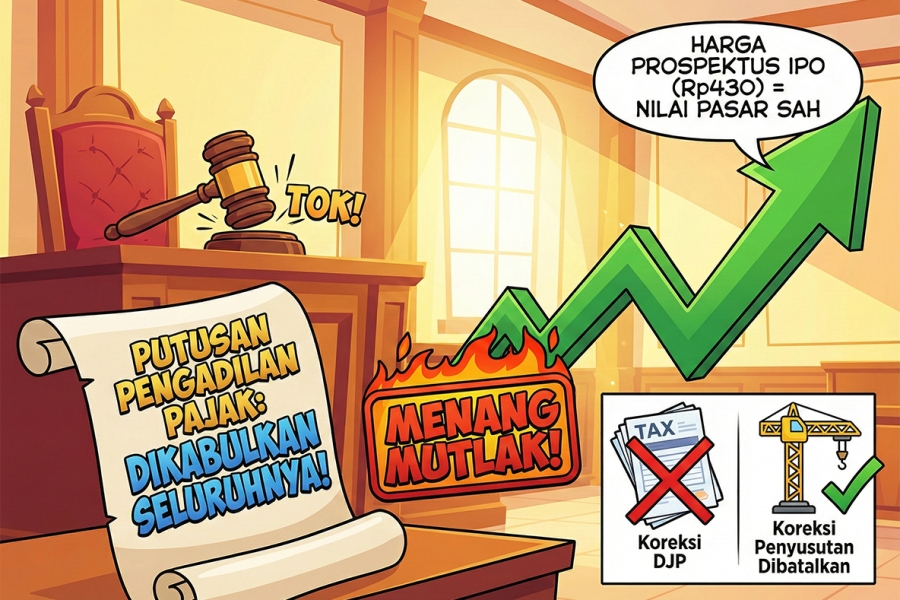

The Corporate Income Tax dispute for Fiscal Year 2017 between PT PM and the Directorate General of Taxes (DJP) centered on the fundamental issue of non-cash transaction valuation: the conversion of receivables into equity participation. In this landmark ruling, the Tax Court Judges Panel unequivocally Granted the Appeal in its Entirety for the Taxpayer. This victory confirms that using the Initial Public Offering (IPO) prospectus price is a valid fair market value (FMV) benchmark, particularly when the transaction occurs between parties with no special relationship.

The core of the dispute arose when PT PM, which operates in the heavy equipment sector (specifically tower cranes and passenger hoists), transferred its receivables from PT PP (Persero) Tbk into an investment in shares of PT PP Presisi Tbk (PPRE)—an entity preparing for an IPO. Based on the Addendum to the Joint Agreement dated November 8, 2017, PT PM’s receivables were converted into 5,135,700 PPRE shares at a price of Rp430 per share, which was the final offering price stated in the PPRE IPO Prospectus.

The DJP raised an adjustment, arguing that the conversion price of Rp430 was excessively high. The DJP cited PPRE stock market data on the Indonesia Stock Exchange (BEI) during the period of November 24–30, 2017, which showed prices fluctuating between Rp410 and Rp382. Consequently, the DJP contended that PT PM should have recorded a loss representing the difference between the conversion value (Rp430) and the lower market price at the end of that month. Additionally, the DJP made Positive Fiscal Adjustments related to the depreciation of Tower Cranes (due to a difference in assumed useful life) and Business Travel Expenses (which the DJP claimed did not satisfy the 3M principle: Obtaining, Collecting, and Maintaining income).

The Judges Panel reviewed the dispute comprehensively, focusing heavily on the substance and timing of the transaction. The Panel affirmed that PT PM and PT PP (Persero) Tbk were business partners with no special relationship between them. The Panel asserted that the agreed-upon conversion price of Rp430 per share was supported by the PPRE Initial Public Offering Prospectus, which was published on November 30, 2017, and which set the public offering price at Rp430. The Panel concluded that the conversion value used the fair market value and was consistent with the principle stipulated in Article 10 paragraph 2 of the Income Tax Law.

In line with the cancellation of the primary adjustment, the Panel also overturned all other minor adjustments. PT PM successfully convinced the Panel that the chosen useful life group for the tower crane assets was appropriate and aligned with applicable fiscal depreciation regulations, rendering the DJP's adjustment unfounded. Likewise, the business travel expenses were proven to be legitimate and directly related to the company’s efforts to satisfy the 3M principle, substantiated by adequate accountability evidence. By canceling all adjustments, the Panel granted the Taxpayer's appeal in its entirety.

This PT PM ruling provides a crucial insight: the IPO prospectus price can serve as a robust and valid fair market value benchmark in receivables conversion transactions involving unrelated parties. The decision explicitly underscores that the DJP’s adjustments must be based on the conditions existing at the time the legal act occurred and cannot be based solely on stock price comparisons made after the offering period. Furthermore, this total victory confirms that when a Taxpayer can present strong and detailed evidence for every disputed item (be it the fair value of conversion, the asset's useful life, or the justification for 3M expenses), the Panel will prioritize the substance of that evidence, overturning all unsubstantiated assessments.