The application of the Arm's Length Principle (PKKU) is an obligation for Taxpayers (WP) in Indonesia in order to determine the Fair Transfer Price for every Transaction Influenced by a Special Relationship. The PKKU is applied by comparing the conditions and price indicators of Affiliated Transactions with the conditions and price indicators of Independent Transactions that are the same or comparable.

In order for the determination of Transfer Pricing to be carried out reliably and accurately, the Taxpayer is required to follow a series of stages in applying the PKKU. Industry Analysis is the second stage that must be carried out, immediately after identifying the Transaction Influenced by a Special Relationship and the Affiliated Parties.

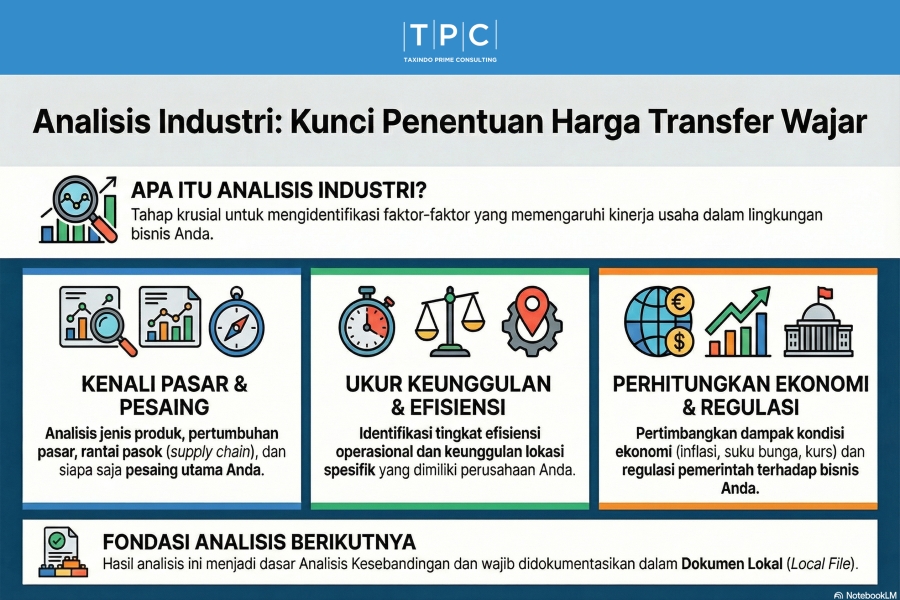

Industry Analysis (as referred to in Article 4 paragraph (4) letter b) is an analysis carried out to identify factors related to the Taxpayer's business activities. The main objective of this analysis is to understand the Taxpayer's operational environment and to identify factors that have the potential to influence business performance within that industry.

The results of this Industry Analysis play a crucial role because they will be used in identifying differences between the conditions of the Affiliated Transaction being tested and the conditions of the potential comparable transaction in the next stage, namely the comparability analysis.

According to Article 6 of the Minister of Finance Regulation Number 172 of 2023, Industry Analysis must identify the following factors in detail:

The analysis must include details regarding the type of product produced, whether in the form of goods or services.

Factors defining the market environment and industry where the Taxpayer operates must be analyzed in depth. This includes:

Taxpayers must identify and analyze major competitors as well as the level of business competition occurring in that industry.

This analysis needs to review the efficiency level possessed by the Taxpayer and also the Taxpayer's specific location savings (advantages) that may affect costs or revenue.

Relevant macroeconomic conditions that can affect business operations must be identified. Examples of these relevant economic circumstances are:

Taxpayers must analyze regulations that influence and/or that determine success in the industry they are engaged in.

In addition to the factors above, the analysis must also include other factors that are relevant and have the potential to influence business performance in that industry.

Industry Analysis is not the final goal, but an important bridge to the next stage:

1. Connection with Transaction Condition Analysis (FAR Analysis)

The factors identified in the Industry Analysis, especially those related to economic circumstances and business strategy, are important components that must also be considered in the Analysis of Transaction Conditions (often called Functions, Assets, and Risks or FAR Analysis).

2. Connection with Comparability Analysis

The main role of Industry Analysis is as a basis for Comparability Analysis. This analysis helps the Taxpayer (and tax authorities) understand the commercial background of the transaction being tested. By understanding industry characteristics and economic circumstances, the Taxpayer can identify material differences between the affiliated transaction and the potential comparable. These material differences—for example, because the Taxpayer has better location savings than the comparable—can then have their impact eliminated through accurate adjustments on the selected comparable.

All results from this Industry Analysis must be documented. In the context of Transfer Pricing Documentation (DPT), the details of industry analysis must be included in the Local File (Attachment E). The Local File must include explanations regarding:

Thus, Industry Analysis ensures that transfer pricing determination is not merely numerical, but is also based on a thorough understanding of the economic reality and competition faced by the Taxpayer in its market, guaranteeing that the price set is fair as applicable in open market conditions.