In Indonesia's new tax landscape with the implementation of the Core Tax Administration System (CTAS), employee income tax administration has undergone significant modernization. One of the most important documents for permanent employees is the Form BP-A1. This form is the evolution of the 1721-A1 Form, known for years as the "ticket" for employees to file their Annual Individual Income Tax Return (SPT Tahunan).

This article dissects the anatomy of BP-A1, its differences from the old form, and specific guidance for employees on which figures to quote in their Annual Tax Return.

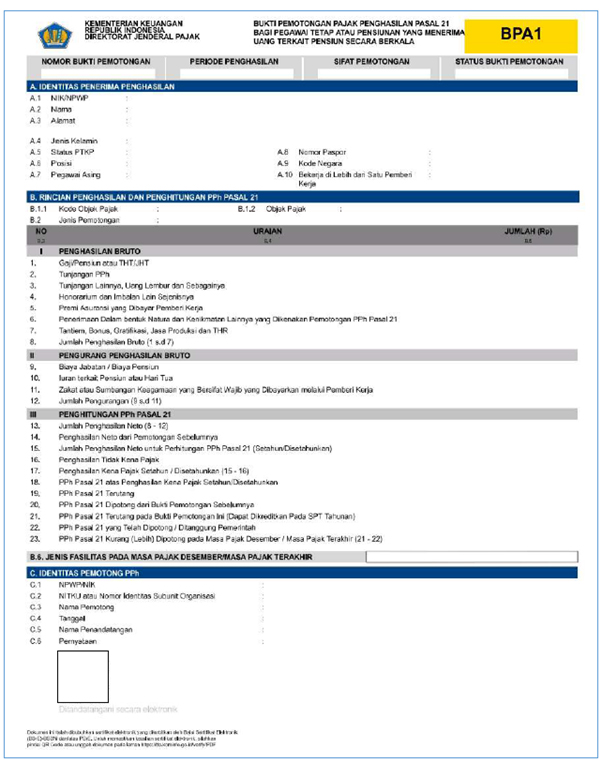

Form BP-A1 (Withholding Slip for Article 21 Income Tax for Permanent Employees or Pensioners Receiving Periodic Pension) is a document created by the employer specifically in the Last Tax Period.

The Last Tax Period is defined as:

Unlike the monthly form (BPMP/L-IA) which uses the Average Effective Rate (TER), the tax calculation in BP-A1 reverts to the progressive Article 17 rate of the Income Tax Law applied to the annual net income, minus Non-Taxable Income (PTKP).

Based on the Appendix of PER-11/PJ/2025, this form consists of several crucial segments:

Contains NIK/NPWP, Name, Address, PTKP Status (K/TK/HB), and Expatriate status. The validity of the NIK is vital because the pre-fill tax data system relies on this single identity.

This records all income components for the year (or working period). A significant change in this era is the inclusion of Benefit in Kind (Natura) (Line 6) as taxable gross income. Additionally, there is a specific line for Zakat/Mandatory Religious Contributions paid through the employer as a deduction.

This is the heart of the BP-A1 form. It summarizes:

For employees, BP-A1 is not just an archive. It is the basis for filling out the Annual Personal Income Tax Return (Form 1770 S or 1770 SS). In the Core Tax system, data from the BP-A1 issued by the company will automatically appear (pre-populated) in the employee's Annual SPT draft in their DJP account.

However, employees must verify these figures. Here are the three key figures from BP-A1 that must be noted or copied into the Annual SPT:

In the Core Tax era, employers are no longer required to print physical paper. If BP-A1 has been issued in the Coretax system, the document is considered delivered to the employee via the "My Documents" menu in their respective Coretax accounts. However, companies are still obligated to provide it no later than 1 month after the last tax period ends (usually by the end of January of the following year).

BP-A1 is the final validation document of an employee's tax obligations for the year. The accuracy of the data within it—from benefit-in-kind income to PTKP status—will determine whether the employee's Annual SPT status is Nil, Underpayment, or Overpayment. Employees must ensure the figure in Line 21 (Tax Payable) is entered correctly as a tax credit in their SPT to avoid double taxation.