In the complex landscape of tax law, Taxpayers often face tax assessments that feel unjust, where one correction triggers a domino effect of others. This is where the relevance of the classical legal maxim "Geen straf zonder schuld" takes center stage. Literally meaning "no punishment without guilt/fault," this principle serves as a vital line of defense for Taxpayers in the Tax Court to ensure that every cent of tax claimed by the state is grounded in factually proven faults, not mere assumptions.

This principle affirms a fundamental legal logic: The Tax Authority (Appellee) cannot impose legal consequences or "punishment" (in the form of tax assessments or penalties) if they cannot prove the existence of the "fault" or underlying fact triggering those consequences.

In the context of tax disputes, this maxim works hand-in-hand with the principle of Affirmantis est probare (he who asserts must prove). If the Appellee fails to prove their primary allegation, then all claims derived from that allegation must fall by law.

The most tangible and frequent application of this principle is found in Transfer Pricing disputes, particularly regarding Secondary Adjustments.

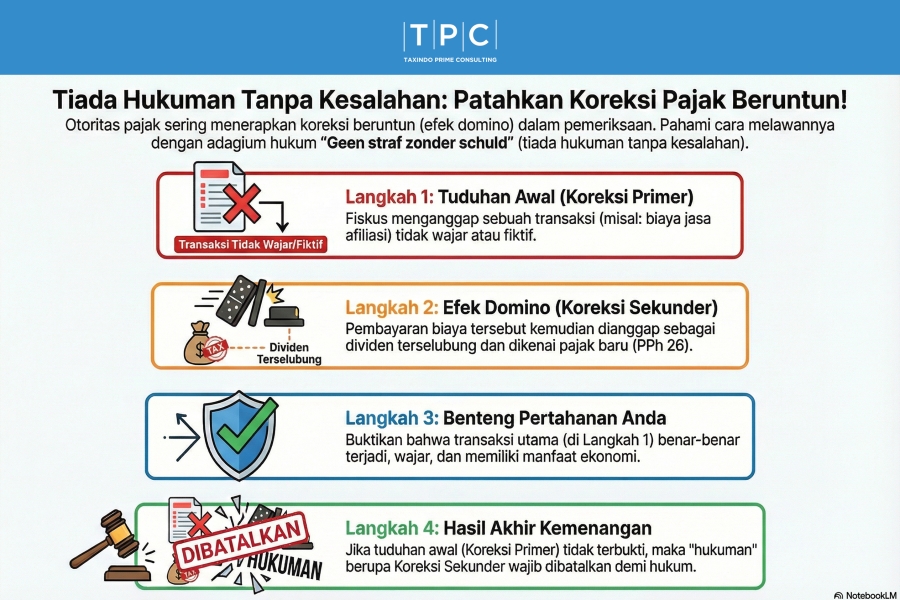

In many audits, the Appellee performs a Primary Adjustment by deeming an affiliated transaction unreasonable or non-existent. For example, the Appellee disallows management fees or royalties paid by the Taxpayer to a parent company abroad, claiming they lack economic benefit.

As a result of disallowing this expense, the Appellee then takes a further step: re-characterizing the payment as a hidden profit distribution or Constructive Dividend. This is the Secondary Adjustment, which is then subjected to Withholding Tax (Income Tax Art. 26).

Before the Panel of Judges in the Tax Court, the Taxpayer uses the Geen straf zonder schuld maxim to break this logic with the following arguments:

The application of this principle prevents tax authorities from using mere conjecture to multiply the tax burden. For instance, in disputes where the Appellee suspects unreported sales transactions without concrete evidence of cash or goods flow. If the Appellee cannot prove the "fault" of concealing turnover (legal fact), then the Appellee is prohibited from assessing VAT or Income Tax on that imaginary turnover.

The maxim Geen straf zonder schuld reminds all parties that tax law is not just about collecting revenue, but about justice based on evidence. In the Tax Court, victory is achieved when the Taxpayer can demonstrate that without valid proof of fault from the tax authority, the state has no right to punish or tax its citizens. Secondary adjustments must be annulled if the primary correction is unproven, affirming that there can be no tax without real economic substance.