The Tax Court has once again ruled on a Corporate Income Tax dispute for Fiscal Year 2017, highlighting the complexity of proving bank account mutations and the importance of meeting formal appeal requirements. In the case of PT SNS, the dispute centered on adjustments to Business Turnover based on a cash flow test and project expense adjustments. Although PT SNS faced a formal challenge (accused of obscuur libel), the Panel proceeded with the substantive examination and ultimately decided to Grant the Appeal in Part for PT SNS.

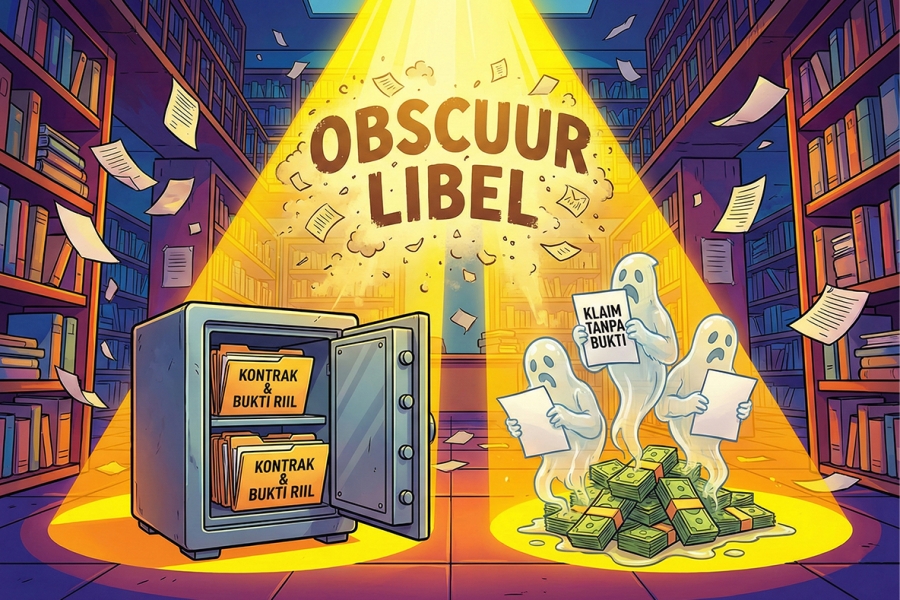

Regarding the fulfillment of formal requirements, the DJP argued that PT SNS's appeal application did not meet the formal provisions of Article 36 paragraph 2 of Law Number 14 of 2002 concerning the Tax Court. The DJP contended that the positum (statement of factual claim) of PT SNS lacked adequate legal grounds (Rechtelijke Grond), and the petitum (demand), which requested the Panel to both grant the appeal and annul the Underpayment Tax Assessment Letter (SKPKB), was deemed contradictory. The DJP's argument, stating the appeal was vague (obscuur libel), aimed for the Panel to reject the substantive examination.

Nevertheless, the Panel proceeded with the examination of the dispute's material, focusing on two issues. The first issue involved the Business Turnover adjustment arising from the analysis of bank current account mutations. PT SNS contended that the deposits into its account represented the repayment of loans from third parties (Rp5.07 Billion), returns from shareholders, repayment of employee receivables, and refunds of excess operational costs. The second issue was the Positive Fiscal Adjustment for Project Expenses amounting to Rp1,080,000,000, which PT SNS claimed were directly related to the company's professional activities.

In examining the account mutations, the Panel exhibited a very strict stance regarding the proof of non-operational transactions. For the components of loan repayments from third parties, shareholders, employee receivables, and excess operational costs (totaling approximately Rp6.06 Billion), the Panel judged that PT SNS failed to substantiate its claims. The lack of strong supporting documents, such as official loan agreements, transfer notifications, the General Ledger, or at least a letter acknowledging the transaction partner's debt, resulted in the incoming funds being treated as Business Turnover. However, the Panel overturned the adjustment related to interbank transfers within PT SNS itself, valued at Rp145,502,772, as PT SNS successfully demonstrated the internal flow of these funds.

Furthermore, concerning the Positive Fiscal Adjustment for project expenses totaling Rp1,080,000,000, the Panel concluded that PT SNS was able to prove its counter-arguments. The supporting evidence for the project expenses presented by PT SNS was deemed to meet the substantive requirement of being directly related to the company's professional activities, thus the adjustment for these expenses could not be upheld by the Panel. In total, the Panel granted the reversal of the Business Turnover adjustment of Rp145,502,772 and the entire project expense adjustment of Rp1,080,000,000.

This PT SNS ruling provides key insights for the Taxpayer: Firstly, even though the DJP raised a formal issue (obscuur libel), the Panel prioritized the substantive examination, demonstrating the principle of material justice. Secondly, the Taxpayer must realize that for non-operational transactions (such as loans, capital returns/receivables), the proof must be supported by very strong legal and accounting documents (loan agreements, a clear General Ledger, notifications), and not merely bank statements. Failure to provide strong legal evidence will result in the adjustment being upheld. Thirdly, conversely, for operational expenses directly related to the 3M principle (Obtaining, Collecting, and Maintaining income), the proof of substance (the veracity of the expense and its relation to income) is often more successful than proving loan transactions.

A comprehensive analysis and the Tax Court Decision on This Dispute Are Available Here