The litigation protocol in Indonesian taxation establishes strict boundaries between the legal remedies of Appeal (Banding, through Objection) and Administrative Petition, a formality that was reaffirmed by the Tax Court Decision Number PUT-005682.99/2021/PP/M.IIB Tahun 2025. The Taxpayer, HYT (an individual taxpayer), filed a lawsuit against the Director General of Taxes (DJP) Letter Number S-453/WPJ.26/2021, which constitutes the return of the request for the Reduction or Cancellation of an Incorrect Tax Assessment Letter (SKPKE PPN) pursuant to Article 36 paragraph (1) letter b of the Law on General Provisions and Tax Procedures (KUP Law). The core of this conflict is not the substance of the corrected VAT, but the legal status of the request return letter, which HYT claimed was detrimental and obstructed his right to challenge the substance of the issued SKP.

The Director General of Taxes argued that the act of returning the request was legal and complied with the formal provisions stipulated in Article 14 paragraph (2) of the Minister of Finance Regulation (PMK) Number 8/PMK.03/2013. This regulation explicitly limits the petition for the cancellation of an incorrect SKP only to cases where the SKP has not been subject to an objection or appeal. The legal fact shows that the disputed VAT SKP has already had an Objection Decision issued, automatically placing the SKP outside the scope of the Article 36 KUP Law petition. The DJP asserted that the return letter was merely an administrative notification, not a legally challengeable "Decision."

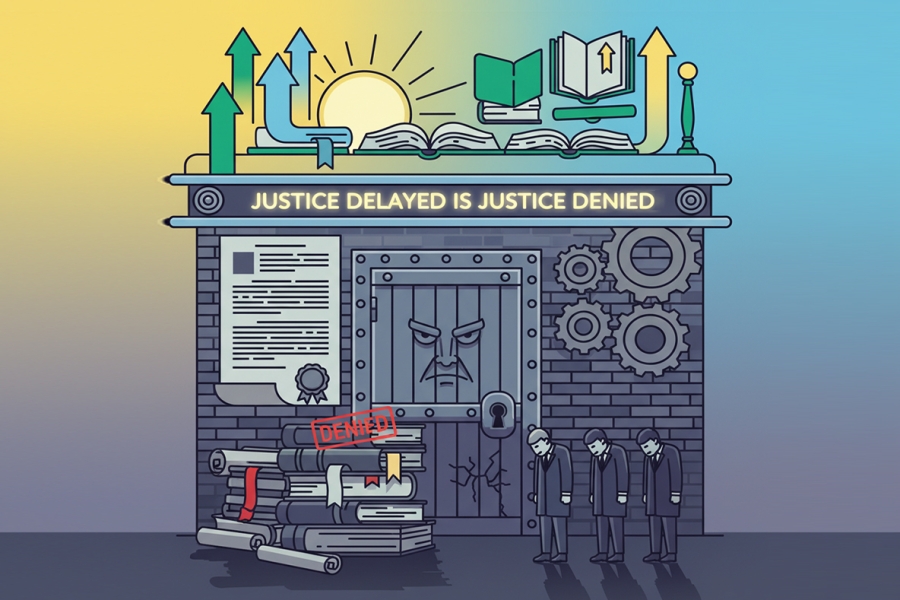

The Tax Court Judges, in their considerations, adopted a very formalistic stance. The Panel agreed with DJP that the Request Return Letter (S-453/WPJ.26/2021) is not a "Decision" of the Director General of Taxes that can be sued based on the jurisdiction set forth in Article 23 paragraph (2) of the KUP Law. Furthermore, the Panel emphasized that HYT had chosen the wrong legal remedy. Given that the Objection Decision had been issued, the correct legal path was an Appeal (Banding). Consequently, the Panel declared itself unauthorized to examine the substance of the dispute and rejected HYT's lawsuit. This decision serves as a stern warning to Taxpayers regarding the importance of a profound understanding of the hierarchy and formal requirements of every legal remedy chosen, where a formal error can result in the loss of the opportunity to challenge the substance of the dispute.