In Indonesia's evolving tax landscape, which is transitioning toward a more integrated digital system through the Core Tax Administration System (Coretax), taxpayer compliance and accuracy are becoming increasingly crucial. One area that often causes confusion among Individual Taxpayers, particularly employees, is the treatment of the Old Age Security (Jaminan Hari Tua or JHT) balance managed by BPJS Ketenagakerjaan.

A common question arises: "Does the JHT balance need to be reported as an asset? Isn't it true that I haven't withdrawn it yet?" This article will thoroughly examine the obligation to report JHT, its legal basis, the distinction between assets and income, and technical reporting guidance within the Coretax application.

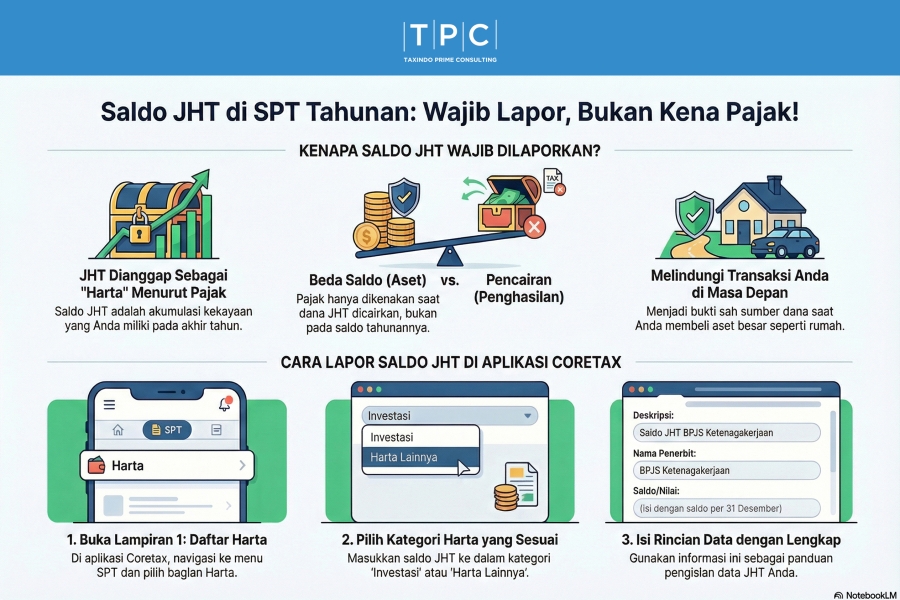

To understand why JHT must be reported, we must return to the fundamental definition of "Assets" in tax regulations. Based on the Director General of Taxes Regulation Number PER-11/PJ/2025, Assets are defined as an accumulation of additional economic capacity in the form of all wealth—whether tangible or intangible, movable or immovable—owned or controlled by the Taxpayer at the end of the Tax Year.

This definition is very broad and encompasses all forms of assets with economic value. Although the JHT balance is managed by a third party (BPJS Ketenagakerjaan) and has specific withdrawal restrictions, it is substantively the property of the Taxpayer. It represents a form of mandatory savings or long-term investment accumulated from deductions from the employee's salary and employer contributions. Therefore, the JHT balance meets the criteria of an "Asset" that must be reported in the Annual Tax Return (SPT Tahunan).

A common misconception is that Taxpayers feel they do not need to report JHT because they "have not received the money." It is vital to distinguish between the JHT Balance as an asset and the JHT Withdrawal as income.

In short, your annual obligation is to report the balance as an asset, not to pay tax on that balance.

Why should you go through the trouble of checking the JMO (Jamsostek Mobile) app and entering the JHT balance into your tax return?

In the Coretax application, asset reporting features a more modern interface compared to the old e-Filing system. Below are the steps based on the 2024 Coretax Manual:

After logging into the Coretax portal, navigate to the Surat Pemberitahuan (SPT) menu and select the creation of an Individual Annual Tax Return.

Coretax uses a structured navigation flow. Go to Appendix 1 (L-1) Section A: Assets at the End of the Tax Year.

In this section, there are several asset categories.

Once the data is entered, click "Save." The Coretax system will automatically calculate your total assets. Ensure the figures match your supporting documents (JMO app screenshots or annual balance certificates).

The transition to the Coretax system requires Taxpayers to be more disciplined in data administration. The JHT balance is a real financial asset that must be reported as a reflection of the Taxpayer's economic capacity. Reporting JHT does not mean paying more tax; rather, it is a form of administrative compliance that protects you in the future.