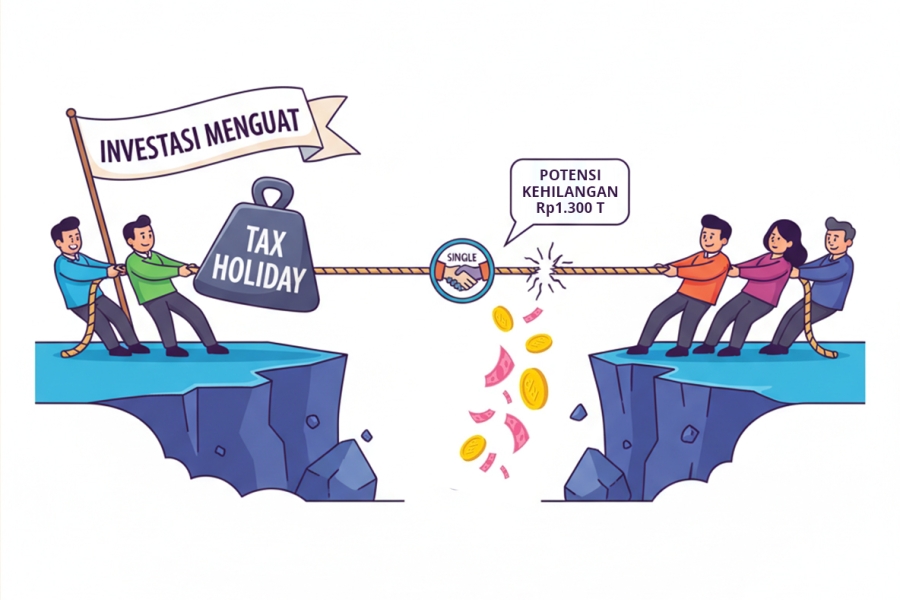

Recent developments highlight the paradox of Indonesia's Fiscal policy: increasing Investment flows coincide with declining Tax Revenue. The government is predicted to potentially lose up to Rp1,300 trillion due to the provision of Tax Holiday and similar incentives. This pressure is amplified because the Tax Collection Power of Value Added Tax (VAT) continues to weaken, according to analysts. Amidst the administrative reform process, HIPMI (Indonesian Young Entrepreneurs Association) requests that the implementation of the Single Profile tax administration should not burden businesses. Nevertheless, there is positive attention regarding the impact of the 'Purbaya Effect' on the national Economy.

Indonesia's Fiscal policy currently faces a significant dilemma, where Tax Revenue continues to decline even though Investment is increasing. Analysts explain that the main cause of this condition is the large provision of Fiscal Incentives and the weak Tax Collection Power of VAT. It is estimated that the Government potentially loses Rp1,300 trillion in tax revenue due to the Tax Holiday and other incentives. This figure shows the magnitude of the fiscal cost borne by the state to boost Investment and create jobs.

This fiscal challenge is compounded by structural problems in Consumption Tax. The Tax Collection Power of Value Added Tax (VAT) is weakening. Analysts reveal the challenges, which affirm the existence of structural issues in Indonesia's consumption Taxation system. Amidst the government's efforts to reform administration, HIPMI requests that the Single Profile tax administration, including customs, does not burden entrepreneurs. This request aims to ensure that administrative reform does not create high compliance costs for the business sector.

Nevertheless, the Fiscal sector receives positive market sentiment. There is attention regarding the benefit of the Purbaya Effect on the Indonesian Economy. This highlight indicates positive market sentiment or a significant impact from policy changes, which is perhaps hoped to address the issue of declining tax revenue.

The paradox between increasing Investment and decreasing Tax Revenue highlights the need for a re-evaluation of the effectiveness of the Tax Holiday and other Fiscal Incentives. The weakening Tax Collection Power of VAT signals a decline in Domestic Consumption and structural Taxation challenges. While the Single Profile reform is welcomed, HIPMI's request emphasizes the importance of business-friendly implementation. On the other hand, the Purbaya Effect offers hope for improved economic sentiment through strong leadership in the fiscal sector.

The latest developments show that Tax Reform and Investment promotion policies are facing a significant dilemma: the high fiscal burden from incentives (potential loss of Rp1,300 trillion) and the continued weakening of Consumption Tax revenue. Future success will largely be determined by the government's ability to balance the cost of the Tax Holiday and the simplification of administration (Single Profile) without adding pressure on businesses.