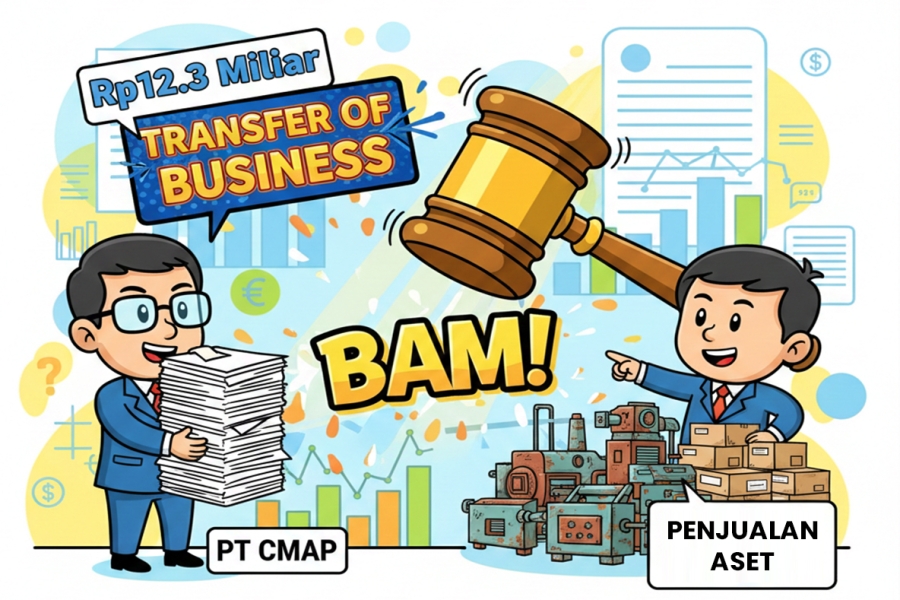

The Tax Court has issued a significant decision that tests the boundary between an ordinary asset sale and a transfer of business in a Corporate Income Tax (CIT) dispute for Fiscal Year 2018 involving PT CMAP. The dispute stemmed from substantial adjustments made by the Directorate General of Taxes (DGT), which determined additional Net Income of more than IDR 12.3 billion. The DGT argued that a series of inventory and fixed asset sales conducted by PT CMAP’s Bukittinggi branch to a newly established entity constituted a transfer of business that generated unrecognized gains, rather than a simple asset sale as claimed by the taxpayer.

The DGT based its adjustment on the assumption that an overall transfer of manufacturing activities had taken place, indicated by the migration of administrative processes, design, R&D, human resources, and sales operations from PT CMAP to the new entity. The DGT further relied on reporting data showing that PT CMAP ceased reporting business activities at that location in the following year, which instead appeared in the new entity’s tax filings. In addition, the DGT calculated Non-Operational Income using revenue projections and business comparison approaches to estimate the transfer value of goodwill or business allegedly conveyed.

PT CMAP strongly rejected the allegation of a business transfer. The company maintained that the transactions consisted purely of inventory sales and disposals of used machinery. The taxpayer argued that no goodwill was transferred and that the valuation basis used by the DGT relied on assumptions and projections that lacked a clear foundation and were not comparable (apple-to-apple). The taxpayer also raised procedural defects, citing significant discrepancies between the Notification of Audit Findings (SPHP) and the Final Discussion Minutes.

The Tax Court ultimately granted the taxpayer’s appeal in part. The financial impact of this decision was substantial: PT CMAP’s Net Income, initially assessed by the DGT at IDR 17.76 billion, was drastically reduced to IDR 5.40 billion. Consequently, the Corporate Income Tax Underpayment Assessment (SKPKB), originally amounting to IDR 3.42 billion, was significantly reduced to only IDR 107.72 million. This drastic reduction clearly demonstrates that the DGT’s major adjustment related to Non-Operational Income (the alleged business transfer/goodwill sale) was successfully overturned before the Court.

The PT CMAP case underscores that in CIT disputes, adjustments based on alleged business transfers cannot rely solely on assumptions or value projections without a verifiable basis. Although the DGT considered the transaction a transfer of business, the Court rejected the adjustment because it was not supported by clear valuation calculations or credible methodology. The taxpayer, on the other hand, succeeded in convincing the Court by demonstrating that the DGT’s valuation approach was inconsistent and not grounded in concrete data. This decision serves as a reminder that methodological accuracy and transparency in valuation fundamentals are critical when defending value-based tax adjustments.

A comprehensive analysis and the Tax Court Decision on This Dispute Are Available Here