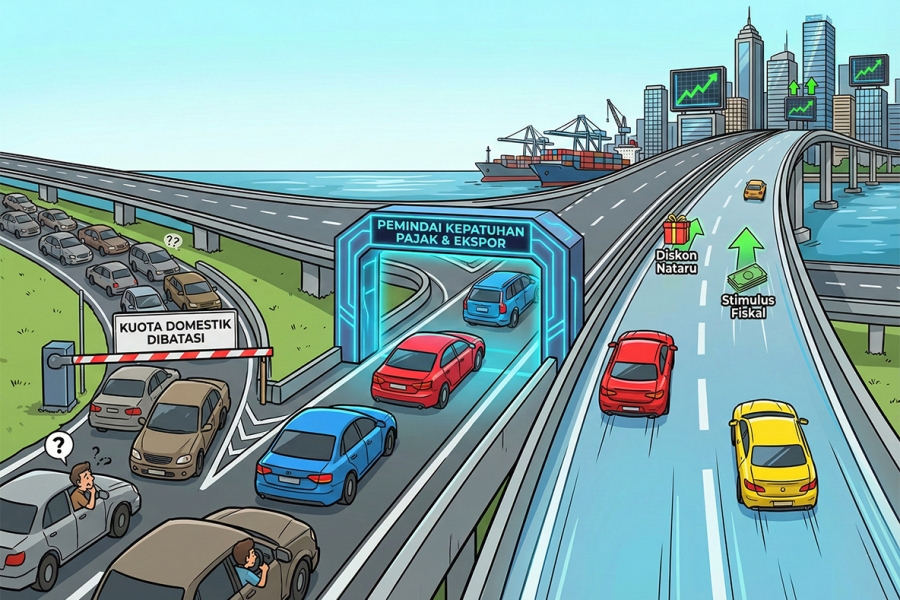

There is optimism regarding economic growth in Q4 2025, driven by fiscal stimulus and regulatory reforms aimed at strengthening compliance and trade governance. On one hand, incentives like the toll tariff discount are rolled out to maintain purchasing power. On the other hand, the government is starting to tighten domestic quotas for Bonded Zones and continuing the digitalization of corporate financial reporting. The main focus is to ensure the stimulus is effective, growth targets are met, and taxation and trade reforms proceed measurably until the end of the year.

The Indonesian Government expressed optimism that the Gross Domestic Product (GDP) growth in Q4 2025 will reach 5.6%. This confidence is supported by a massive rollout of fiscal stimulus, including Direct Cash Assistance (BLT), which is expected to boost consumption and create a significant economic multiplier effect toward the end of the year. To support the stimulus and encourage mobility, the Government will also provide a toll tariff discount of up to 20% on 26 toll road sections during the 2025 Christmas and New Year (Nataru) Holiday period, aiming to stimulate consumption and ensure the smooth distribution of logistics. Nevertheless, Economists suggest that the effectiveness of the fiscal stimulus will depend on the speed and accuracy of fund disbursement.

Regarding reform and regulatory tightening, the Minister of Finance decided to cut the domestic sales quota for companies in Bonded Zones (KB). This policy aims to restore the primary function of KBs as export-oriented production facilities and prevent the misuse of facilities to flood the domestic market with imported goods.

Furthermore, Purbaya, a related official, is confident that large companies will not object to submitting their financial statements (Lapkeu) through a centralized government platform. This digitalization step for reporting is intended to enhance transparency, facilitate tax supervision, and minimize tax avoidance practices.

This policy direction has direct implications for consumption, investment, and business compliance. The optimism for 5.6% GDP growth signals a potential economic rebound, but the stimulus effectiveness remains a determining factor for the market to observe. The toll discount and BLT stimulus are projected to drive consumption and create demand momentum at the year-end. Conversely, the cutting of the domestic quota for Bonded Zones potentially pressures the operations of certain companies, prompting them to refocus on exports and strengthen global competitiveness. Meanwhile, the digitalization of financial reporting creates a more transparent business environment and simplifies the task of fiscal authorities in ensuring tax compliance from large corporations.