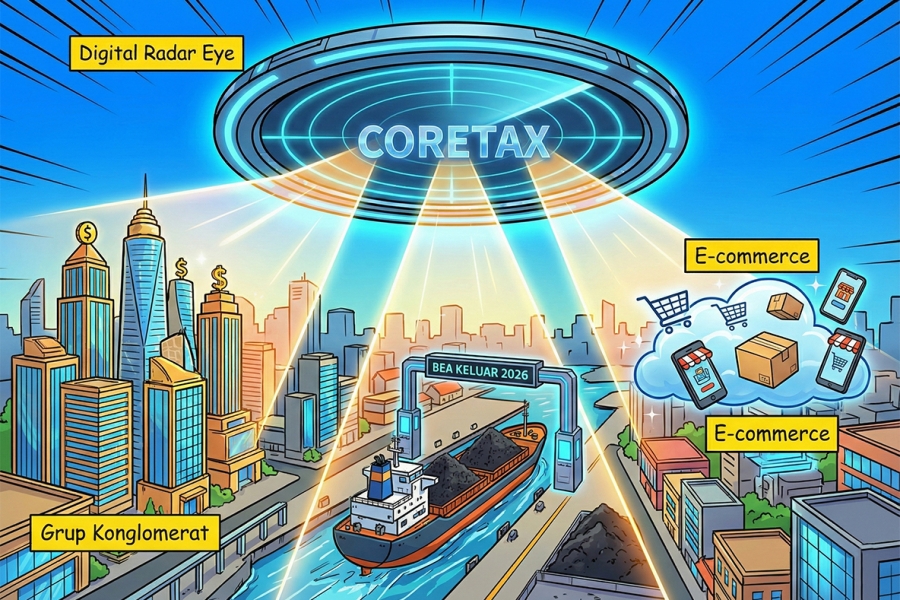

Amidst global challenges, the Directorate General of Taxes (DJP) continues to intensify supervision over large and conglomerate Taxpayers (WP) through the implementation of the Coretax system and risk profile assessment. This step is part of a strategy to maximize revenue amidst a potential shortfall. In addition to strengthening compliance supervision, the Ministry of Finance (Kemenkeu) is also preparing to expand the tax base to the online trade sector and establish a new export duty for strategic commodities, including coal. This policy focus covers the optimization of supervision, the strategy for revenue dynamism in the current year, and the preparation of new fiscal provisions to take effect next year.

The Directorate General of Taxes (DJP) is consistently tightening supervision over large and conglomerate Taxpayers (WP) by utilizing the Coretax system and an integrated risk profile. This strict supervision ensures that their business activities and financial transactions are recorded in real-time, facilitating the DJP in analyzing compliance and identifying tax anomalies, thereby preventing tax avoidance practices. To achieve this year's revenue target, the DJP will also rely on a dynamism strategy, which includes the effort of ijon pajak (tax acceleration/early collection) from certain Taxpayers. This strategy is necessary to minimize the widening potential shortfall before the end of the fiscal year.

Approaching 2026, the Ministry of Finance (Kemenkeu) has an ambitious revenue target and is implementing a tax base extensification strategy. Kemenkeu intends for online merchants on platforms like Shopee, Tokopedia, and similar sites to be taxed soon, which aims to expand the tax reach in line with the rapid growth of the digital economy.

Furthermore, Purbaya, a related official, confirmed that coal exports will be subject to export duty starting in 2026. This policy aims to optimize state revenue from the commodity sector and eliminate disparities with other mining products that are already subject to export duty.

These measures carry significant implications for business actors and the commodity market. The tightening of supervision over large and conglomerate WPs through Coretax demands higher transparency and tax compliance from these companies. The dynamism strategy (ijon tax) will create short-term liquidity pressure for certain WPs at year-end. Meanwhile, the certainty of coal export duty starting in 2026 will change the cost structure for coal companies, encouraging efficiency optimization to maintain export competitiveness. Most broadly impacted, the ambitious plan to tax e-commerce creates both challenges and opportunities for online merchants to operate more formally and transparently in line with the expansion of the state's tax base.

Overall, the news today shows that Indonesian fiscal authorities are adopting a two-pronged approach: intensifying supervision with advanced technology (Coretax) for existing WPs and extending the tax base to new sectors (e-commerce and commodity export duty). This strategy is essential to ensure state revenue can meet the ambitious APBN targets. Business actors and Taxpayers across all sectors must be prepared for an increasingly transparent and strict regulatory environment, and understand the new fiscal policies that will change their business models in 2026.