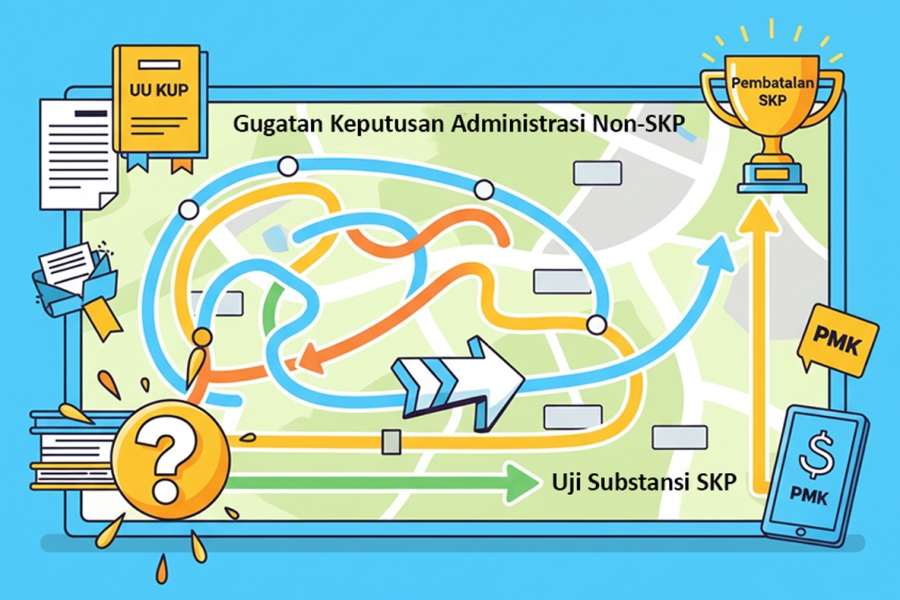

Regulation of the Minister of Finance Number 8/PMK.03/2013 explicitly restricts Taxpayers from filing a request for the reduction or cancellation of an incorrect tax assessment (SKP) more than twice, a provision that sparked a formal dispute in the Tax Court. In Decision Number PUT-011048.99/2021/PP/M. XVIB Tahun 2025, the Plaintiff (PT BSM) filed a lawsuit against the Director General of Taxes' decision, which was in the form of a Request Return Letter regarding the third application filed. This lawsuit was primarily intended to cancel the underlying VAT Tax Assessment Letter (SKPKB PPN), arguing that the two-time limit in the PMK contradicts Article 36 of the General Provisions and Tax Procedures Law (UU KUP) which champions the principle of justice.

The core conflict in this case does not lie in the substance of the Value Added Tax (VAT) correction itself, but in the formal legality of returning the third request. The Plaintiff believed that a provision at the PMK level should not limit the rights of the Taxpayer guaranteed by the UU KUP, and furthermore asserted that the SKPKB was procedurally flawed because it was issued before the deadline for responding to the Audit Results Notification Letter (SPHP) had expired. Conversely, the Defendant (Director General of Taxes) maintained its administrative action, citing Article 15 paragraph (5) of PMK 8/PMK.03/2013, under which the third application must be returned as it exceeded the maximum limit. The DG Tax adhered to the principles of legal certainty and orderly administration stipulated in the implementing regulation.

In its resolution, the Tax Court Panel meticulously applied the principle of jurisdiction. The Panel opined that the object of the lawsuit was a Non-SKP Administrative Decision, specifically the Request Return Letter, whose content only decided the formal aspect. Based on Article 40 paragraph (6) of the Tax Court Law (UU PP), the Panel's authority is limited to examining and ruling on matters contained in the contested decision. The Plaintiff's demand to cancel the VAT SKPKB (a material issue) was deemed inconsistent with the scope of the contested Decision (a formal issue).

The analysis of this Decision indicates an inconsistency between the object being sued and the final claim of the Plaintiff. The Taxpayer's attempt to use a formal lawsuit as an entry point to test the material substance of the SKP was deemed inadmissible. The consequence of this ambiguity is that the Panel declared the lawsuit as obscuur libel, or unclear. The implication of this decision reinforces the importance for Taxpayers to select the appropriate legal remedy. If the goal is to materially cancel the SKP, a lawsuit against a formal administrative decision rejecting the third request is not an effective route and carries a high risk of resulting in an Inadmissible ruling.

A Comprehensive Analysis and the Tax Court Decision on This Dispute Are Available Here