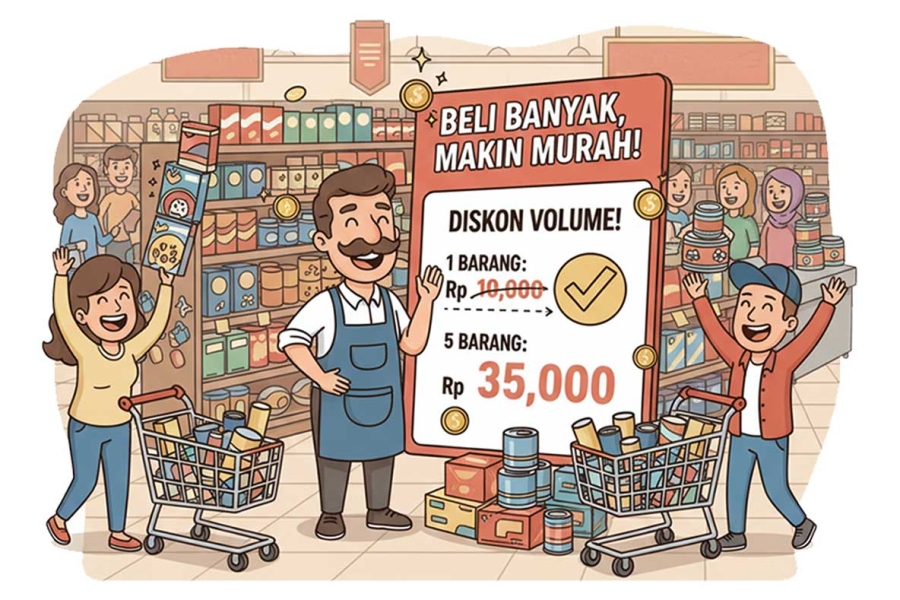

Tax disputes often arise from differing interpretations of common business practices, as reflected in the case of PT PL. The context of this dispute began with a sales incentive program, where distributors who successfully achieved certain purchasing volume targets would receive an additional discount. This standard commercial practice was viewed differently by the Directorate General of Taxes (DGT), which subsequently triggered a PPh Article 23 correction amounting to Rp35,802,958,467.00.

The core of the conflict lay in the characterization of the discount. The DGT, based on Regulation PER-11/PJ/2015, deemed the discount an "award" for the distributor's "achievement" in meeting the target. Thus, this remuneration was considered an object of PPh Article 23 that PT PL was obliged to withhold. Conversely, PT PL maintained the argument that the discount was purely a sales price reduction whose essence was a commercial element. They asserted that the relationship with the distributor was a trade relationship, not the provision of services, and this practice was supported by previous DGT affirmation in S-1045/PJ.313/2004 as well as tax court jurisprudence that distinguishes volume discounts from taxable prizes.

In its resolution, the Panel of Judges unequivocally sided with the Taxpayer. Their legal consideration focused on the economic substance behind the transaction. The Panel stated that the volume discount scheme is a common marketing strategy to boost sales, and the distributor's decision to purchase in large quantities is a business choice, not an "achievement" in a competitive activity. The fact that this discount was transparently administered as a reduction of the selling price in the tax invoices became strong evidence supporting PT PL's argument. Based on these considerations, the Panel of Judges granted the appeal and annulled the DGT's correction.

This ruling serves as an important affirmation of the principle of substance over form in tax law. The implication is that the business world now has a more solid legal basis to defend sales incentive schemes from the risk of reclassification as an object of PPh Article 23. This case highlights the crucial role of accurate documentation. As long as volume discounts or incentives are consistently recorded and proven as a price reduction element, both in contracts and invoices, their position as a commercial instrument not subject to PPh Article 23 will be strengthened.

Comprehensive and Complete Analysis of This Dispute is Available Here