As the year draws to a close, the national economy presents a variety of trends that must be closely monitored by decision-makers and market participants. This summary aims to provide a comprehensive overview of the significant opportunities in the sustainable export sector, domestic challenges in subsidy distribution and the labor market, and the crucial issue concerning pressure on the government's fiscal condition.

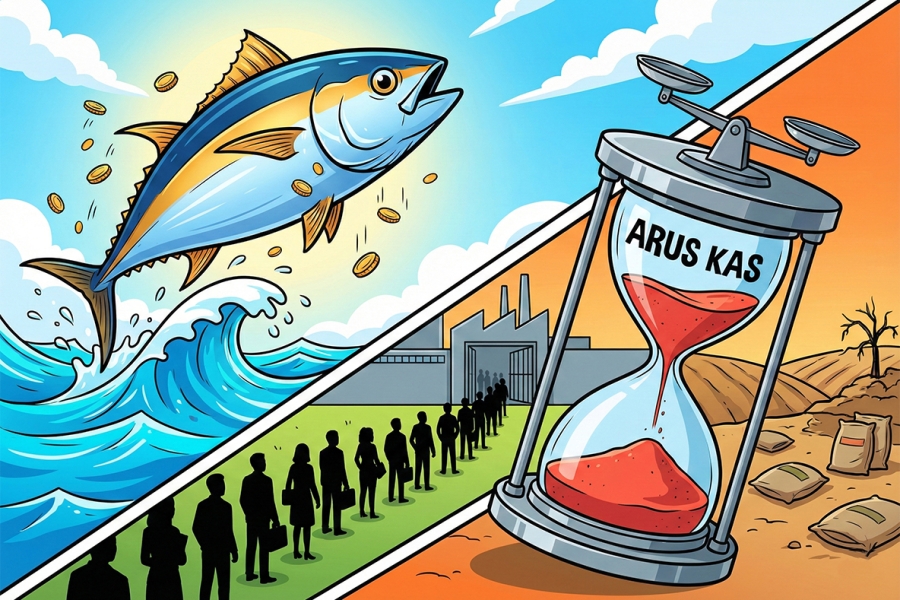

Indonesia holds a significant opportunity to become a major player in the global sustainable tuna market. International markets continue to increase demand for sustainably verified fishery products, making Indonesia's rich marine resources a substantial export potential. Fishery businesses must adopt responsible and certified fishing practices, while the government needs to strengthen regulations and port infrastructure to support export competitiveness; this opportunity promises an increase in foreign exchange earnings and fishermens' welfare.

However, in the domestic food sector, the government's subsidized fertilizer program is facing obstacles. Problems with inaccurate farmer data have led to a decrease in subsidy allocation absorption and ineffective fertilizer distribution, resulting in many eligible farmers struggling to gain access. This data issue threatens the stability of national food production. The government must immediately and comprehensively validate and update farmer data. A failure to address this problem will increase farmers' production costs and potentially trigger food price inflation.

On the domestic demand side, household spending, which is the main engine of economic growth, shows a tendency toward stagnation after experiencing a post-pandemic rebound. Economists refer to this phase as consumption normalization, characterized by slower growth in retail sector sales. This condition forces companies in the consumer and retail sectors to revise sales growth expectations and focus on operational efficiency. Investors need to be wary of sectors highly dependent on domestic purchasing power, as the consumption boom is likely over.

Meanwhile, the labor market faces a major imbalance. The Indonesian Employers Association (APINDO) noted that one job position is now being contested by an average of 16 job seekers. This figure reflects very fierce competition and a mismatch between applicants' qualifications and industry needs. This gap demands that businesses and the government collaborate to strengthen vocational education and training programs that align with market demands, in order to reduce the rate of educated unemployment.

Finally, the government's cash flow condition at the end of 2025 is projected to experience pressure or become "tight". This is due to high spending absorption toward the end of the year, while state revenues from tax and non-tax sources do not always follow the same absorption pattern, creating a short-term cash deficit. Cash flow pressure requires the Ministry of Finance to manage liquidity cautiously, including through the issuance of short-term financing instruments. For the market, this condition potentially affects short-term interest rates and investor sentiment towards the country's fiscal health.

The overall message of this news confirms the need for a balance between optimizing opportunities, such as the sustainable tuna sector, and addressing domestic challenges, such as farmer data and the tight labor market. Furthermore, fiscal vigilance is crucial leading up to the end of the budget year. Accurate understanding of the dynamics of the real sector and fiscal regulations will determine the success of future business strategies and economic policies.