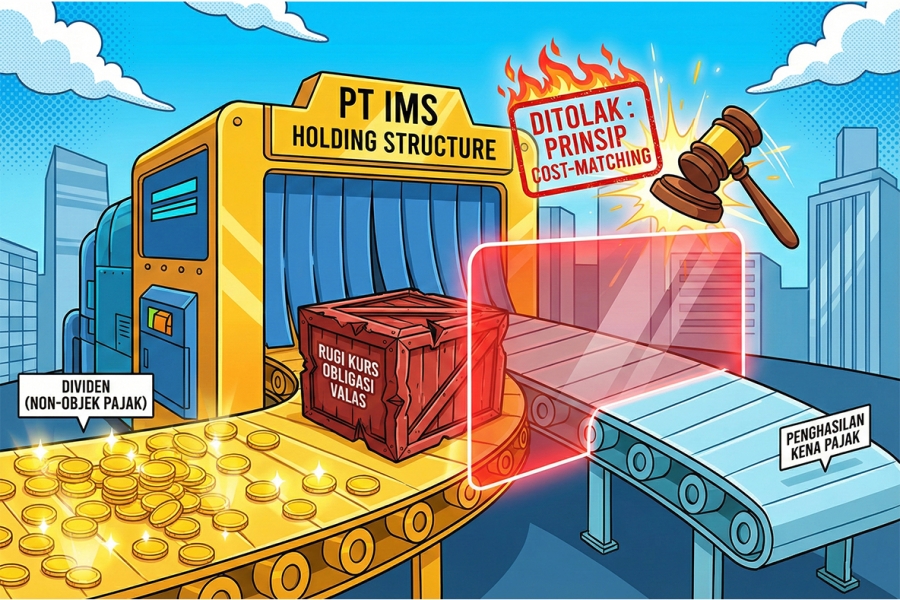

The Tax Court ruled on the Corporate Income Tax dispute for Fiscal Year 2015 involving PT IMS, a holding company. The core of the dispute focused on a Positive Fiscal Adjustment correction to non-operating expenses, specifically the foreign currency (forex) loss on foreign currency bonds, totaling a net value of Rp133,718,213,358. This case serves as a crucial study on the strict application of the Cost-Matching Principle, which separates deductible expenses for taxable income from expenses related to non-taxable income.

PT IMS, the Taxpayer, argued that the forex loss originated from foreign currency bond debt and had been calculated consistently according to PSAK 10 concerning Foreign Currency Transactions. PT IMS also asserted that the forex loss calculation had been independently verified by a Public Accountant with an Unqualified Opinion, and generally, such losses should be deductible from gross income per Article 6 paragraph 1 letter e of the Income Tax Law. PT IMS claimed consistent recognition of forex gains and losses, including a gain recognized in Fiscal Year 2016.

However, the Directorate General of Taxes (DJP) rejected the PT IMS's argument. The DJP contended that PT IMS is a holding company whose primary business activity is solely capital participation, with no other main operating activities. The DJP highlighted that PT IMS received dividend income in Fiscal Year 2015, which was recorded as non-taxable income under Article 4 paragraph 3 letter f of the UU PPh because the WP held a 72.73% stake in its subsidiary. Since the PT IMS's main income was deemed non-taxable, the expenses incurred, including the forex loss on the bond transaction, could not be deducted in determining the Taxable Income, pursuant to Article 6 paragraph 1 letter a of the UU PPh jo. Article 13 letter a of Government Regulation No. 94 of 2010.

The Tax Court Panel fundamentally agreed with the DJP's position, confirming the fact that PT IMS was a holding company whose primary income from capital participation was non-taxable income. The Panel affirmed that only expenses incurred in connection with the 3M principle (Obtaining, Collecting, and Maintaining) income subject to tax are deductible from gross income.

According to the Panel, the forex loss/gain arising from the bond loan used for the settlement of USD-denominated debt/receivables, which solely generated non-taxable profit/loss, could not be expensed. Consequently, the Panel ruled that expenses incurred to obtain non-taxable income cannot be deducted from taxable gross income, pursuant to Article 6 paragraph 1 and Article 9 paragraph 1 of the UU PPh jo. its implementing regulations, thereby upholding the DJP's Positive Fiscal Adjustment correction (net Rp133.7 Billion).

This PT IMS ruling provides a very critical insight for Taxpayers with a holding company structure that utilizes foreign currency debt: the key to deductibility is not the validity of the forex loss calculation itself, but the validity of the causal relationship (fund tracing) between the foreign currency debt and activities that generate taxable income. PT IMS's failure to prove that the bond funds were used to finance or generate other sources of taxable income (e.g., working capital for management fees) resulted in the entire expense, including the associated forex loss, being deemed attached to the acquisition of non-taxable income, thus becoming a non-deductible expense.

A comprehensive analysis and the Tax Court Decision on This Dispute Are Available Here