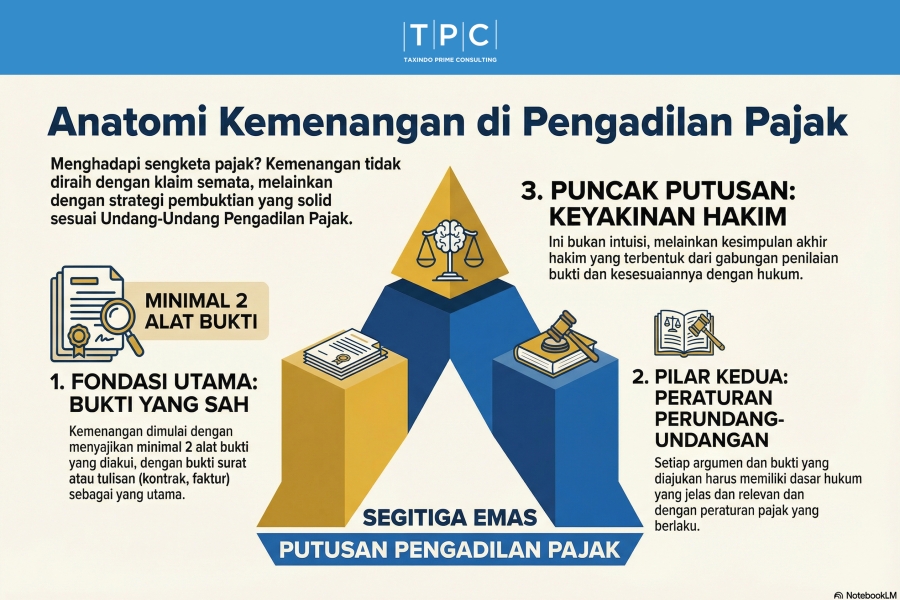

In the arena of tax litigation, victory is not won merely by loud claims, but through a solid construction of proof that meets statutory standards. This process is strictly regulated under Law Number 14 of 2002 concerning the Tax Court, which establishes the types of evidence, the role of the judge's knowledge, and the ultimate basis for a verdict. Understanding these three elements is key for Taxpayers to defend their rights.

The gateway to proof is opened by Article 69 paragraph (1), which exclusively lists five types of valid evidence in tax hearings. These five types are:

It is important to note that Tax Court procedural law requires a minimum of 2 (two) pieces of evidence for valid proof to achieve material truth. Although it adheres to the principle of free evaluation of evidence, the Panel of Judges typically prioritizes documentary evidence before turning to other forms.

Often concerned as subjective assumption, Judge's Knowledge has a strict legal definition in Article 75. The article defines it as "matters known to and believed to be true by the Judge".

This is not mere intuition. Judge's Knowledge is the understanding gained by the Judge during the proceedings—for example, from directly observing evidence, transaction patterns revealed in court, or general facts that need no further proof (such as natural disasters or macroeconomic conditions). This knowledge acts as a bridge when physical documents alone are insufficient to explain complex economic realities.

The culmination of all arguments and evidence lies in Article 78. This article asserts that a Tax Court Decision cannot be made arbitrarily but must be based on three inseparable elements:

If the Panel of Judges' deliberation does not reach a consensus, the decision is taken by majority vote.

Let us look at its application in a dispute over a Management Fee Correction (Intra-group Services) deemed unreasonable by the Tax Authority (Appellee).

Tax disputes are a battle of factual reconstruction. By presenting at least two valid pieces of evidence (Article 69), the Taxpayer helps shape the Judge's Knowledge (Article 75), which ultimately builds the Judge's Conviction to render a just decision pursuant to Article 78.