The digital transformation of Indonesia’s tax administration system has reached a new milestone with the implementation of the Core Tax Administration System (Coretax). One of the fundamental shifts brought by this system is how the state views the smallest economic unit in society: the family. The integration of the National Identity Number (NIK) as the Taxpayer Identification Number (NPWP) demands a deeper understanding of the synchronization between population data and tax data.

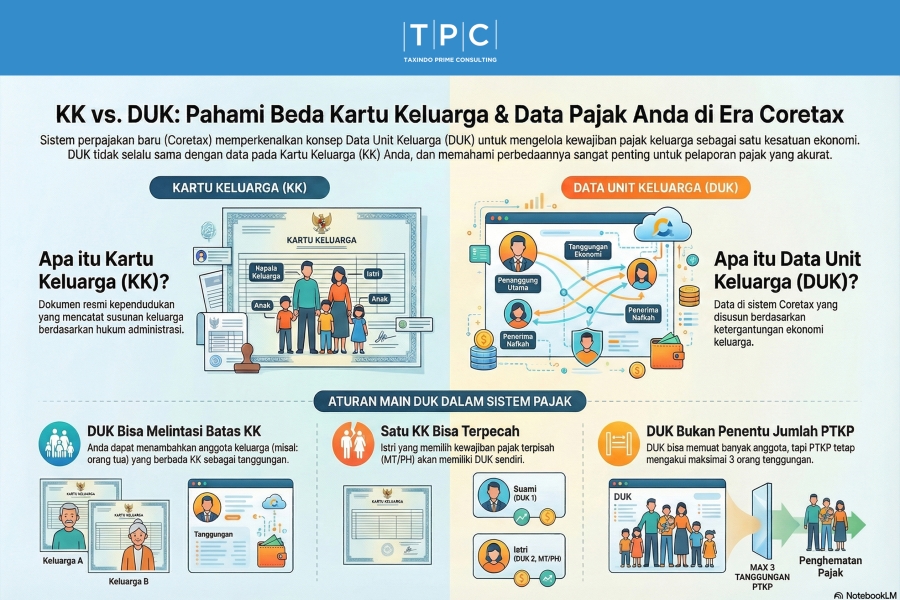

Amidst this transition, a crucial question often arises from taxpayers: Is the Family Unit Data (DUK) in the tax system identical to the Family Card (KK) issued by the Population and Civil Registry Office (Dukcapil)? The answer is not a simple "yes" or "no."

This article will explore the relationships, differences, and rules of play between the KK and DUK, as well as the implications for your tax obligations.

Before dissecting the technicalities of DUK and KK, we must understand the underlying philosophy of taxation in Indonesia. In accordance with Article 8 of the Income Tax Law (UU PPh) and its explanation, the Indonesian tax system adheres to the Family Tax Unit principle, where a family is treated as a single economic entity. This means that the income or losses of all family members—husband, wife, and minor children—are essentially combined into one unit, and the fulfillment of tax obligations is carried out by the head of the family.

In the Coretax system, this principle is manifested through the Family Unit Data (DUK) feature. DUK is a data container within a Taxpayer’s profile that lists family members whose tax rights and obligations are linked to the head of that family.

Many taxpayers assume that anyone listed on a Family Card (KK) automatically becomes a tax dependent, and conversely, anyone not on the KK cannot be included in the tax system. This understanding needs clarification.

While population data from Dukcapil serves as the primary basis for NIK validation, DUK offers flexibility that extends beyond the administrative boundaries of the KK to accommodate the economic realities of the Taxpayer.

By default, immediate family members (husband, wife, children) within one KK will be included in the DUK of the Head of the Family. However, sharing the same KK does not automatically require unification into a single DUK if specific tax conditions exist. There are "distortions" where members of one KK can be split into different tax entities:

A unique feature of the DUK system in Coretax is its ability to accommodate dependents who are administratively on a different Family Card. The tax system recognizes the reality that many taxpayers support the living expenses of parents or parents-in-law who live separately.

Based on the Director General of Taxes Regulation No. PER-7/PJ/2025, Taxpayers are permitted to include family members not listed on their Family Card into their DUK, under strict conditions:

Case Example: A Taxpayer (husband) has a KK consisting of himself, his wife, and two children. However, he also supports his retired mother who lives in his hometown (different KK). In Coretax, this Taxpayer can add his mother's NIK to his DUK through the profile data update menu. This is legal and recognized for the purpose of calculating Non-Taxable Income (PTKP).

It is vital to distinguish between members registered in the DUK and members calculated for Non-Taxable Income (PTKP).

In short, DUK is your family data "pool," while PTKP is the tax calculation "filter" that draws a maximum of 3 people from that pool.

In the Coretax implementation, DUK management is autonomous and digital. Taxpayers no longer need to visit the Tax Service Office (KPP) with stacks of photocopied KKs just to update family data.

The relationship between DUK and KK in the Coretax ecosystem is complementary but not identical. The KK is the legal population database, while the DUK reflects the economic reality of the family for taxation purposes.

Understanding this difference is vital for Taxpayers to ensure accurate tax calculations, optimize PTKP facilities, and avoid administrative disputes in the future.

References: (Titles of regulations remain in Indonesian for legal precision)