In the dynamics of international taxation, balancing the provision of tax facilities with the protection of the domestic tax base is a primary challenge. The Government of Indonesia, through the Ministry of Finance, has taken decisive steps by issuing Minister of Finance Regulation Number 112 of 2025 (PMK 112 of 2025) concerning Procedures for the Implementation of Double Taxation Agreements (DTA). This regulation marks a fundamental shift from an administrative-based approach to one based on economic substance over form.

The core of this regulation is the assertion that DTA benefits—such as lower tax rates or tax exemptions—are not automatic rights. Article 2 paragraph (4) explicitly requires that a Non-Resident Taxpayer (WPLN) must meet three cumulative criteria: they are not an Indonesian resident taxpayer, they are a resident of the DTA partner country, and crucially, they do not engage in treaty abuse. The definition of treaty abuse is formulated as an attempt by a WPLN to reduce, avoid, or defer tax payments contrary to the object and purpose of the DTA.

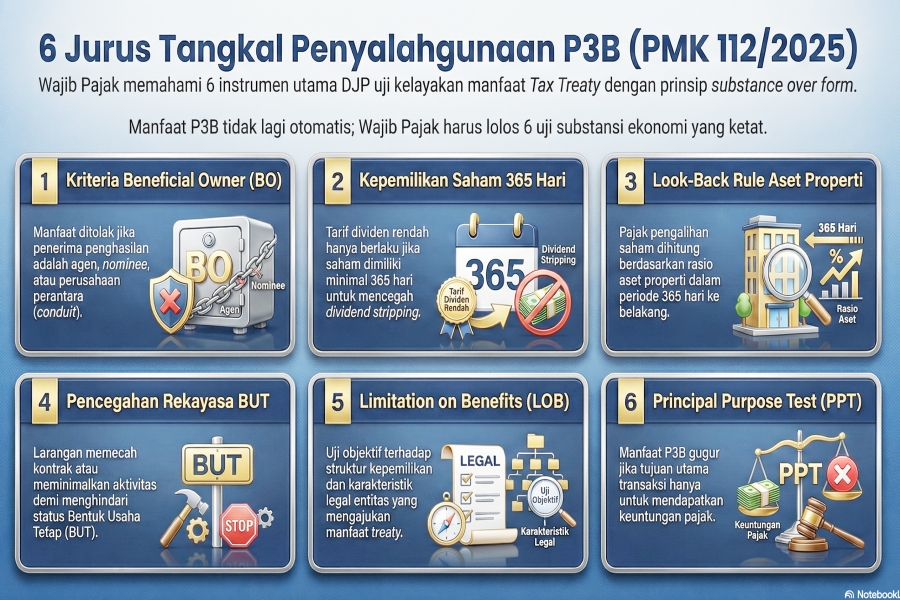

Article 18 of PMK 112 of 2025 grants broad authority to the Director General of Taxes to prevent abuse through six main anti-avoidance instruments. This article dissects these mechanisms in depth along with illustrations of their application.

The first and most fundamental instrument is the establishment of the Beneficial Owner (BO) criteria. Article 19 asserts that a WPLN acting as an Agent, Nominee, or Conduit Company is not entitled to DTA benefits.

An entity is considered a BO only if it has full control to use or enjoy the funds/assets, bears the risk on those assets, and has no obligation to pass on the majority of its income. Specifically, this PMK prohibits back-to-back practices where a WPLN uses more than 50% of its income to satisfy obligations to third parties.

The second mechanism targets dividend stripping. Article 20 stipulates that preferential dividend rates are only granted if the WPLN satisfies a minimum shareholding period of at least 365 calendar days, including the day of dividend payment.

Article 21 regulates capital gains on land-rich companies. Taxing rights reside in Indonesia if the value of immovable property in Indonesia exceeds a certain threshold (e.g., 50% of total assets).

The look-back period test ensures the property ratio is met "at any time" within the 365 calendar days preceding the transfer. This prevents "asset dilution" where WPLNs inject cash shortly before a sale to drop the property ratio below 50%.

PMK 112 of 2025 aggressively closes loopholes for avoiding PE status through three main methods:

Article 27 applies the LOB clause as an objective test. It looks at hard facts: Is the WPLN publicly traded? Is it owned by residents of the partner country? Does it pass the base erosion test? Failing this mechanical test indicates a lack of genuine economic connection to the domicile country.

The ultimate safety net. Article 28 states DTA benefits will be denied if "one of the principal purposes" of the transaction is to obtain the benefit.

The PPT lowers the burden of proof; authorities only need to show the tax motive was dominant. It analyzes the scheme, timing, and economic substance vs. form.

PMK 112 of 2025 marks a significant evolution in Indonesia's tax governance. Administrative compliance (like Form DGT) is no longer enough. Transactions must be underpinned by economic substance and business purpose. This layered defense ensures DTA benefits are enjoyed only by those truly entitled.