Disputes over the deductibility of expenses often stem from the Directorate General of Taxes' (DGT/DJP) strict interpretation of the definitions of "fringe benefits/benefits in kind" (natura and kenikmatan) and the fulfillment of the 3M expense criteria (Obtaining, Collecting, and Maintaining Revenue - Mendapatkan, Menagih, Memelihara Penghasilan). The case of PT MHP serves as an important precedent in reversing the DGT's correction on Operating Expenses (Non-TP) amounting to USD515,616, where most of the correction was based on the assumption of fringe benefits or insufficient evidence.

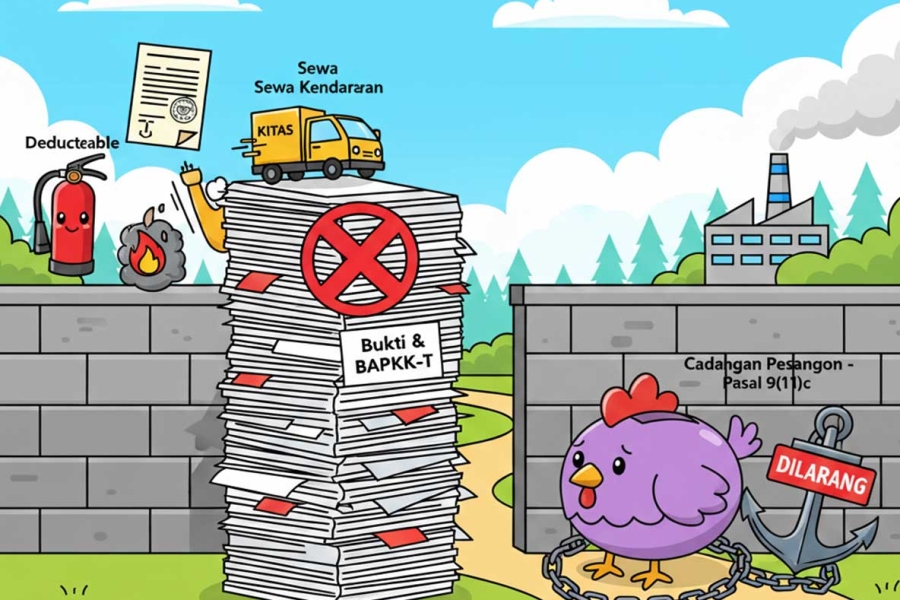

The core conflict in this operational cost issue is whether expenditures such as KITAS processing fees for foreign workers, operational vehicle rental costs, and Industrial Plantation Forest (HTI) fire suppression costs can be categorized as reasonable and necessary 3M expenses. The DGT argued that costs related to employee facilities (KITAS, vehicle rental, cell phone credit) are fringe benefits (natura/kenikmatan) and should not be deductible according to Article 9 paragraph (1) letter e of the Income Tax Law (UU PPh). The DGT also rejected the HTI Fire costs because they were deemed unsupported by strong evidence and lacked a direct connection to revenue.

PT MHP strongly refuted the DGT's interpretation. They asserted that KITAS fees and operational vehicle rental costs are mandatory company expenditures to ensure the legality and smooth operation of the business, not a personal benefit provided to employees. Similarly, the HTI Fire costs were essential for maintaining revenue-generating assets and were supported by the Integrated Fire Incident Report (Berita Acara Kejadian Kebakaran-Terpadu - BAPKK-T). PT MHP relied on Article 6 paragraph (1) of the Income Tax Law, which permits the deduction of all 3M expenses.

The resolution by the Panel of Judges demonstrated prudence. The Panel partially reversed most of the corrections (USD445,691). The Panel rejected the DGT's argument regarding fringe benefits (natura/kenikmatan), affirming that KITAS fees and operational vehicle rental costs are reasonable and customary 3M expenses. The HTI Fire costs and Commission Service Fees were also reversed because they were supported by adequate evidence and proven to be related to operations. However, the Panel upheld the correction on Severance Reserve (USD69,396). This is a crucial point, as such reserves are explicitly prohibited from being deducted by Article 9 paragraph (1) letter c of the Income Tax Law, and the Taxpayer failed to prove that they had made an adequate positive fiscal correction in their Annual Tax Return (SPT).

The analysis of this ruling confirms that costs incurred to meet the company's legal or operational obligations (such as permits and asset risk mitigation) should not be immediately classified as fringe benefits (natura). The implication of this ruling is that Taxpayers must strengthen the documentation of non-routine operational costs. However, Taxpayers are also reminded that violations of explicit prohibitions (such as the deduction of reserve funds) remain a high dispute risk, and a perfect positive fiscal correction for such items is an absolute mitigation step.