Executive Summary:

The Arm’s Length Principle (ALP)—known in Indonesia as Prinsip Kewajaran dan Kelaziman Usaha (PKKU)—is a principle that must be applied by Taxpayers when exercising rights and fulfilling tax obligations related to Transactions Influenced by a Special Relationship. The ALP is applied to determine a fair Transfer Price. A Transfer Price is considered fair (arm's length) if the value of its indicators matches those of a comparable Independent Transaction.

Minister of Finance Regulation (PMK) Number 172 of 2023 stipulates that the application of the ALP must be conducted based on actual circumstances at the time the Transfer Price is determined and/or at the time the Transaction Influenced by a Special Relationship occurs. It must also strictly follow the stages of applying the Arm’s Length Principle.

Generally, the ALP must be applied separately for each type of Transaction Influenced by a Special Relationship. However, if two or more types of transactions are interrelated and influence each other in pricing, the ALP may be applied by aggregating these transactions if a separate application cannot be performed reliably and accurately.

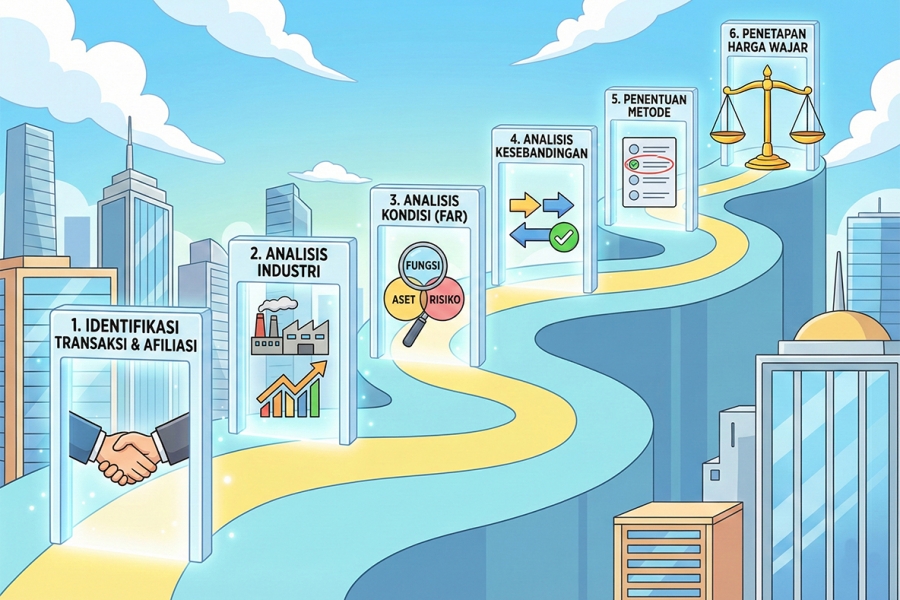

The following are the six mandatory stages for applying the Arm’s Length Principle:

1. Identifying Transactions Influenced by a Special Relationship and Affiliated Parties

This initial stage involves activities to identify: a. Transactions Influenced by a Special Relationship conducted by the Taxpayer. b. The parties involved in the Transaction Influenced by a Special Relationship. c. The form of the special relationship existing between the transacting parties, whether due to capital ownership/equity participation, control, or consanguinity/affinity family relationships.

2. Conducting Industry Analysis

Industry analysis is performed to identify factors related to the Taxpayer's business activities, which will subsequently be used for comparison. The identified factors include: a. Types of products (goods or services). b. Characteristics of the industry and market, such as market growth, segmentation, market cycles, technology, market size, prospects, supply chain, and value chain. c. Competitors and the level of business competition. d. The level of efficiency and location savings of the Taxpayer. e. Economic circumstances affecting business performance (e.g., inflation rates, economic growth, interest rates, and exchange rates). f. Regulations that influence and/or determine success within the industry. g. Other factors affecting business performance in the industry.

The results of this analysis will be used to identify differences between the conditions of the tested Transaction Influenced by a Special Relationship and the conditions of potential comparable transactions during the comparability analysis.

