In the current global business landscape, cross-border transactions between companies in a multinational group (Multinational Enterprises/MNEs) dominate world trade. For tax authorities, ensuring that profits are taxed where the economic activity generating those profits takes place is a top priority. This is where the vital role of the Arm's Length Principle (ALP), or known in Indonesian domestic regulation as the Principle of Fairness and Business Prevalence (PKKU), comes into play.

The Arm's Length Principle is an international standard agreed upon by OECD member countries to determine transfer prices for tax purposes. This principle is enshrined in Article 9 of the OECD Model Tax Convention, which states that if conditions are made or imposed between two enterprises having a special relationship (associated enterprises) in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly.

Theoretically, the ALP adopts a "separate entity approach". This means that members of an MNE group are treated as if they operate as separate and independent entities, rather than as inseparable parts of a unified business. The goal is to create tax treatment parity between MNEs and independent companies and to prevent competition distortion.

In Indonesia, the ALP is adopted into domestic law through the term Principle of Fairness and Business Prevalence (PKKU). Based on Government Regulation (PP) Number 55 of 2022 and MoF Regulation (PMK) 172 of 2023, PKKU is defined as the principle applicable in healthy business practices carried out as independent transactions.

Taxpayers are required to apply PKKU in exercising rights and fulfilling obligations in the taxation field regarding transactions influenced by a special relationship. The essence of PKKU is comparing the conditions and price indicators of affiliated transactions with the conditions and price indicators of comparable independent transactions. If the conditions of the affiliated transaction are the same as the independent transaction, then the price must also be the same.

If ALP/PKKU is the "rule of the game," then the Arm's Length Price is the final result. A Transfer Price is considered to meet PKKU if the value of its price indicator is the same as the value of the price indicator of a comparable independent transaction. This price indicator is not limited to the unit price of goods only, but can be:

In practice, setting transfer prices is not an exact science, and it is often difficult to find a single absolute price figure. Therefore, the application of transfer pricing methods often produces a range of figures called the Arm's Length Range.

This range is formed from two or more comparables that have different price indicator values. In Indonesia, if the transfer price falls within this range, then the price is considered fair and no adjustment needs to be made. However, if the transfer price falls outside the arm's length range, the tax authority (Director General of Taxes) has the authority to re-determine the price using the most appropriate point within the range (usually the median).

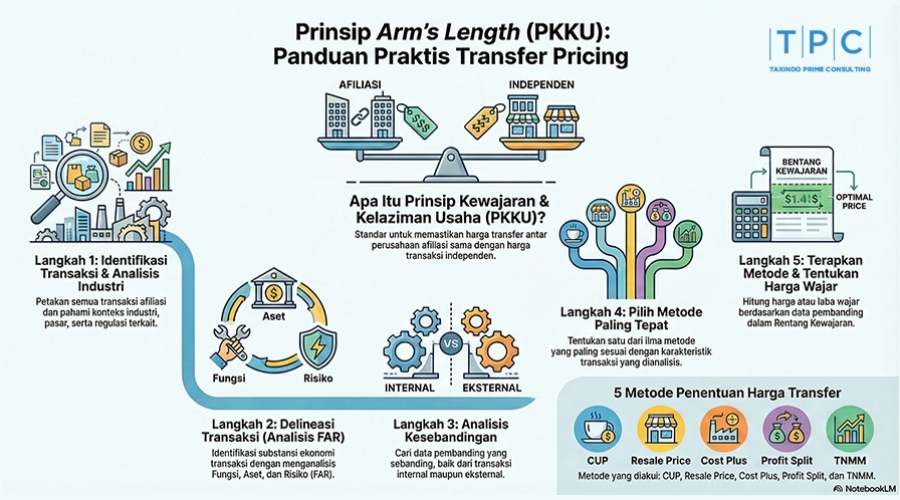

Applying PKKU is not a haphazard process but must go through standard stages regulated in PMK 172 of 2023 Article 4. The following are the systematic steps that Taxpayers are required to perform:

The initial step is to identify all transactions influenced by a special relationship and the parties involved. This includes determining whether the relationship is based on capital ownership, control, or family relationships.

Taxpayers must conduct an industry analysis related to their business activities. This includes identifying market characteristics, market growth, technology, competitors, efficiency, and government regulations affecting industry performance. This analysis is important to understand the economic context in which the transaction occurs.

This is a crucial stage to identify the actual commercial and financial relationships (substance over form). This analysis covers five main comparability factors:

After the transaction conditions are understood, the next step is to search for comparable independent transactions. Taxpayers can use Internal Comparables (Taxpayer transactions with independent parties) or External Comparables (transactions between independent parties in the market). If available, internal comparables are preferred because their level of comparability is usually higher.

Taxpayers must select the most appropriate method based on transaction characteristics, data availability, and level of comparability. Recognized methods include:

After the method is selected, the Taxpayer calculates the fair price or profit based on the selected comparable data. If there are material differences in conditions between the affiliated and independent transactions, accurate adjustments (comparability adjustments) must be made to increase data reliability.

Is My Company Required to Create a Transfer Pricing Document?