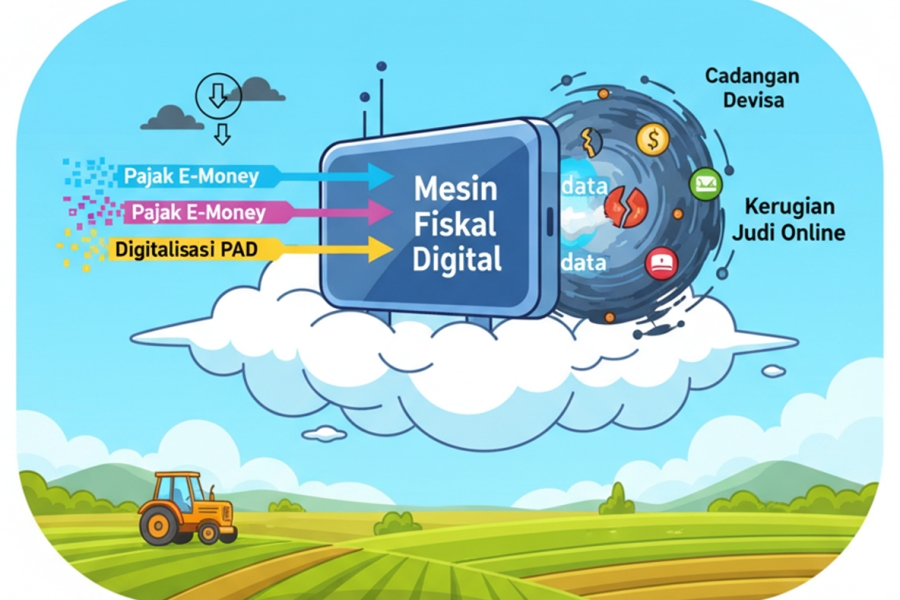

This period is marked by the deepening of Taxation reform that extends into the digital and financial sectors. The government is preparing a Minister of Finance Regulation (PMK) that will integrate e-money and digital assets data into the Global Tax system starting in 2026. This step aligns with efforts to strengthen State Revenue amidst a 10.86% decline in Regional Original Revenue (PAD), which is driving the acceleration of Regional Tax Digitalization. Meanwhile, the rise of Online Gambling practices is under scrutiny due to potential state losses of up to US$8 billion, and the Agricultural Sector is once again affirmed as the main pillar of the national Economy. On the other hand, macroeconomic pressure also arises from the predicted decline in October 2025 Foreign Exchange Reserves due to Rupiah intervention and foreign debt payments.

The government is implementing fiscal tightening in the digital and decentralization domains to secure State Revenue amidst the threat of financial losses. The government is preparing a PMK that will include e-money and Digital Currency data in the Global Tax data starting in 2026. This step aims to broaden the tax base and increase transparency in the Digital Economy era. In line with this, the government encourages Tax Digitalization at the regional level in response to the fact that PAD has dropped by 10.86%. This measure aims to increase the efficiency and transparency of the eroded regional revenue.

Digital financial enforcement efforts must be strengthened amidst significant losses. Online Gambling causes the state to lose US$8 billion. Economists highlight that the key figures behind this huge loss have not yet been touched by law enforcement. This issue shows the need for more serious regulation against digital financial crime that drains state resources.

On the macroeconomic side, exchange rate stability is under pressure, despite the crucial role of the real sector. Foreign Exchange Reserves in October 2025 are predicted to decrease due to Rupiah intervention and debt payments. This projection highlights the foreign currency liquidity pressure faced by Bank Indonesia (BI) in maintaining exchange rate stability. This challenge arises even though the Agricultural Sector is the main driver of the Economy, contributing 14.35% to Indonesia's Gross Domestic Product (GDP). This fact affirms the crucial role of the food and Agricultural Sector in maintaining national economic resilience.

The PMK initiative to include e-money/Digital Currency data in Global Tax information shows a major step in Digital Tax enforcement. This effort is consistent with the push for Regional Tax Digitalization to offset the PAD decline. Macroeconomically, the decline in Foreign Exchange Reserves poses a challenge to Rupiah stability. Meanwhile, the large losses from Online Gambling and the crucial role of the Agricultural Sector underscore the need for a balanced policy between technological innovation and the protection of the real sector/cybersecurity.

The latest developments show the government's increasingly strong focus on revenue recovery through Digital Tax reform, including the integration of e-money data and the acceleration of Regional Tax Digitalization. On the other hand, external pressures such as the decline in Foreign Exchange Reserves and domestic issues like massive losses from Online Gambling underscore the need for fiscal vigilance and stricter law enforcement.