3. Identifying Commercial and/or Financial Relations (Analysis of Transaction Conditions)

This stage involves analyzing transaction conditions to identify the relevant economic characteristics of the commercial and/or financial relationship between the Taxpayer and the Affiliated Party. These transaction conditions include: a. Contractual Terms: Provisions implemented and/or applicable to the transacting parties based on actual circumstances, whether written or unwritten. b. Functions performed, Assets used, and Risks assumed (FAR Analysis): * Functions: Activities and/or responsibilities of the transacting parties. * Assets: Includes tangible assets, intangible assets, financial assets, and/or non-financial assets that influence value creation, including access to and level of market control in Indonesia. * Risks: The impact of uncertain conditions in achieving business objectives borne by the transacting parties. c. Characteristics of the traded product: Specific characteristics of the goods or services that significantly influence pricing in the open market. d. Economic circumstances: The economic conditions of the transacting parties and the market in which they transact. e. Business strategies pursued by the parties.

4. Conducting Comparability Analysis

This analysis aims to determine whether an Independent Transaction has conditions that are the same as, or comparable to, the tested Transaction Influenced by a Special Relationship. An Independent Transaction is considered comparable if: a. The conditions are the same or similar to the tested transaction. b. The conditions differ, but the differences do not influence the price determination. c. The conditions differ and influence the price, but accurate adjustments can be reasonably made to eliminate the material impact of such differences on price determination.

The steps taken in the comparability analysis include: a. Understanding the characteristics of the tested transaction based on the results of the transaction condition analysis (FAR). b. Identifying the existence of Independent Transactions as reliable potential comparables (internal or external). c. Determining the tested party if a profit-based method is used. The tested party is the entity with the less complex functions, assets, and risks. d. Identifying differences in conditions between the affiliated transaction and the potential comparables. e. Performing accurate adjustments on the potential comparables. f. Determining the Independent Transactions selected as comparables.

5. Determining the Transfer Pricing Method

The method is selected based on appropriateness and reliability, considering the method's compatibility with the transaction characteristics, the strengths/weaknesses of the method, the availability of comparables, the degree of comparability, and the accuracy of adjustments.

Applicable methods include: a. Traditional Transaction Methods: Comparable Uncontrolled Price (CUP) Method, Resale Price Method (RPM), and Cost Plus Method (CPM). b. Profit-Based Methods: Profit Split Method and Transactional Net Margin Method (TNMM). c. Other Methods: Such as the Comparable Uncontrolled Transaction (CUT) Method, Tangible/Intangible Asset Valuation Method, and Business Valuation Method.

Hierarchy of Method Selection: The CUP or CUT method is prioritized over other methods if reliability is equal. The RPM or CPM is prioritized over the Profit Split Method or TNMM if reliability is equal.

6. Applying the Transfer Pricing Method and Determining the Arm's Length Price

In the final stage, the selected method is applied to determine the fair Transfer Price.

The fair Transfer Price may be an arm’s length point or a point within an arm’s length range. The arm's length range can be the minimum to maximum value (full range, if formed from two comparables) or the first quartile to the third quartile (interquartile range, if formed from three or more comparables).

Additional Obligations: Preliminary Stages for Specific Transactions

This regulation also mandates that the application of the ALP for certain Transactions Influenced by a Special Relationship must undergo preliminary stages in addition to the six stages above. These specific transactions include service transactions, intangible asset transactions, loan transactions, asset transfer transactions, business restructurings, and cost contribution agreements.

Legal Consequences: If the Taxpayer cannot prove the validity of these specific Transactions Influenced by a Special Relationship based on the preliminary stages (Article 13), the Transaction is deemed not to meet the Arm’s Length Principle. This indicates that the verification of the transaction's substance (preliminary stages) is an absolute prerequisite before the authorities proceed to the price analysis (Stages 5 and 6).

References

Minister of Finance Regulation Number 172 of 2023 concerning the Application of the Arm's Length Principle in Transactions Influenced by a Special Relationship (Peraturan Menteri Keuangan Nomor 172 Tahun 2023 tentang Penerapan Prinsip Kewajaran dan Kelaziman Usaha Dalam Transaksi yang Dipengaruhi Hubungan Istimewa).