Transfer pricing dispute, Corporate Income Tax, royalty disallowance, intangible assets, tax court decision, arm's length principle, related party transactions, tax litigation, taxindo prime consulting, tpc transfer pricing

Royalty Payments to Affiliates Still Corrected! The Two Key Lessons from This Tax Court Ruling

PUT-006760.15/2020/PP/M. XVIB Of 2025, 14 August 2025

The consistent application of Article 18 paragraph (3) of the Income Tax Law (UU PPh) continues to be a major challenge for multinational enterprises, particularly concerning the deductibility of royalty expenses for the utilization of Intangible Assets from related parties. The dispute between PT DTI and the Directorate General of Taxes (DJP) in this case highlights the complexities of proving the benefit test and the arm's length rate in trade secret licensing transactions. This case highlights how a positive correction to Taxable Income (PKP) originated from the DJP's rejection of royalty fees paid by PT DTI to an offshore affiliate, deemed non-compliant with the Arm's Length Principle (ALP).

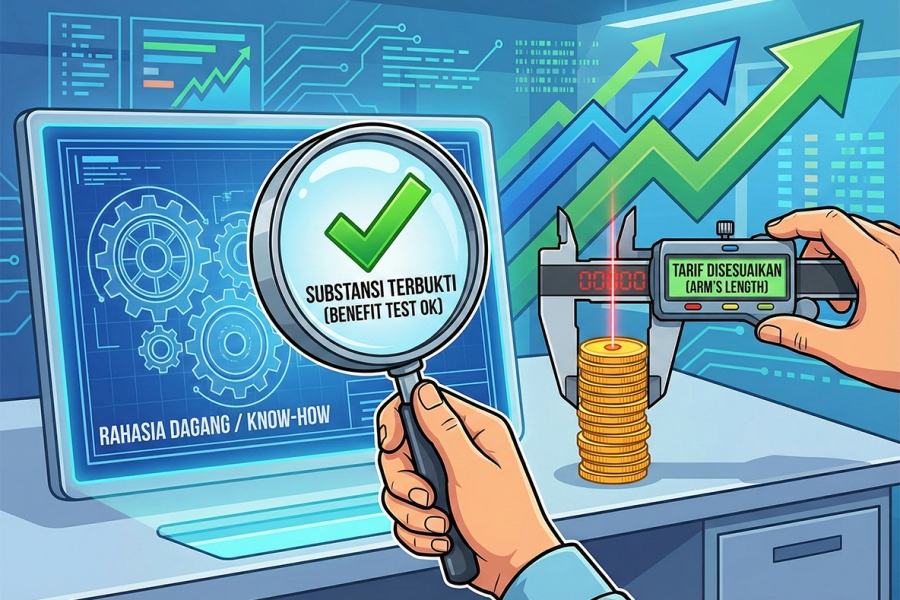

The core conflict in this dispute revolves around two aspects: substance and quantification. The DJP insisted that PT DTI failed to prove the existence of genuine economic benefits derived from the licensed Trade Secret, thereby characterizing the expense as non-deductible and an indication of profit shifting. The DJP utilized the authority under Article 18 paragraph (3) of the Income Tax Law to wholly disallow the cost deduction. Conversely, PT DTI vehemently contested this correction, asserting that the know-how they acquired was a crucial element supporting product quality and efficiency, and therefore, the royalty expense was a legitimate cost necessary to Obtain, Collect, and Maintain (3M) income. PT DTI submitted licensing agreements, technical reports, and comprehensive Transfer Pricing Documentation (TP Doc) to demonstrate compliance with the ALP.

In resolving the dispute, the Panel of Judges adopted a balanced and pragmatic approach. The Panel's legal consideration began by testing the substance, where the evidence presented by PT DTI was found sufficiently convincing to establish the existence of utilization and real economic benefits from the trade secret license. This invalidated the DJP’s argument for the total disallowance of the royalty expense. However, the Panel did not stop at the substance; they proceeded to test the fairness of the royalty rate. Based on the independent comparative analysis conducted (utilizing PT DTI's data, the DJP's data, or other data developed by the Panel), the Judges concluded that the royalty rate paid by PT DTI exceeded the arm's length range that would apply to similar transactions between independent parties.

The Tax Court's decision to partially grant the appeal carries a dual implication. The ruling sets a positive precedent by affirming that intangible assets which have a real function and provide specific benefits can be deducted as expenses. However, simultaneously, the decision delivers a vital lesson to Taxpayers: focus must not only be on the benefit test but also on establishing a rigorous and defensive benchmarking of the royalty rate. The implication for tax practice is an increasing emphasis on the quality of Transfer Pricing Documentation, particularly in presenting relevant and detailed comparable data to validate the quantum of the royalty fee paid. This case demonstrates that dispute risk can be minimized through a proactive approach, such as applying for an Advance Pricing Agreement (APA), to agree upon the royalty rate upfront.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here.