In the realm of tax disputes, corrections based on cash flow equalization often serve as a lethal "weapon" for tax authorities. However, a recent Tax Court Decision reaffirms that mathematical assumptions cannot defeat material bookkeeping evidence. This case serves as a crucial precedent for Taxpayers in facing presumptive corrections regarding business turnover.

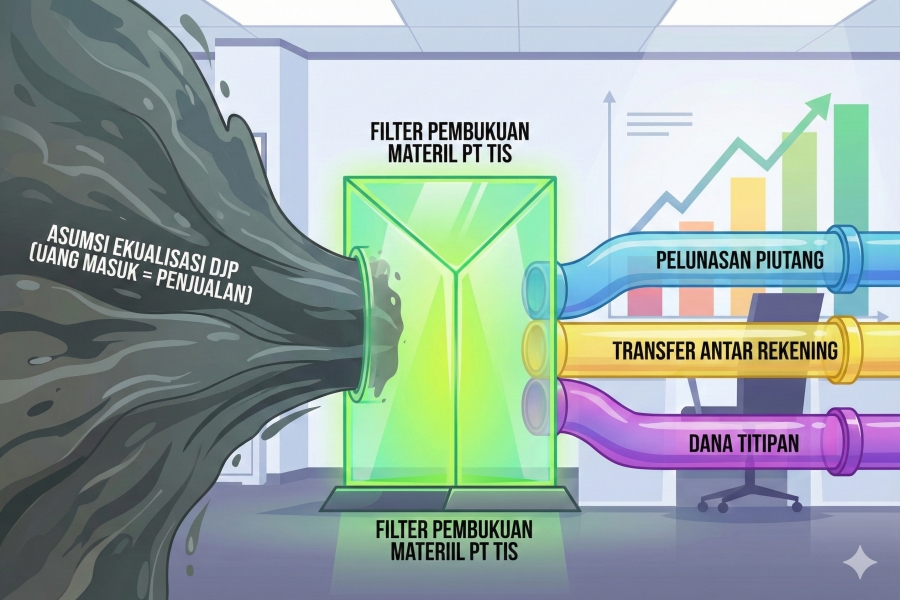

The dispute originated when the Directorate General of Taxes (DJP) issued a Value-Added Tax (VAT) Underpayment Assessment (SKPKB) against PT TIS for the January 2019 Tax Period. The DJP identified a positive discrepancy between cash inflows in the bank account and the turnover reported in the Tax Return (SPT). Without hesitation, the DJP assumed the entire discrepancy as concealed deliveries of Taxable Goods (BKP) and established tax payable. For the DJP, "cash inflow" was synonymous with "sales."

In the trial, two paradigms collided. The DJP persisted with Article 12 paragraph (3) of the General Provisions and Tax Procedures Law (UU KUP), demanding the Taxpayer prove the incorrectness of the correction. On the other hand, PT TIS vehemently refuted this. They presented an "anatomical dissection" of their bank statements and general ledger, demonstrating that the figures suspected by the DJP were actually repayments of old receivables, internal inter-account transactions, and entrusted funds—not the delivery of new goods as defined in Article 1A of the VAT Law (UU PPN).

The Panel of Judges of the Tax Court played a crucial role by applying Article 76 of the Tax Court Law. The Judges did not immediately accept the DJP's equalization calculations. After meticulously examining the transaction evidence presented by PT TIS, the Judges were convinced that the flow of funds proved to be non-VAT objects. The DJP was deemed to have failed in proving the physical delivery of goods regarding the corrected value. Consequently, the Panel of Judges granted the appeal entirely and annulled the DJP's correction.

This ruling sends a strong message: Neat bookkeeping and the ability to trace transactions are the best defense. DJP cannot arbitrarily establish turnover solely based on numerical discrepancies if the Taxpayer can demonstrate the "true nature" of every rupiah entering the company's account. For tax practitioners, this case underscores the importance of periodic reconciliation between cash flow and reported turnover to anticipate similar disputes.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here