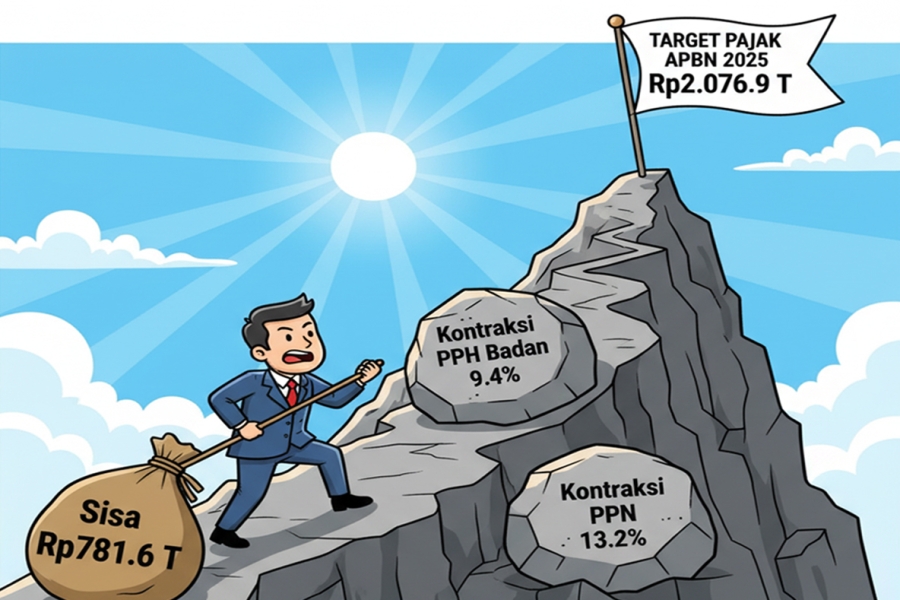

Tax Realization Contracts by 4.4%; Pressure on Corporate Income Tax and VAT Triggers Concerns Over 2025 State Budget Target

National tax revenue performance as of September 2025 shows a significant contraction trend of 4.4% year-on-year (YoY), with the realization only reaching Rp1,295.3 trillion. This achievement is equivalent to 62.4% of the target set in the 2025 State Revenue and Expenditure Budget (APBN) of Rp2,076.9 trillion. This sharp decline is dominated by the sluggish collection of two main components: Corporate Income Tax (PPh Badan) and Value Added Tax (PPN).

Data shows that Corporate Income Tax collection was only realized at Rp215.1 trillion, contracting by 9.4%. Meanwhile, VAT performance showed a worse condition with a contraction of 13.2%, valued at Rp474.4 trillion. The September 2025 realization, in percentage terms, is also lower than the achievement for the same period in 2024, which had reached 70%. This situation reinforces analysts' predictions that the annual tax revenue target will be difficult to achieve, even with the implementation of the six quick win programs launched by the Minister of Finance.

According to analysis, if this trend continues without significant intervention, tax collection by the end of 2025 is projected to reach only about 82% of the APBN outlook. Macroeconomic stability, particularly public purchasing power and corporate financial performance, is deemed a crucial factor in boosting revenue, given that consumption and company profitability are the main bases for VAT and Corporate Income Tax revenue.

Fiscal Dynamics: State Budget Deficit Reaches Rp371.5 Trillion as of September 2025

The fiscal report as of September 2025 indicates that the State Revenue and Expenditure Budget (APBN) recorded a deficit of Rp371.5 trillion, equivalent to 1.56% of the Gross Domestic Product (GDP). This deficit was triggered by the difference between the realized state expenditure, which reached Rp2,234.8 trillion, and the realized state revenue of Rp1,863.3 trillion.

The realization of state revenue has reached 65% of the full-year outlook target of Rp2,865.5 trillion. Meanwhile, the realization of state expenditure has reached 63.4% of the annual outlook set at Rp3,527.5 trillion. Nevertheless, this deficit figure remains within a relatively safe limit compared to the full-year 2025 APBN deficit target, which was designed at 2.53% of GDP, or the outlook approved by the House of Representatives (DPR) in the first semester of 2025, which widened to 2.78% of GDP.

Minister of Finance Purbaya Yudhi Sadewa emphasized that this deficit trend reflects an adaptive and credible APBN in maintaining a balance between economic recovery efforts and medium-term fiscal sustainability. Furthermore, the primary balance as of September 2025 is reported to still be Rp18 trillion, which is much better than the outlook designed at minus Rp109.9 trillion, indicating that debt management is on a prudent path.

Crucial Target: Ministry of Finance Must Chase Rp781.6 Trillion in Tax Revenue

Minister of Finance (Menkeu) Purbaya Yudhi Sadewa confirmed that as of the end of September 2025, the net tax revenue realization for the 2025 APBN only reached Rp1,295.3 trillion. This figure shows a contraction of 4.4% (YoY) compared to the same period last year and has only reached 62.4% of the annual tax revenue outlook set at Rp2,076.9 trillion. Thus, the fiscal authority still has a major task to chase a revenue shortfall of Rp781.6 trillion in the remaining three months of the fiscal year.

In general, total tax revenue (including customs and excise) reached Rp1,516.6 trillion or 63.5% of the outlook, experiencing a decrease of 2.9% YoY. This revenue decline is in line with the trend of global and domestic economic slowdown, which is also reflected in the falling prices of oil/gas and mining commodities, impacting collections of Income Tax (PPh) and Non-Tax State Revenue (PNBP). PNBP itself dropped 19.8% YoY due to the absence of State-Owned Enterprise (SOE) dividends in state coffers.

On the other hand, there is good news from customs and excise revenue, which actually grew by 7.1% (YoY), reaching Rp221.3 trillion as of September 2025. This growth indicates the effectiveness of law enforcement in the customs and excise sector. Nevertheless, Deputy Minister of Finance Suahasil Nazara emphasized that tax refunds returned to taxpayers (the business world) also contributed to the decline in the net revenue figure, but this is expected to boost overall liquidity and economic movement.