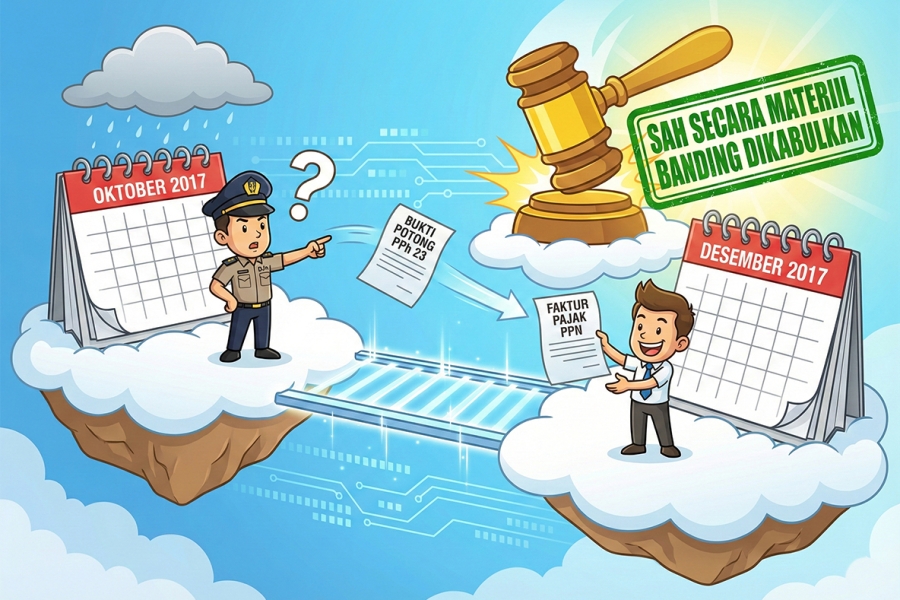

Disputes over VAT reporting timing persist in the Indonesian tax litigation landscape. PT Haur Kuning Rahmat PT HKR faced a VAT DPP (Tax Base) correction for the October 2017 Tax Period stemming from an equalization procedure of PPh Article 23 Withholding Proof data. Although the Directorate General of Taxes (DJP) insisted that the VAT was due in October, the Tax Court Judicial Panel granted PT HKR's appeal because the VAT was proven to have been reported in the December 2017 Period.

This case began when the DJP issued a VAT Underpayment Tax Assessment Letter (SKPKB) for the October 2017 period to PT HKR. The sole material dispute was a VAT DPP correction amounting to Rp. 892,858.00. This correction was based on the DJP's finding of a PPh Article 23 Withholding Proof (No. 00010/X/XVII/23-26/F/501) issued by PT FIF which was dated October 31, 2017.

The DJP's argument was based on Article 13 paragraph (1a) of the VAT Law, which requires a Tax Invoice to be issued upon the delivery of taxable services or upon receipt of payment. For the DJP, the withholding proof dated October 31, 2017, was strong evidence that payment had been made in that month, meaning the VAT should have been collected and reported in the October 2017 period. Furthermore, PT HKR could not provide strong underlying documents due to weaknesses in its bookkeeping administration.

On the other hand, PT HKR did not dispute the existence of the transaction. Their main defense focused on the fact that the VAT had been collected, but was reported in a different period. PT HKR explained that the PPh 23 withholding proof from PT FIF (which served as the basis for the DPP information) was only received by them after the October period had ended. Due to this administrative delay, PT HKR was only able to issue the Tax Invoice (No. 011.019-17.67991102) on December 18, 2017 and dutifully reported it in the December 2017 VAT Return.

The Judicial Panel adopted a stance focused on material evidence (Article 78 of the Tax Court Law). The Panel found as a matter of fact that PT HKR had proven the issuance of the Tax Invoice and its reporting in the December 2017 VAT Return.

In its deliberation, the Panel judged that because the VAT on the disputed DPP had already been collected and reported by PT HKR, the DJP's correction for the October 2017 period was incorrect. The Panel was convinced that no tax revenue was lost; rather, only a shift in the reporting period had occurred. Based on this conviction, the Judicial Panel ruled to Fully Grant PT HKR's appeal. This decision underscores the importance of evidence in court proceedings, even when the tax authority's formal argument on timing has a strong legal basis.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here