Tax Oversight Intensifies Amid Economic Uncertainty

Taxindo Prime Consulting

Monday, October 06, 2025 | 13:48 WIB

Optimized with Google Chrome

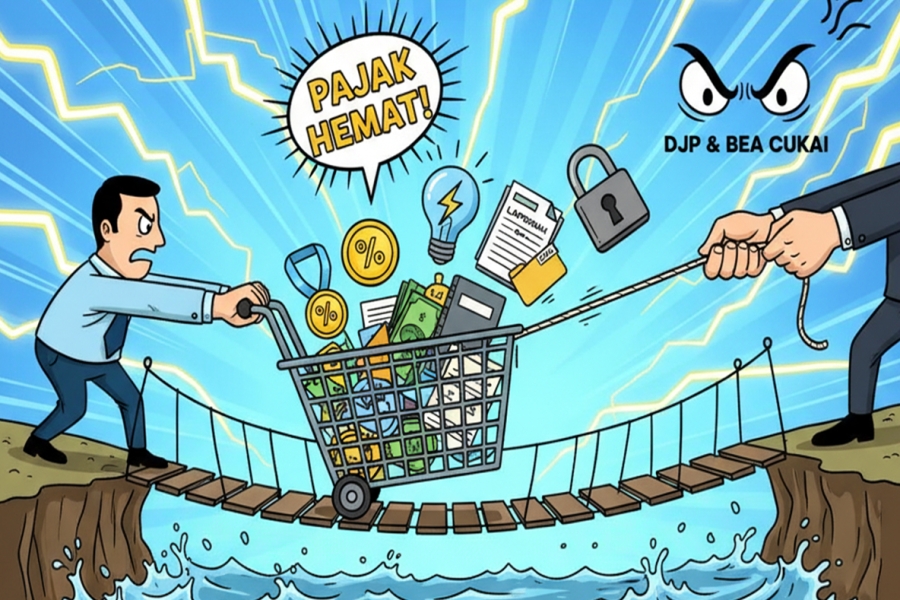

Public attention is currently focused on the strategic measures taken by fiscal authorities—specifically the Directorate General of Taxes (DGT) and Customs and Excise—to maintain the stability of state revenue amid increasing global economic uncertainty. Key issues highlighted include the crackdown on the circulation of illegal goods, concerns over potential revenue slowdown due to incentive policies, and strengthened supervision of non-compliant Taxpayers (WPs). This analysis reviews these fiscal policy dynamics and how the government attempts to balance tax compliance, economic growth, and the protection of state revenue.

The Indonesian government is strengthening fiscal supervision and Taxpayer (WP) compliance amidst concerns over state revenue. The Directorate General of Customs and Excise (DGCE) reports that the crackdown on illegal goods has reached a staggering value of Rp6.8 trillion up to September 2025, aiming to protect domestic industries, secure state financial rights, and eradicate illicit trade practices that harm the national economy. However, on the tax side, the massive provision of fiscal incentives is feared to drain tax revenue and potentially cause the target achievement to stall toward year-end. To mitigate this risk, the DGT will conduct intensive audits of WPs who are dishonest in reporting their SPT or abuse tax incentives, aiming to ensure compliance and prevent the misuse of fiscal facilities.

In the macro-economic sphere, stimulus policy is the main focus in dealing with uncertainty. Economists assess that the level of Indonesia's economic uncertainty is at its highest in Quarter II 2025, attributed to global commodity price volatility and geopolitical situations that affect investment prospects. Therefore, the re-implementation of a 50% electricity discount will provide a positive boost to public purchasing power and reduce production cost burdens for the industry. Economists assess that this stimulus could be an effective instrument to boost consumption and maintain the momentum of economic recovery amidst high global uncertainty.

The DGCE successfully seized Rp6.8 trillion in illegal goods, demonstrating the government's commitment to creating healthy business competition and protecting excise revenue. However, the concern over the stalling of tax revenue due to incentives is a risk that must be mitigated; the DGT responds by threatening audits of dishonest WPs, meaning the tax compliance environment will become increasingly stringent for business players. On the macro side, the high economic uncertainty in Quarter II 2025 demands adaptive monetary and fiscal policies, including consideration for stimulus such as the 50% electricity discount, which has proven capable of maintaining public purchasing power and easing industrial costs.

The dynamics of early October 2025 illustrate the government's "push-and-pull" effort in managing state finances: on one hand, providing incentives to support purchasing power and investment, but on the other, fighting hard to secure revenue and combat illegal practices. Business players must realize that tax and customs authorities are now significantly increasing supervision. Honest compliance with the SPT and the use of incentives, amid high global economic uncertainty, will be the main determining factor for the sustainability and operational success of companies.