The financing industry often faces complex issues regarding the Value Added Tax (VAT) treatment of repossessed assets, or what is known as collateral. The case involving PT TPF (as the Appellant) has become a major highlight because it underscores the clash between the tax authority's attempt to broaden the tax base and the principle of legal certainty for Taxpayers. This financing company filed an appeal against the correction of Output VAT for the December 2020 Tax Period, which was imposed by the Directorate General of Taxes (DGT). The core conflict centered on the correction of the VAT Tax Base (DPP PPN) amounting to IDR 12,300,389,000.00, which originated from the Sale of Repossessed Vehicle Units.

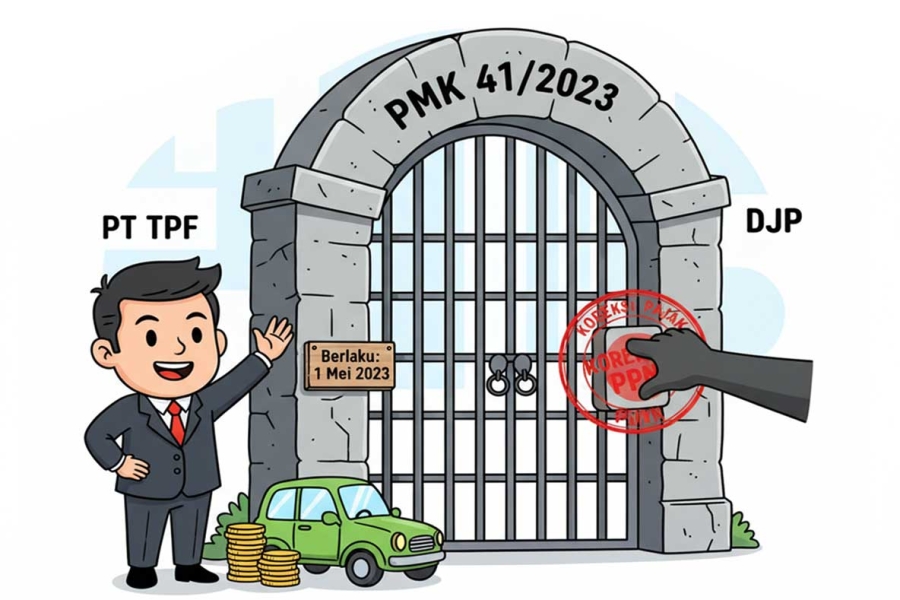

The Directorate General of Taxes firmly argued that the sale of collateral met the elements of a taxable transaction as stipulated in Article 4 paragraph (1) letter a of the VAT Law. However, PT TPF contested the correction by relying on the principle of tax legality. The company emphasized that at the time the collateral sale transaction occurred in December 2020, there was no specific regulation governing the imposition of VAT on the sale of repossessed assets by financing companies. The relevant and specific regulation, namely Minister of Finance Regulation (PMK) Number 41 of 2023—which implements Article 9A of the VAT Law to impose VAT at a certain rate—explicitly only came into effect on May 1, 2023. Consequently, the company argued that the retroactive application of the PMK to tax the 2020 transaction lacked a valid legal basis.

The Tax Court Panel of Judges accepted this argument and provided strong legal consideration. The Panel acknowledged that although the Law grants the Government the authority to set VAT at a certain rate (Article 9A of the VAT Law), this authority must be implemented through implementing regulations that have an effective date. The Panel affirmed that a tax provision, especially one concerning the imposition of a new tax, is prohibited from being applied retroactively. Since the collateral sale transaction occurred long before May 1, 2023, the Panel was of the opinion that there was no adequate legal basis to levy VAT on that transaction in 2020. This decision logically resulted in the cancellation of the IDR 12.3 billion VAT Tax Base correction, and ultimately, the Panel decided to Grant the Entirety of PT TPF's appeal request.

This ruling sets an important precedent that affirms the protection of Taxpayers in Indonesia from retroactive corrections. This victory reinforces the principle that the tax authority must be bound by the effective date of a regulation, especially when that regulation is issued to broaden the scope of taxation or change the calculation scheme. For financing companies, this case serves as a benchmark that the VAT obligation on the sale of collateral under the specific rate scheme only commences from the date PMK 41/2023 became effective. Clearly, the PT TPF case demonstrates the strength of the non-retroactivity principle in the Indonesian tax legal system.

The comprehensive analysis and full judgment on this dispute are available here