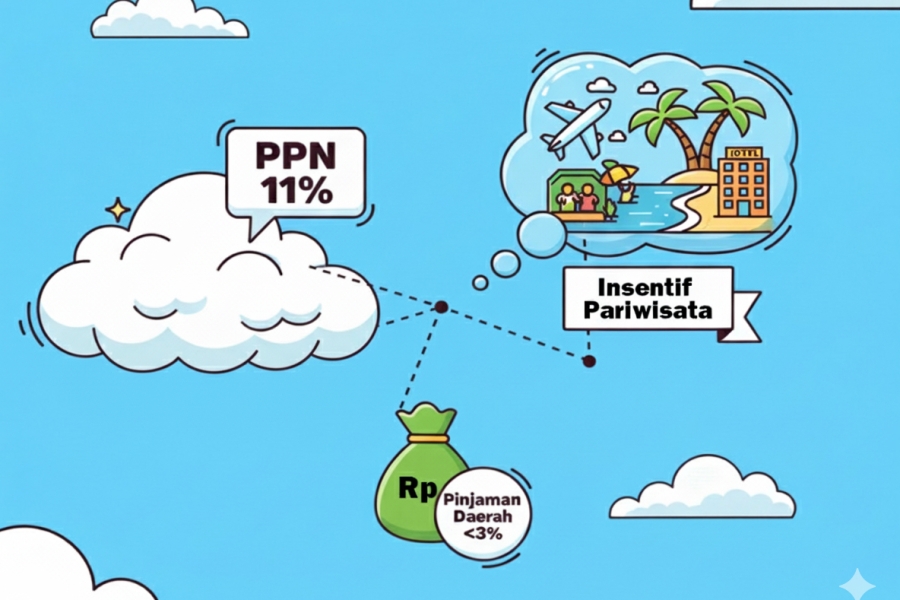

Fiscal issues and decentralization are the main highlights in the latest developments of national economic policy. Minister of Finance (Menkeu) Purbaya Yudhi Sadewa reviews the plan to reduce the 11% VAT rate, reflecting the government's prudence in maintaining the stability of state revenue. On the other hand, the Government-Borne Income Tax (PPh 21 DTP) incentive policy for the Tourism Sector, which is limited to workers earning below Rp10 million, is considered by several observers to be merely symbolic and insufficient to boost Consumption. Meanwhile, the discussion of the central government providing loans to the regions also draws attention, with demands from Regional Governments (Pemda) that the interest rate be set below 3% so as not to increase the Regional Fiscal Burden.

The Central Government shows caution in Fiscal Policy that affects state revenue. Minister of Finance Purbaya recalculates the reduction of the 11% Value Added Tax (VAT) rate. This action shows the government is very careful in making large fiscal decisions, considering their significant impact on state revenue. On the other hand, the Central-Regional Loan scheme triggers fiscal concern at the local level. Regional Governments (Pemda) request interest rates below 3% in the scheme. This request indicates that Pemda is trying to ensure the loan can be managed lightly and does not become a Fiscal Burden in the future.

This decentralization and loan issue raises a fundamental debate. The Central Government provides loans to the regions, which triggers a debate on whether the scheme is a solution or a burden for the Pemda. This debate is related to the Pemda's ability to manage debt and the benefits of the funded projects.

Meanwhile, the effectiveness of Tax Stimulus in the Tourism Sector is questioned. The Minister of Tourism asserts that tax exemption for employees in the Tourism Sector is only valid for wages below Rp10 million. This assertion aims to clarify the target beneficiaries of the Government-Borne PPh 21 (DTP) Incentive. However, observers judge that the PPh 21 DTP tourism incentive is merely year-end window dressing and not enough to boost Consumption. This assessment highlights doubts about the short-term effectiveness of the incentive in substantially lifting Purchasing Power.

Minister Purbaya's decision to recalculate the 11% VAT underscores the fiscal dilemma faced: balancing the need for state revenue with stimulus efforts. On the other hand, the effectiveness of the PPh 21 DTP tourism incentive is questioned, being assessed as mere window dressing. Regarding the Central-Regional Loan, the demand for interest rates below 3% from Pemda is a critical indicator that the scheme will only be effective if its terms are light and do not add to the Regional Fiscal Burden.

The latest developments show that Indonesia's Fiscal Policy is at a point of balance between prudence in maintaining state revenue through the review of the 11% VAT rate and the push for stimulus whose effectiveness is still doubted, such as the PPh 21 DTP incentive for the Tourism Sector. On the other hand, the implementation of the Central-Regional Loan scheme will highly depend on the central government's willingness to lower the interest rate below 3%, so that the policy truly functions as an instrument for recovery, rather than merely adding to the Regional Fiscal Burden