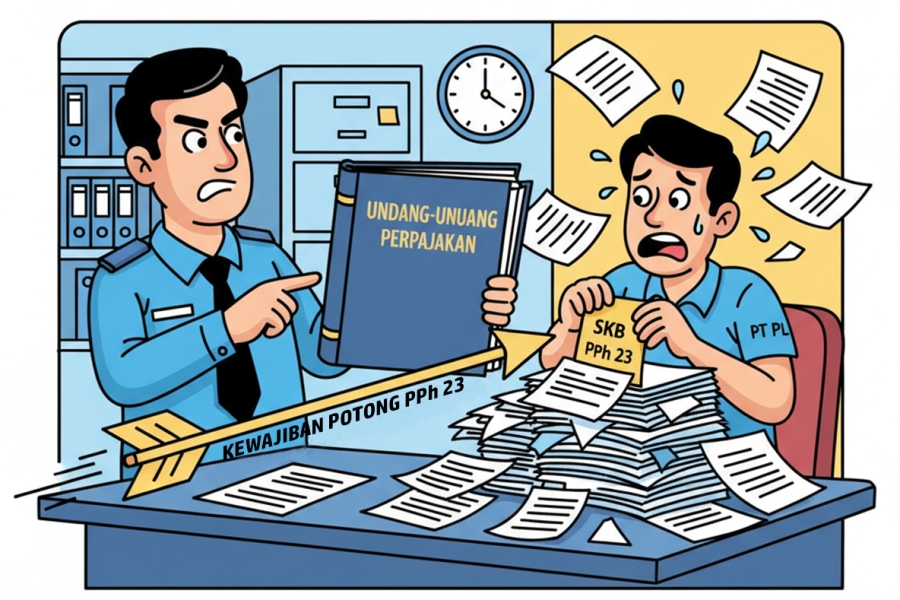

Tax facilities such as a Certificate of Exemption (Surat Keterangan Bebas or SKB) offer significant relief, but their utilization demands high administrative discipline. This is the main lesson from one of the dispute items faced by PT PL, where the claim of SKB ownership by the vendor was insufficient to free PT PL from the obligation to withhold Income Tax Article 23 (PPh Pasal 23). This case underscores a fundamental principle in tax law: the burden of proof.

The dispute originated from the DJP's correction of a taxable service payment amounting to Rp4,585,500.00 to PT Bintang Sempurna, for which PT PL had failed to withhold PPh Article 23. PT PL's defense argument was that they did not withhold the tax because they believed the vendor held a valid SKB. However, this argument came face-to-face with the DJP's demand for formal substantiation.

The conflict was ultimately resolved by the Panel of Judges not through complex legal interpretation debates, but through a simple test of evidence. The Panel of Judges stated that the burden to prove the existence of a valid SKB rests entirely on the Taxpayer as the party seeking to benefit from the exemption facility. During the trial, PT PL was proven unable to present or submit the physical evidence of the PPh Article 23 SKB in the name of the relevant vendor.

This failure to meet the burden of proof had fatal consequences. The Panel of Judges concluded that in the absence of a verifiable SKB as evidence, the general rule regarding the PPh Article 23 withholding obligation remained applicable. The Taxpayer's verbal claim or assumption held no legal force. Therefore, the Panel of Judges rejected PT PL's appeal on this item of dispute and upheld the correction made by the DJP.

This ruling provides a very clear and administrative lesson: tax compliance is about proof. For Taxpayers who function as withholding agents, it is crucial to implement strict internal procedures. The policy of "No SKB Evidence, No Withholding Exemption" must become the operating standard. This means Taxpayers must proactively request a copy of the SKB from the vendor, verify its validity period, and archive it properly before making a payment without withholding. This administrative discipline is the true defense line in a tax audit.

Comprehensive and Complete Analysis of This Dispute is Available Here