This is the first step and an internal dispute resolution effort within the DGT. A taxpayer can file an objection if they disagree with the amount of tax assessed in a tax assessment letter (SKP), such as:

Underpayment Tax Assessment Letter (SKPKB)

Additional Underpayment Tax Assessment Letter (SKPKBT)

Nil Tax Assessment Letter (SKPN)

Overpayment Tax Assessment Letter (SKPLB)

Process:

Requirement: The taxpayer must clearly state the reasons for their objection and provide supporting documents.

Timeline: The letter of objection must be submitted within 3 months from the date the tax assessment letter was sent.

Outcome: The DGT will review and consider the objection. Ultimately, the DGT will issue a Decision Letter of Objection. This decision can either fully accept, partially accept, or reject the taxpayer's objection.

If the taxpayer is still not satisfied with this decision, they have the right to proceed to the next stage.

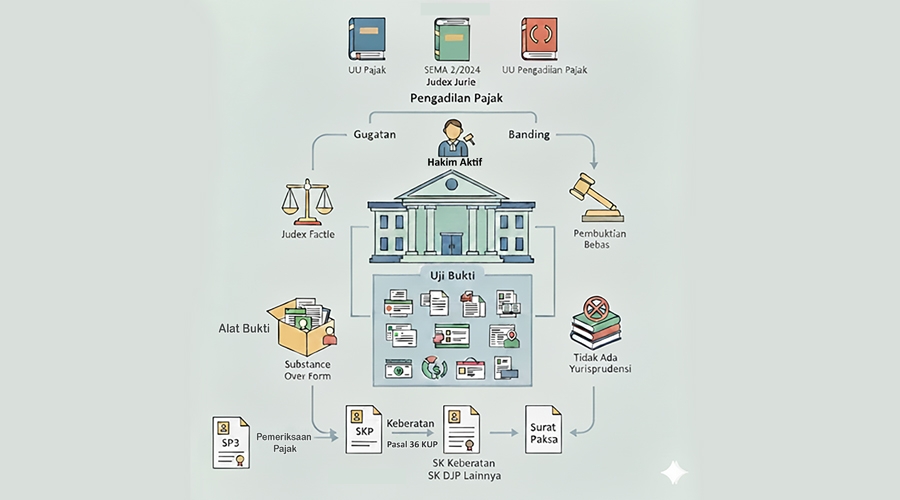

The Appeal stage is a legal action filed by the taxpayer with the Tax Court, an independent judicial body that is separate from the DGT.

Process:

Requirement: The taxpayer can file an appeal if their objection was rejected or only partially accepted by the DGT.

Timeline: The appeal must be submitted within 3 months from the date the Decision Letter of Objection was received.

Hearing: The appeal process involves a court hearing where both the taxpayer and the DGT (as the respondent) will present their arguments, evidence, and witnesses before a panel of Tax Court judges.

Outcome: The Tax Court will issue an Appeal Ruling. This ruling is final and binding on both parties.

The Lawsuit stage is different from an Appeal because it is not related to the amount of tax owed but rather to an administrative tax action carried out by the DGT.

Examples of Lawsuit Cases:

The enforcement of a distress warrant.

The issuance of a tax assessment letter without proper procedure.

The seizure of a taxpayer's assets.

The freezing of bank accounts.

Process:

Timeline: A lawsuit must be filed within 30 days from the date the contested administrative action was carried out.

Outcome: The Tax Court will issue a Lawsuit Ruling that either revokes or upholds the administrative action.

This is the final and extraordinary legal remedy. A Judicial Review is filed with the Supreme Court to re-examine a ruling that has been issued by the Tax Court.

Requirement:

A Judicial Review cannot be filed simply because you disagree with the Tax Court's ruling.

The grounds for filing are very limited, for example: the discovery of new evidence (novum), conflicting rulings, or a clear error of law by the judge.

Process:

Timeline: The petition for judicial review must be filed within 3 months from the date the Tax Court's ruling became legally final.

Outcome: The Supreme Court will decide whether to revoke, modify, or uphold the Tax Court's ruling. The Supreme Court's decision is final and binding.

The tax dispute resolution process is highly complex, filled with strict deadlines, and requires a deep understanding of tax regulations and practices. As tax consultants, we help you by:

Analyzing your case and determining the best strategy.

Drafting objection or appeal letters with strong legal arguments.

Preparing evidence and supporting documents.

Representing you in hearings at the Tax Court.

Having professional assistance is crucial to increase your chances of successfully winning a dispute and avoiding unnecessary financial loss.