Transfer pricing disputes continue to be one of the most complex areas in tax litigation, often centering on methodology and comparability analysis. The appeal case filed by PT AI serves as a relevant study, where the dispute was not about the choice of method—both parties agreed on using the Transactional Net Margin Method (TNMM)—but its application. The DJP performed a positive fiscal adjustment correction of Rp49 billion after rejecting the set of comparable companies used by PT AI and applying its own analysis. The ruling on this case provides critical lessons on how to defend a transfer pricing analysis and the legal strength of the arm's length range as a safe harbor.

The conflict in this dispute is rooted in the benchmarking analysis process. The DJP's argument was based on its authority under Article 18 paragraph (3) of the Income Tax Law (UU PPh). The DJP rejected 5 out of the 6 comparable companies used by PT AI, citing incomparable functions (e.g., manufacturing and services). The DJP then constructed a new set of comparables that it deemed "purer" distributors, and based on this new analysis, PT AI's operating profit was concluded to be outside the arm's length range. On the other hand, PT AI provided a multi-layered rebuttal. They argued that the DJP's comparability standard was too rigid for a TNMM analysis. Furthermore, PT AI proved that the DJP's chosen new set of comparables were actually less comparable because many of them had significant R&D and manufacturing functions. Crucially, PT AI successfully demonstrated that its operating profit was already within the arm's length range calculated from its valid set of comparables, thus nullifying the DJP's legal basis for correction.

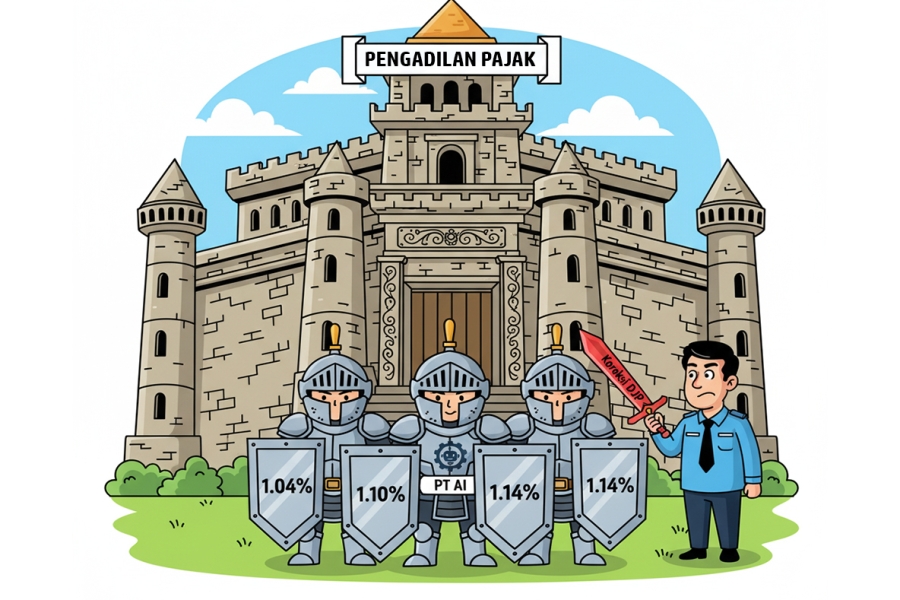

In delivering the ruling, the Panel of Judges fully agreed with PT AI's arguments. The Panel deemed the DJP's rejection of the comparables was not based on strong evidence, while the selection of new comparables tended to be subjective. The most decisive consideration for the Panel was the fact that PT AI's operating profit (ROS of 1.10%) was proven to be within the arm's length range generated from the reliable set of comparables (between 1.04% to 1.14%). The Panel of Judges affirmed the fundamental legal principle: if the Taxpayer's profit is already within the arm's length range, the DJP's authority to make a correction based on Article 18 paragraph (3) of the Income Tax Law becomes void. This ruling has significant implications as it strengthens the function of the arm's length range as a "safe harbor." It signals that the DJP cannot unilaterally make adjustments to a specific point if the Taxpayer's transaction results are already proven to be within that range of arm's length.

In conclusion, the PT AI transfer pricing case is an important precedent confirming that a Taxpayer with solid Transfer Pricing Documentation (TP Doc) can effectively defend its transfer pricing policy. The takeaway lesson is that investing in high-quality benchmarking analysis, including in-depth functional analysis and careful data verification, is a highly effective risk mitigation strategy. For multinational companies, this ruling underscores the importance of not only complying with formal obligations but also being substantively prepared to defend the arm's length nature of their transactions by focusing on proving that the company's profitability is within the arm's length range.

Comprehensive and Complete Analysis of This Dispute is Available Here