Indonesian tax regulations, specifically the Value Added Tax Law (VAT Law/UU PPN) and General Provisions and Tax Procedures Law (UU KUP), unequivocally mandate taxpayers to report all transactions related to tax objects in their Periodic VAT Returns. This Tax Court Decision establishes a critical precedent by highlighting the conflict between the non-commercial economic substance of a transaction and the formal compliance obligation for reporting Export Declaration Notices (PEB). This ruling confirms that any export of Tangible Taxable Goods (BKP) possessing a PEB, including those with a Non-Commercial Value (NCV), must be reported as Export Value, notwithstanding the zero-rated VAT status.

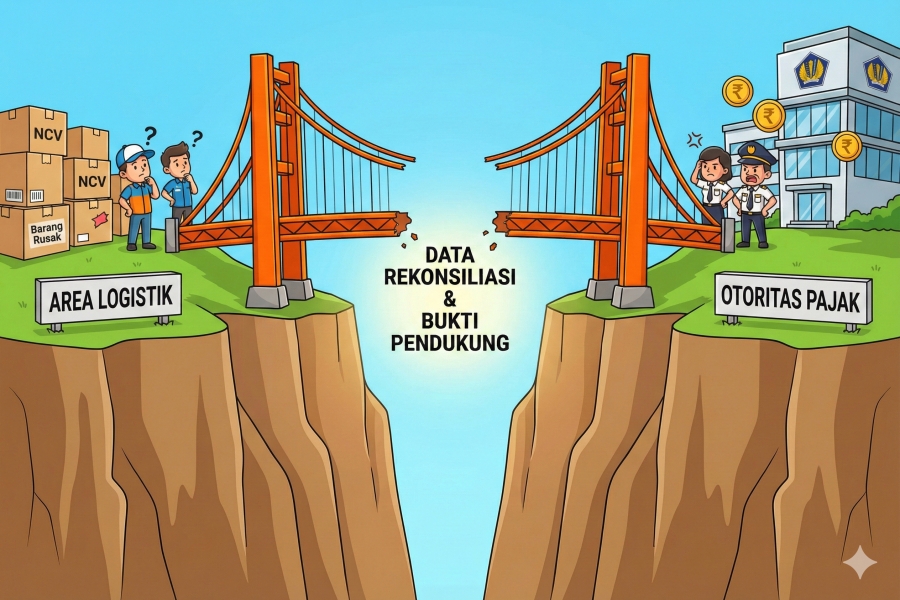

The core dispute revolves around the Directorate General of Tax’s (DJP) correction of the VAT Export Tax Base (DPP) amounting to IDR 1,197,908,111.00. The DJP identified a discrepancy between the Export Declaration Notices (PEB) data from the Customs system (DJBC) and the Export Value reported by PT FEI in its Periodic VAT Return. The DJP argued that this data mismatch constituted a violation of the formal obligation to file a correct and clear VAT Return, validating the correction as necessary to ensure the integrity of tax data.

Conversely, PT FEI challenged the correction, asserting that the exported goods did not qualify as a "delivery of Taxable Goods," which is the object of VAT. PT FEI contended that the items were either returned engineer tools or customer-owned damaged goods shipped for investigation, substantially recorded as Non-Commercial Value (NCV). PT FEI conceded a formal reporting oversight but maintained that the VAT liability was materially zero (0%) as per Article 7 paragraph (2) of the VAT Law, arguing the DJP's correction should be nullified.

The Tax Court adopted a balanced approach, reaching two key legal affirmations. First, the Court upheld the DJP on the formal aspect, maintaining the Export DPP correction because PT FEI failed to present sufficient, complete supporting evidence (such as initial Import Declaration Notices, accounting ledgers, or return agreements) to rebut the DJP’s assertion and meet the burden of proof. Second, the Court rectified the material implication of the VAT liability. Citing regulations, the export of Tangible Taxable Goods is subject to a 0% VAT rate. Consequently, although the DPP was sustained, the resulting VAT payable was adjusted to IDR 0.00.

This decision carries significant implications. For the DJP, it solidifies their authority to issue corrections based on formal reporting non-compliance and reconciliation with third-party data (DJBC). For multinational taxpayers, the case serves as a stern reminder to fortify documentation for NCV asset and goods transfers. Reconciling PEB data with the VAT Return is now a mandatory practice, and documentation must comprehensively substantiate that NCV transactions do not result in any VAT liability.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here